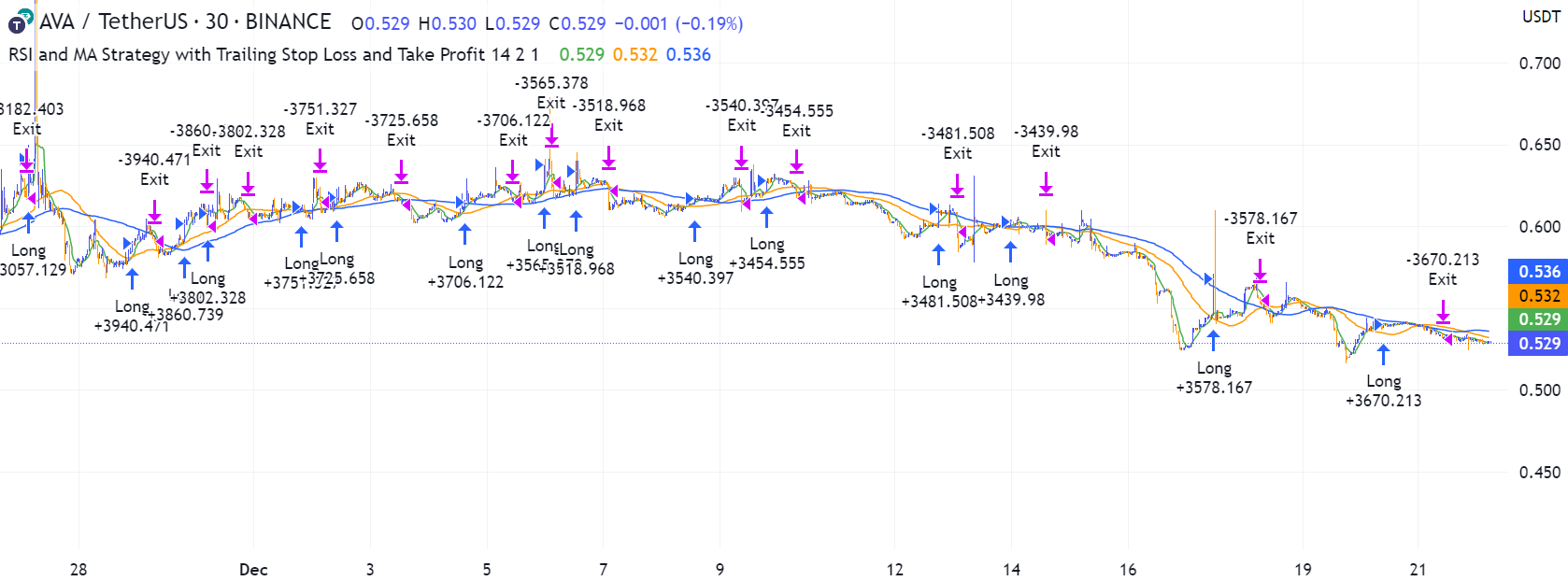

Optimised RSI and MA Strategy

Last updated January 14, 2025

Introducing The 'Optimised RSI and MA Strategy' Template

The relative strength index is a momentum indicator used in technical analysis. It measures the speed and magnitude of a coin's recent price changes to evaluate overvalued or undervalued conditions in the price of that coin. The RSI is displayed as an oscillator (a line graph essentially) on a scale of zero to 100. When the RSI reaches oversold levels, it can provide a signal to go long. When the RSI reaches overbought levels, it can mark a good exit point or alternatively, an entry for a short position. Traditionally, an RSI reading of 70 or above indicates an overbought situation. A reading of 30 or below indicates an oversold condition.

A moving average (MA) calculates the average of a selected range of prices, usually closing prices, by the number of periods in that range. Essentially it is used to help smooth out price data by creating a constantly updated average price.

This strategy is uses the RSI and MA With Trailing Stop Loss and Take Profit. The Strategy enters and closes trades when the following conditions are met:

Entry Conditions:

RSI is greater than 40

MA9 is greater than MA50

RSI increases by 3

Exit Conditions:

Price increases by 2% trailing (from buy price)

Price decreases by 2% trailing

This strategy is back-tested from 1 January 2022 to simulate how the strategy would work in a bear market. The strategy provides good returns.

The strategy assumes each order is using 30% of the available coins to make the results more realistic and to simulate you only ran this strategy on 30% of your holdings. A trading fee of 0.1% is also taken into account and is aligned to the base fee applied on Binance.