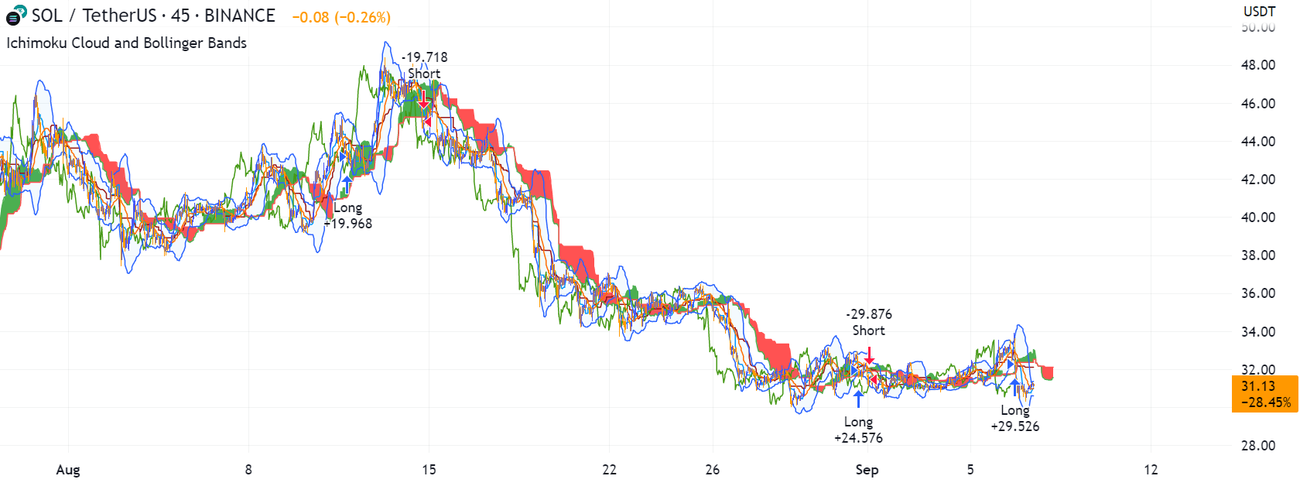

Ichimoku Cloud and Bollinger Bands (by Coinrule)

Last updated November 4, 2024

Introducing The 'Ichimoku Cloud and Bollinger Bands (by Coinrule)' Template

The Ichimoku Cloud is a collection of technical indicators that show support and resistance levels, as well as momentum and trend direction. It does this by taking multiple averages and plotting them on a chart. It also uses these figures to compute a “cloud” that attempts to forecast where the price may find support or resistance in the future. The Ichimoku Cloud was developed by Goichi Hosoda, a Japanese journalist, and published in the late 1960s. It provides more data points than the standard candlestick chart. While it seems complicated at first glance, those familiar with how to read the charts often find it easy to understand with well-defined trading signals. The Ichimoku Cloud is composed of five lines or calculations, two of which comprise a cloud where the difference between the two lines is shaded in. The lines include a nine-period average, a 26-period average, an average of those two averages, a 52-period average, and a lagging closing price line. The cloud is a key part of the indicator. When the price is below the cloud, the trend is down. When the price is above the cloud, the trend is up. The above trend signals are strengthened if the cloud is moving in the same direction as the price. For example, during an uptrend, the top of the cloud is moving up, or during a downtrend, the bottom of the cloud is moving down. The Bollinger Bands are among the most famous and widely used indicators. A Bollinger Band is a technical analysis tool defined by a set of trendlines plotted two standard deviations (positively and negatively) away from a simple moving average ( SMA ) of a security's price, but which can be adjusted to user preferences. They can suggest when an asset is oversold or overbought in the short term, thus providing the best time for buying and selling it. This strategy combines the Ichimoku Cloud with Bollinger Bands to better enter trades. Long orders are placed when these basic signals are triggered. Long Position: Tenkan-Sen is above the Kijun-Sen Chikou-Span is above the close of 26 bars ago Close is above the Kumo Cloud The closing price is greater than the upper standard deviation of the Bollinger Bands Short Position: Tenkan-Sen is below the Kijun-Sen Chikou-Span is below the close of 26 bars ago Close is below the Kumo Cloud The upper standard deviation of the Bollinger Band is greater than the closing price The script is backtested from 1 January 2022 and provides good returns. The strategy assumes each order is using 30% of the available coins to make the results more realistic and to simulate you only ran this strategy on 30% of your holdings. A trading fee of 0.1% is also taken into account and is aligned to the base fee applied on Binance. This script also works well on BTC 30m/1h, ETH 2h, MATIC 2h/30m, AVAX 1h/2h, SOL 45m timeframes