Short Selling MA Cross

Last updated November 4, 2024

Introducing The 'Short Selling MA Cross' Template

This simple, but effective rule focuses on selling and buying back coins to profit from bearish market conditions. It also uses a moving average as trend protection from trying to sell when the price direction reverses and market conditions become bullish.

Build This Rule on Coinrule !

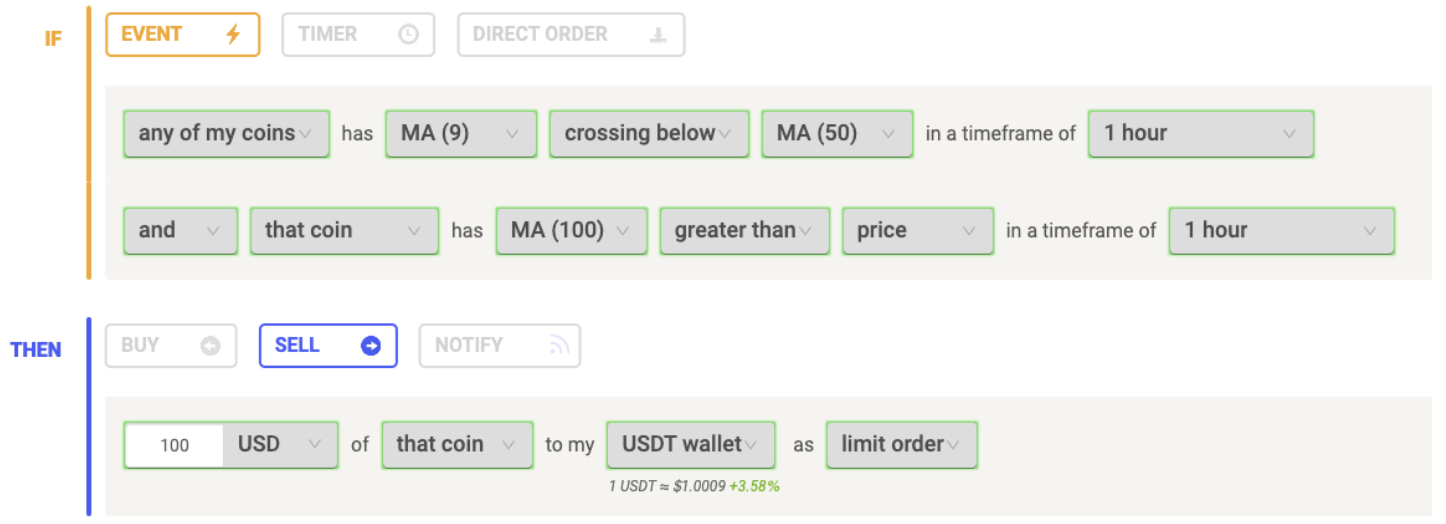

Entry

Condition 1

The first condition uses the Moving Average (MA) 9 and Moving Average (MA) 50, both in the 1-hour timeframe. Once the MA 9 crosses below the MA 50 - signalling that there has been a recent decline in the price of the asset and the start of a downtrend.

Condition 2

The second condition features the MA 100, in the 1-hour timeframe, having to be greater than price. This condition acts as trend protection and prevents the rule from selling when prices are increasing and the asset has regained strength as it surpasses the 100-hour moving average.

Read this article for more information on trend protection and trading in a bear market.

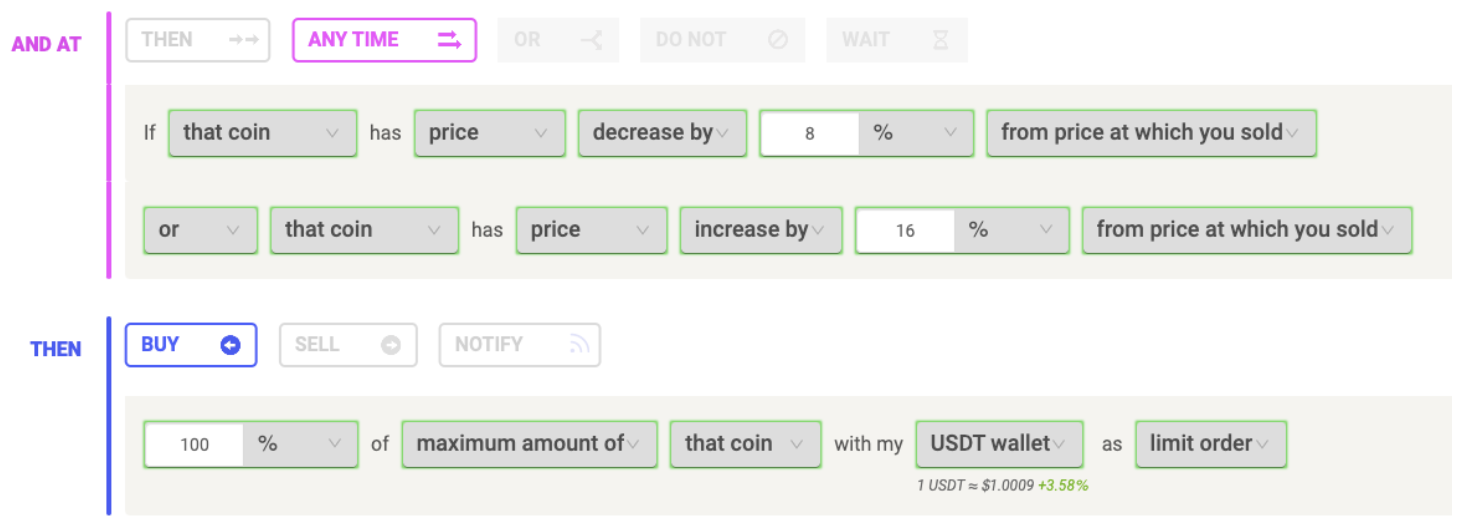

Exit

The exit for this rule uses a fixed stop loss and take profit.

