Scalping Dips On Trend

Last updated November 4, 2024

Introducing The 'Scalping Dips On Trend' Template

Coinrule's Community is an excellent source of inspiration for our trading strategies.

During the Bull Market, our traders opted mostly on buy-the-dips strategies, which resulted in great returns recently. But there has been an element that turned out to be the cause for deep division among the Community.

Is it advisable or not to use a stop-loss during a Bull Market?

This strategy comes with a large stop-loss to offer a safer alternative for those that are not used to trade with downside protection.

Stop-loss: Yes or No?

In general, a strategy with no stop-loss:

- trades less, which means that it catches fewer opportunities but also results in lower transaction fees

- has higher volatility of the P&L. It suffers when it gets stuck in trades in loss

- while being stuck in loss, it may miss new opportunities.

On the other hand, a strategy with stop-loss:

- opens and closes more trades

- has a more linear growth of the returns, with less dramatic drawdowns

- it doesn't lock for long periods the allocation, so it allows you to catch more opportunities.

This strategy blends the best of these two approaches.

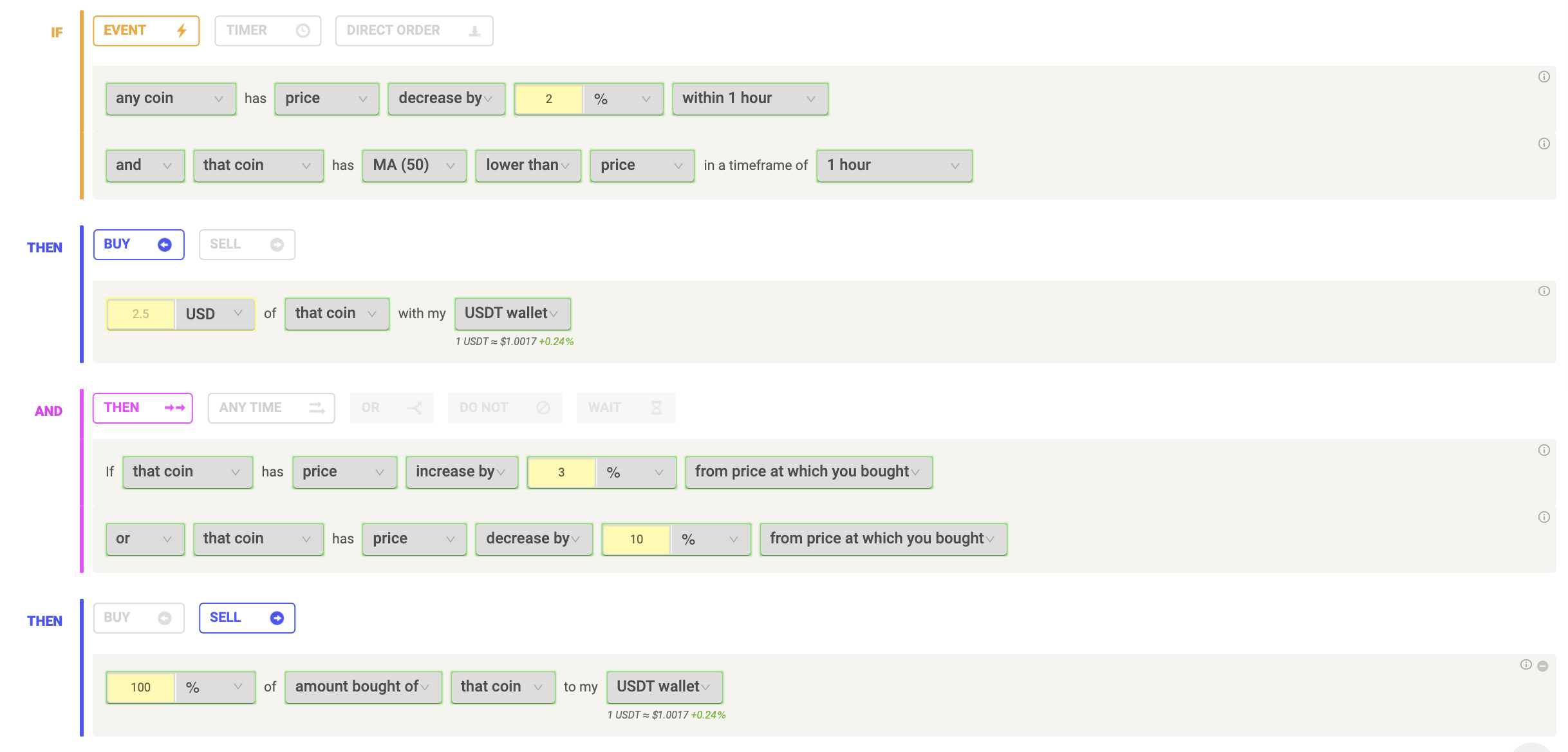

The setup

It buys only when the price is above the Moving Average 50, making it less risky to buy the dip.

The stop-loss is set to be quite loose to increase the chances of closing the trade in profit, yet protecting from unexpected larger drawdowns that could undermine the allocation's liquidity.

In times of Bull Market, such a trading system has a very high percentage of trades closed in profit (ranging between 70% to 80%), which makes it still overall profitable to have a stop-loss three times larger than the take profit.

Pro tip: use a larger stop-loss only when you expect to close in profit most of the trades!

Create the strategy with Coinrule

You will find the strategy in the template library, or you can build it yourself step-by-step.

This strategy made 38.99% net profit on BNB/USDT on the 1Day timeframe from January 2022 - November 2022.

Backtest the strategy on Tradingview

You can backtest this strategy using this trading script published on Tradingview. You can test the results on historical data, selecting the coin of your choice, and adjusting the parameters to fit even better your needs.

This is a guide to learn how to backtest strategies on Tradingview.

Try out the Scalping Dips on Trend now on Coinrule to maximize your profits and trade safely!