RSI-Based Dollar Cost Averaging

Last updated November 3, 2024

When you want to buy a coin, you may be tempted to chase the price. Watching the price increasing will lead you to fear you will miss out on potential gains. The truth is that most of the time, a patient approach is the one that turns out to be more profitable long-term.

An optimised option to build a position is to let an automatic trading strategy send the orders only when, on average, it's more convenient to buy. You can use the RSI to spot when the price is oversold, and the likelihood of a rebound is higher.

This way, you can focus on your research and finding the best coins, while Coinrule does the heavy lifting by accumulating the coins.

The Perfect Long-Term Accumulation Strategy

Successful long-term investing consists of two parts

- buying the right asset

- buying it at the right price.

Distributing your buy orders across a more extended period of time, gives you the possibility of buying at an average lower price, thereby lowering your average cost of purchase. This strategy is called Dollar-cost averaging (DCA).

A classic DCA strategy implies buying periodically, regardless of how the price move over time.

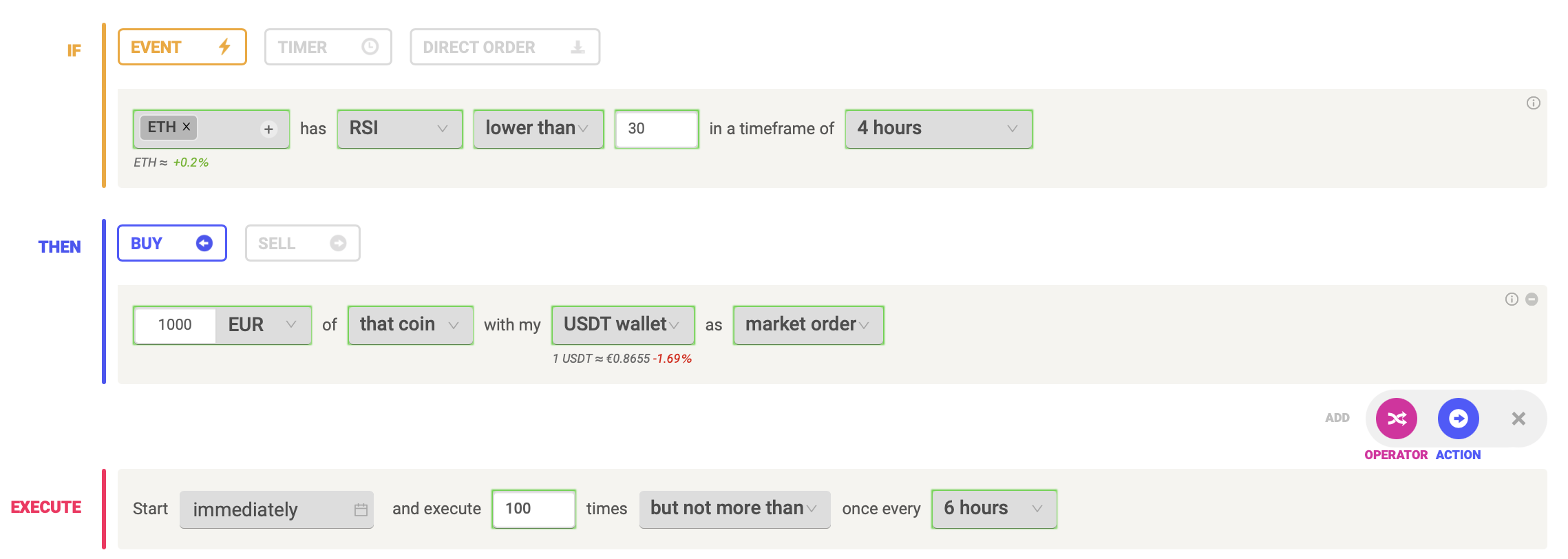

We Coinrule, you can take it one step further, and buy only on weakness. So, on average, you get even better prices by taking advantage of short-term fluctuations and buying only when the RSI is below 30 on the 4-hour timeframe.

RSI-based Dollar-cost averaging

So, when the RSI is below 30 on the 4-hour timeframe, you send in part of our total buy order. This helps ensure that we aren't chasing pumps due to FOMO. In fact, we take advantage of the irrationality of human behaviour by buying when the coin is oversold.

Also, if you set up a rule like this, remember to define how often you want to execute a buy order to avoid over-trading!

All the parameters are fully customisable to meet every investor's/trader's needs. Whatever parameter you will set, the rule will run automatically 24/7, so you won’t miss a dip of your favourite coin anymore!

The advantage of RSI-Based DCA

The advantage of RSI-based DCA shows up in the number. We ran some backtests on this strategy on the most popular coins and here are some numbers:

| Coin | % Orders in Profit | Max Drawdown | Average Entry | Mkt Price 31/08/21 | Return |

| BTC | 65% | 60% | 41268 | 471666 | 14.3% |

| ETH | 100% | 66% | 1967 | 3433 | 74.5% |

| LTC | 57% | 71% | 153 | 171 | 11.6% |

| XRP | 96% | 54% | 0.755 | 1.19 | 57.6% |

| SOL | 100% | 65% | 26.2 | 108.5 | 314% |

The strategy assumes to start on Jan 1st 2021 and buys every time the RSI is below 30 on the 4-hr time frame.

In the example below, the green line shows the average entry price on Ethereum. You can see how during 2021 the price traded mostly above the average entry, which means that most likely you would have got a worse execution by not running this strategy to buy Ethereum long-term.

To conclude, if you have a portfolio of coins that you believe in long-term and are willing to HODL through the downswings, RSI-based DCA through Coinrule is a great, reliable way to maximise the value you get with the least amount of effort and complexity.

Try out the RSI Dollar Cost Averaging Strategy now on Coinrule to maximize your profits and returns!