Rebalance Trend Following

Last updated November 4, 2024

Introducing the 'Rebalance Trend Following' Template

Trading in bull markets can be as stressful as managing your assets during downtrends. Crypto markets trade 24/7, and reacting at any price move it's challenging. This strategy makes it easy to rebalance the coins in your wallet in a bull market, taking advantage of the daily volatility.

Daily Rebalancing

How many times every day do you check the prices of your coins? Each price increase tempts you to sell to take some profit. On the other hand, you tend to stick with those coins underperforming, hoping that they will rebound soon. The reality is that during a bull market, the best strategy is to follow the trend.

As price moves quickly at any time of the day, it's virtually impossible to catch up with all the market opportunities. This strategy is the perfect auto-pilot for your wallet in a bull market.

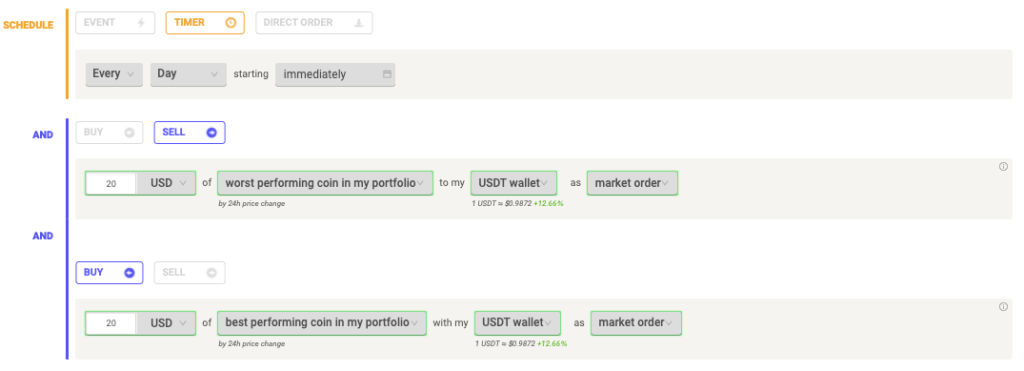

Periodically, the rule sells the coins in your wallet underperforming and uses the allocation to buy those with the strongest price increase.

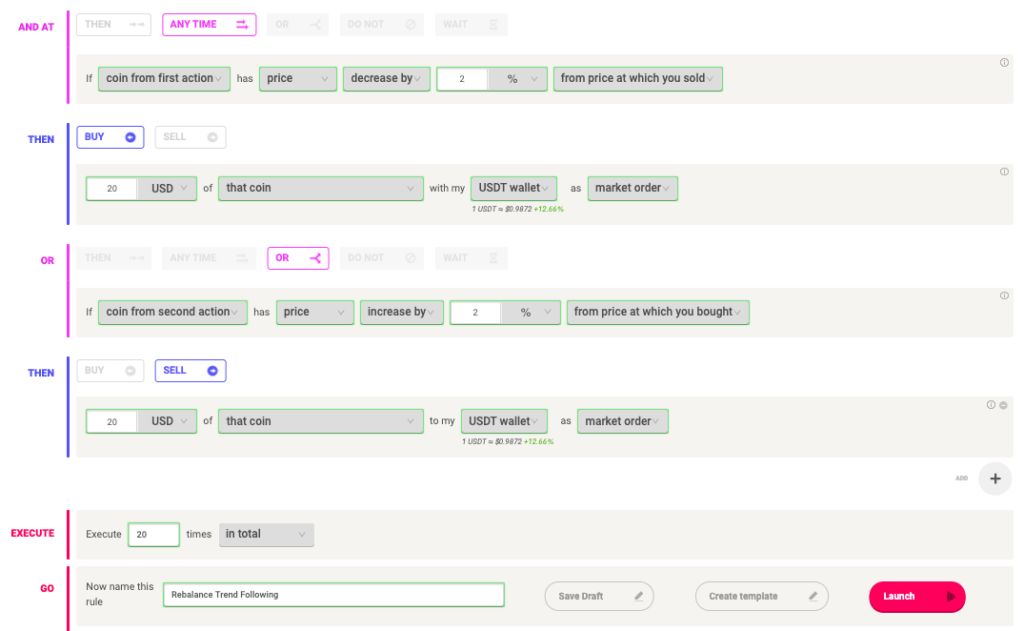

Take Profit To Optimize The Return

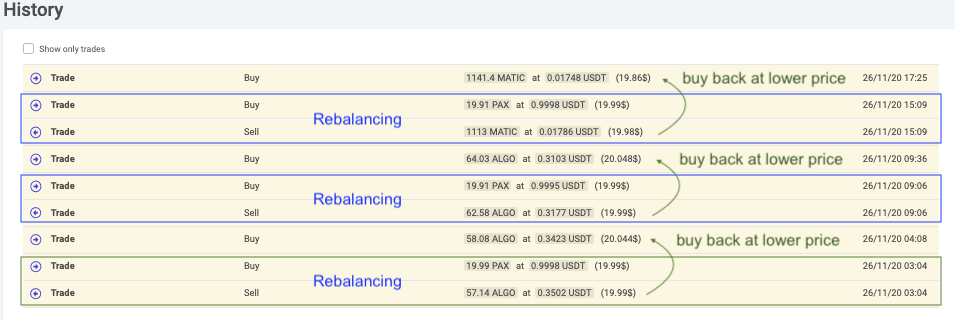

The strategy can then alternatively buy back or sell in profit the coins previously traded for every rebalancing event.

Bull markets are typically very directional. Sharp price drops break long streaks of price increases. After the temporary dips, the price typically rebounds strongly, making sense to try to buy back the coins sold.

This system combines a rebalancing strategy based on coins' daily wallet performances with short-term tactical trades to improve the returns.

Complete control of your assets

There are two advantages of using such an approach.

This rule is that it's not demanding in terms of capital to invest. This makes it easier to have available capital for other live strategies. If you select the same wallet across all the actions, the rebalancing occurs with no need for additional capital apart from the coins traded.

A small amount of capital is only required to make sure the rule has enough funds to buy back the coins sold in the previous rebalancing action.

Another interesting advantage is to avoid adding to your wallet undesired coins. You decide which coins to hold. The strategy only adjusts the amounts based on the market volatility to optimize the wallet return.

On the contrary, if you want to exploit even more opportunities you can run this strategy in parallel with other rules. For example, you can accumulate your favorite coins and let this rebalance them automatically in your wallet.

Another option would be to buy the best performing coin on the market every day with a take profit. If that coin has a price drops the take profit won't apply but this rule will manage it, selling it if it will underperform other coins in your wallet.

How to build the strategy on Coinrule

When the price volatility is high, trading manually can be very challenging and stressful. This rule to rebalance your wallet in a bull market strategy allows you to catch more opportunities. You can adjust the frequency of the rebalancing actions according to your preferences.