Catch The Falling Knife With An Exception

Last updated November 4, 2024

Introducing The 'Catch The Falling Knife With An Exception' Strategy

To "catch a falling knife" is a common way to describe a strategy where a trader tries to buy a strongly depressed asset at, or near, its low point to speculate on a rebound, at least in the short term.

Cryptocurrencies are very volatile assets; thus, there are daily opportunities of catching "falling knives."

Buying dips of coins in a downtrend may be risky. Still, it may also be very profitable during a Bull Market or when the market participants' general mood is overall positive.

The psychology behind the drop

When a coin has a significant price drop, investors and traders enter into a "panic selling" mode which propels further downside. This psychological effect is much stronger than the cold thinking of assessing whether fundamental causes justify such a drop.

On top of that, leveraged traders or those with high exposure to the coin rush into selling to trim the risk.

Panic selling events create interesting opportunities, especially in times when the market is generally trading on the upside. This strategy gives you the chance to catch the falling knife.

How to catch the falling knife with Coinrule

You will find the strategy in the template library, or you can build it yourself step-by-step.

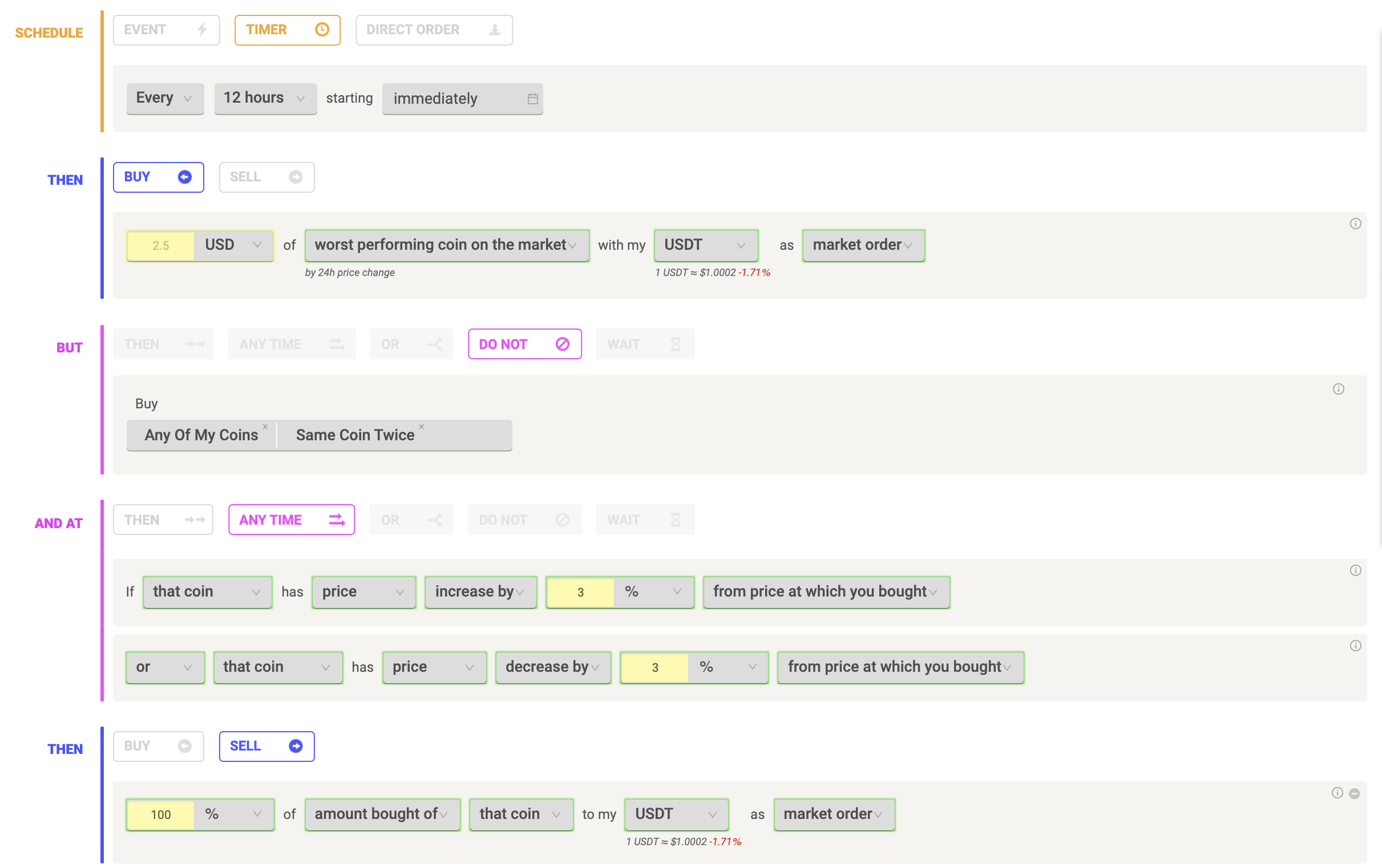

The strategy periodically buys the most sold coin on the market to sell it with a pre-set take profit at 3%. The system comes with a stop-loss to prevent unexpected losses in case the downtrend extends further.

An important addition to the rule is the setup is:

DO NOT buy twice the same coin and any of my coins.

This reduces the risk of overexposing to coins already in the portfolio. It would increase the overall risk. Also, the rule makes sure you don't buy twice the same dip to avoid getting stuck with coins in strong downtrends.

Trade safely