Take Profit

The take-profit is set to trigger a buy when price decreases by 8% from the price at which the rule sold.

Stop Loss

The stop-loss is set to trigger a buy once price increases by 16% from price at which the rule sold.

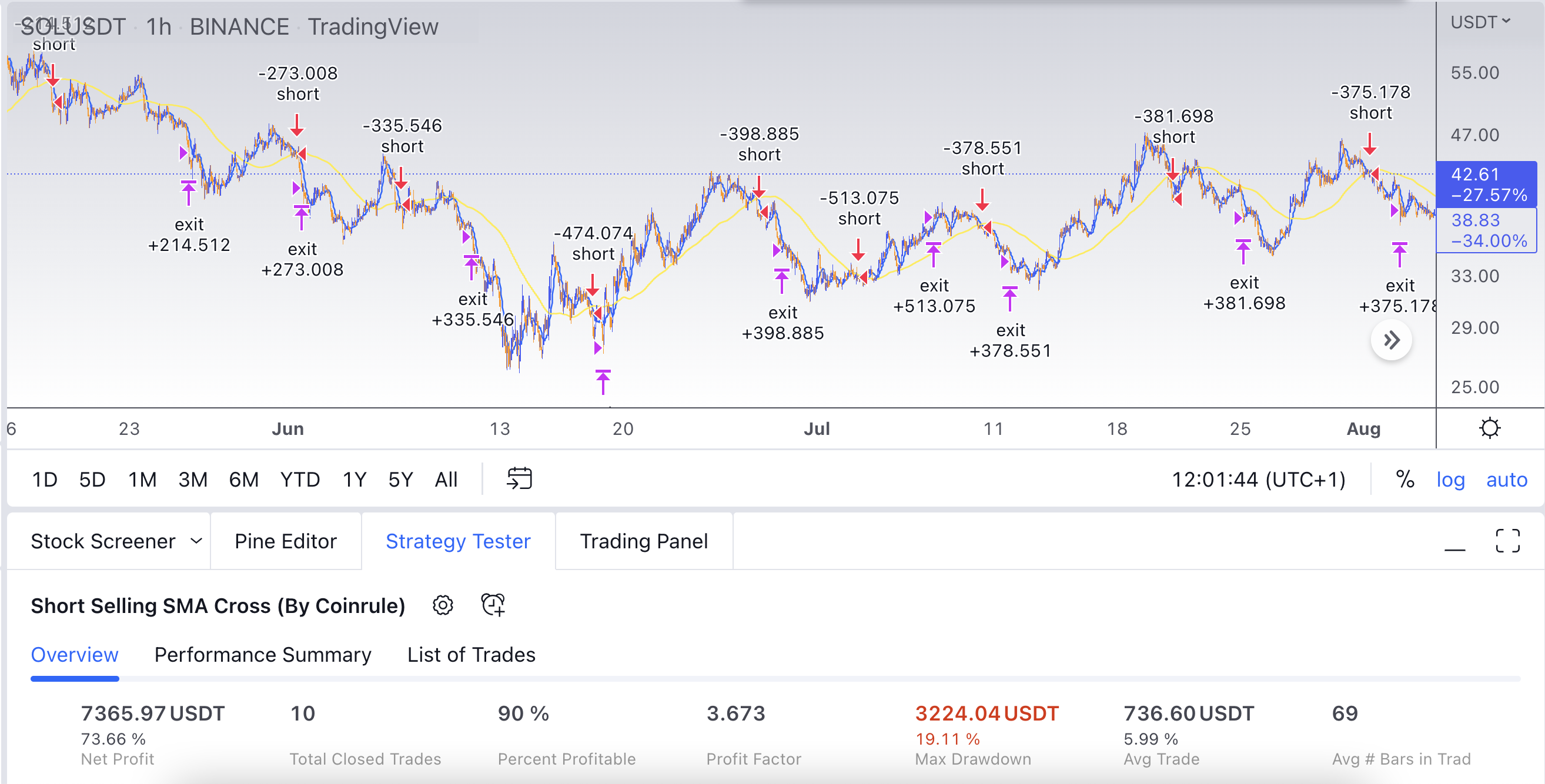

Backtesting Results

The risk:reward of this rule is 0.5. This means that for the rule to break even, for every trade that the rule hits the stop loss, the rule will have to have two trades execute at the take profit. This results in the rule requiring a win ratio of at least 66.6% for the rule to be profitable.

When backtested against Solana / USDT from May 1st 2022 to August 12th 2022, the rule achieved a net profit of 73.66% with a 90% win ratio.

Try out the Short Selling MA Cross Strategy now on Coinrule to maximize your profits and returns!