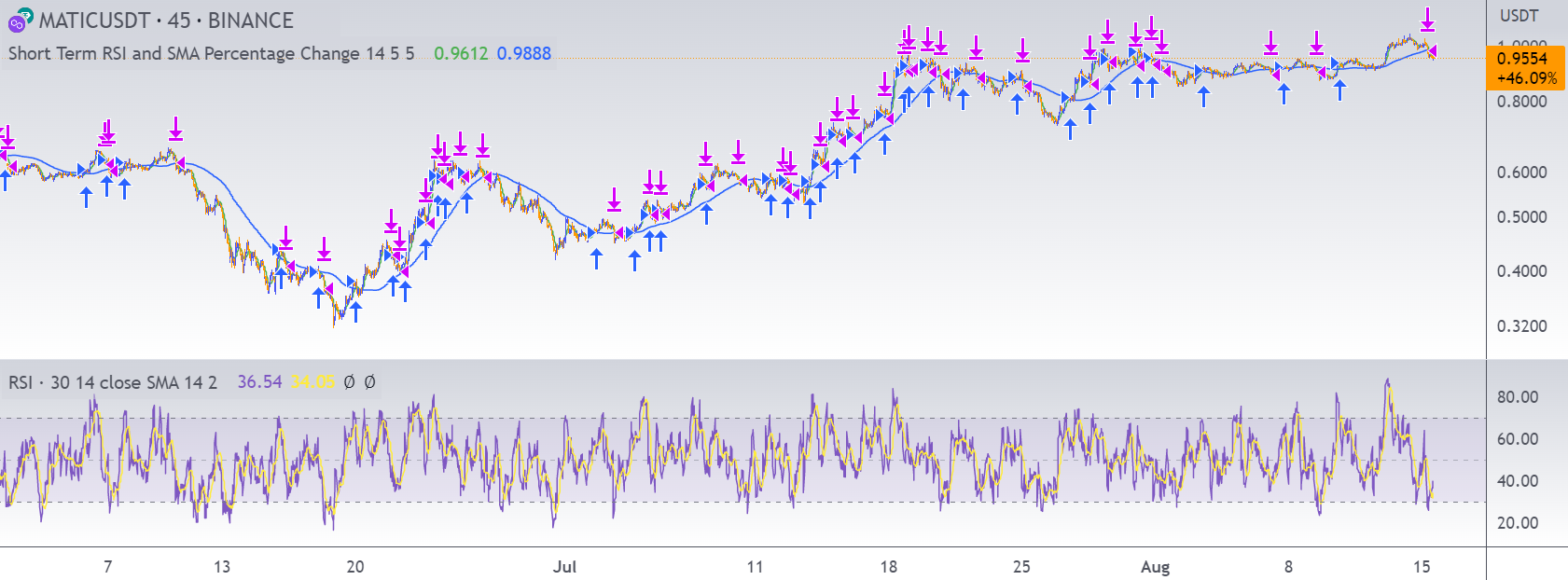

Short Term RSI and SMA Percentage Change

Last updated November 4, 2024

Introducing The 'Short Term RSI and SMA Percentage Change' Template

This strategy utilises common indicators like RSI and moving averages in order to enter and exit trades. The Relative Strength Index (RSI) is a momentum indicator that has a value between 0 and 100, where a value greater than 70 is considered overbought and a value less than 30 is oversold. If the RSI value is above or below these values, then it can signal a possible trend reversal.

The second indicator used in this strategy is the Simple Moving Average (SMA). A SMA is an arithmetic moving average calculated by adding recent prices and then dividing that figure by the number of time periods in the calculation average. For example, one could add the closing price of a coin for a number of time periods and then divide this total by that same number of periods. Short-term averages respond quickly to changes in the price of the underlying coin, while long-term averages are slower to react.

Long/Exit orders are placed when three basic signals are triggered.

Long Position:

- RSI is greater than 50

- MA9 is greater than MA100

- MA9 increases by 6%

Exit Position:

- Price increases 5% trailing

- Price decreases 5% trailing

The script is backtested from 1 May 2022 and provides good returns.

A trading fee of 0.1% is also taken into account and is aligned to the base fee applied on Binance.

This script also works well on AVAX 45m/1h, MATIC 15m/45m/1h and ETH 4h.