Multi Time Frame Buy Low Sell High - Short-Term

Last updated November 3, 2024

Introducing The 'Multi Time Frame Buy Low Sell High-Short-Term' Strategy

Sometimes, there is great value to be found in being contrarian. But you have to do it at the right time when there is enough strength behind the reversal.

No matter what you and I think about the market and where it "should" go, where it does go is all that matters. In the end, the market is always right. So, even if you want to be a contrarian, you have to wait for the right opportunity to enter a position.

The purpose of this strategy is to be contrarian on a longer timeframe and simultaneously be trend-following on a shorter timeframe. This combined, multi-timeframe strategy gives you a great signal to buy just when a longer trend is beginning to reverse.

Basically, you want to buy on reversing weakness in the longer term but only when you get sufficient signs of strength on the lower term. To achieve this, you can look at the moving averages on the shorter timeframe and to the RSI on the longer timeframe.

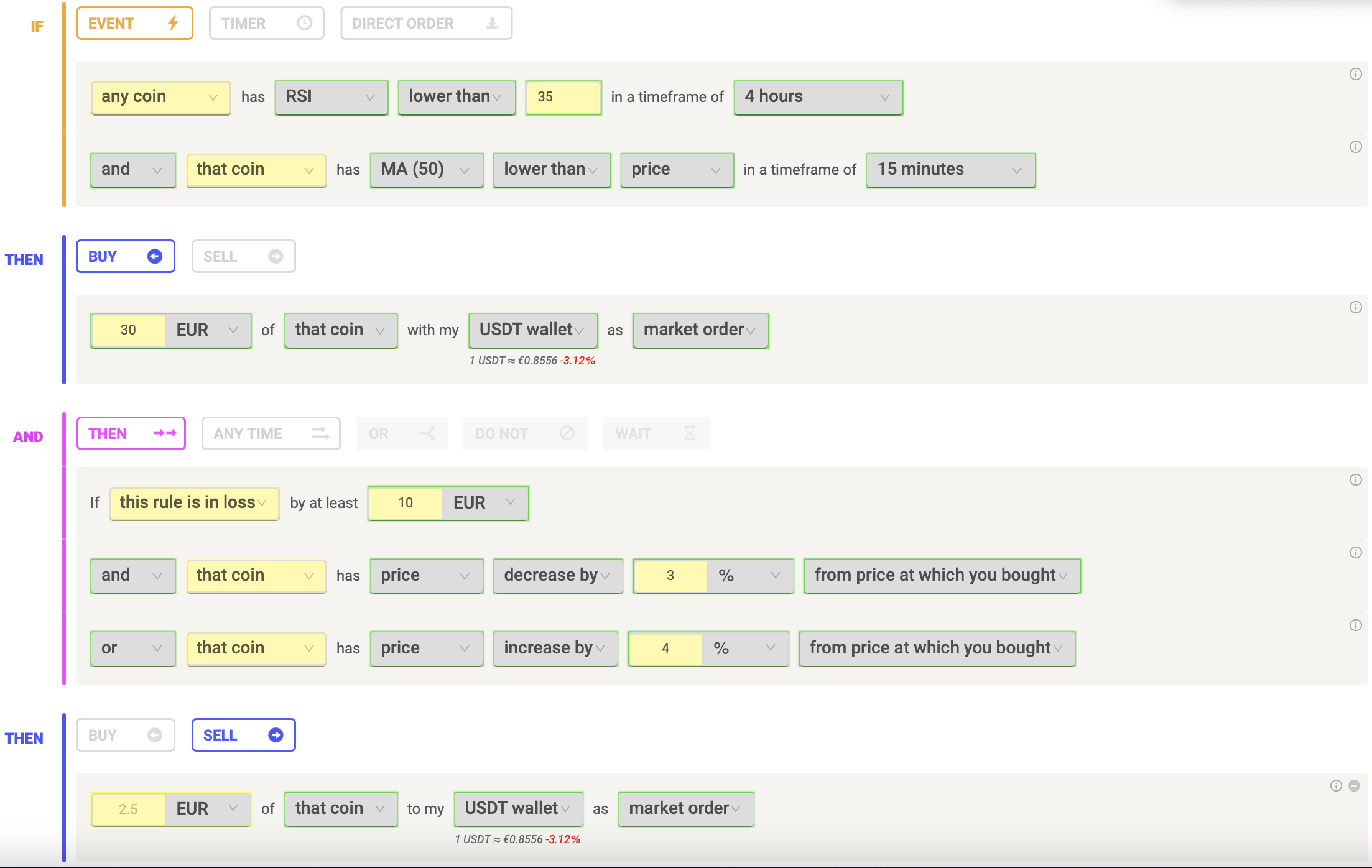

ENTRY

To capture the strength behind the reversal on the asset, the strategy requires that MA50 be lower than the current market price. To capture a contrarian opportunity on the asset, the rule requires that RSI be lower than 35 on a higher timeframe.

The rule places the order when both conditions above are met. The buy order only ends up being placed on assets when it seems they are leaving the "oversold" status on the RSI.

EXIT

This strategy comes with a conditional stop loss and a target take profit.

The engine only engages the stop loss if, as a whole, the rule is in a certain pre-defined loss. The rule checks the total cumulative PnL across all trades (open and closed) by that strategy, and if this is greater than the predefined amount, only then does it apply the stop loss logic. This way you can adapt the risk management of the strategy to the market, becoming more risk-averse when the market turns against you and become more risk-loving when you are trading in favourable market conditions.

This also prevents trades from being closed out too soon due to short-term volatility. The idea is that you cut your losses when the overall market conditions change but not on small fluctuations.

Alternatively, the trade is closed at a target take profit. This percentage can be adjusted to suit your needs.

Create the strategy with Coinrule

You will find the strategy in the template library, or you can build it yourself step-by-step.

Pro tip: This combination of timeframes has proven to return the best results on average, but please feel free to test out other combinations as well.