Grid Trading Strategy

Last updated November 3, 2024

Introducing The 'Grid Trading Strategy' Template

This strategy buys and sells in predefined price intervals to benefit from fluctuations in sideways markets.

It's tricky to trade when the market has no clear direction because of the high uncertainty of each price swing. During these times, the rate of growth of your profits on your assets can decrease. However, an automated trading strategy can add significant value to your wallet with these market conditions.

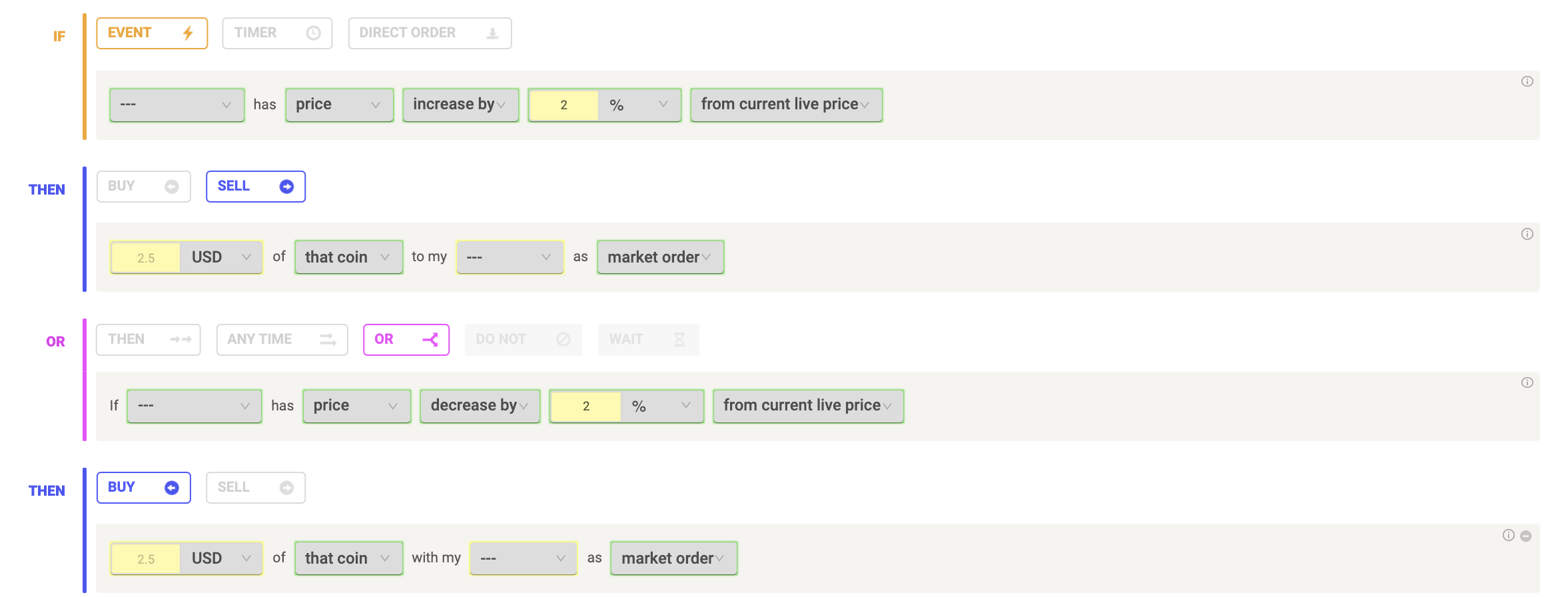

Grid trading is a trading system where within a determined price range,

a certain number of sell and buy orders are placed at regular intervals above and below the current price of the trading asset.

In general, buy orders are placed below the current price, while sell orders are always placed above the current price. It would be very time-consuming if this strategy was operated manually, and this is where our rules come in handy. Once the position's market price meets a predefined target, the rule will create new buy and sell orders around the executed price.

This will create a fishing net-like grid of orders to gain profits back and forth in any fluctuating market.

How to design the Grid Trading Strategy

Even though the design of the trading grid may depend on each trader's risk tolerance, to maximize the profits from this rule, one must follow some basic steps.

- Determine the target levels

This step is equivalent to deciding the number of predetermined grid levels that will act as buy and sell orders according to the dynamic market conditions.

You can set price increases both in percentage terms (eg. 2%), and in absolute price changes (eg. 10 USD).

- Define the trade size

If applied properly, this strategy trades very frequently. Thus we suggest making use of relatively small balances for each trade. In fact, the idea is to focus on frequency rather than profits on single trades.

- Set the exchange

At Coinrule, you have the choice to decide whether to launch your rule on a spot exchange market or on Binance Future and, when it comes to this strategy, each option has its own implications:

Spot exchange market: once you decide to launch the grid strategy on a specific trading pair, you are required to have a minimum balance of that coin in your wallet to fulfill the sell orders, as well as enough capital to open the buy orders.

Binance Futures: on this platform, the bot opens long and short positions regardless of whether you own any quantity of the trading coin.

How the strategy works

Create the strategy with Coinrule

You will find the strategy in the template library, or you can build it yourself step-by-

step.

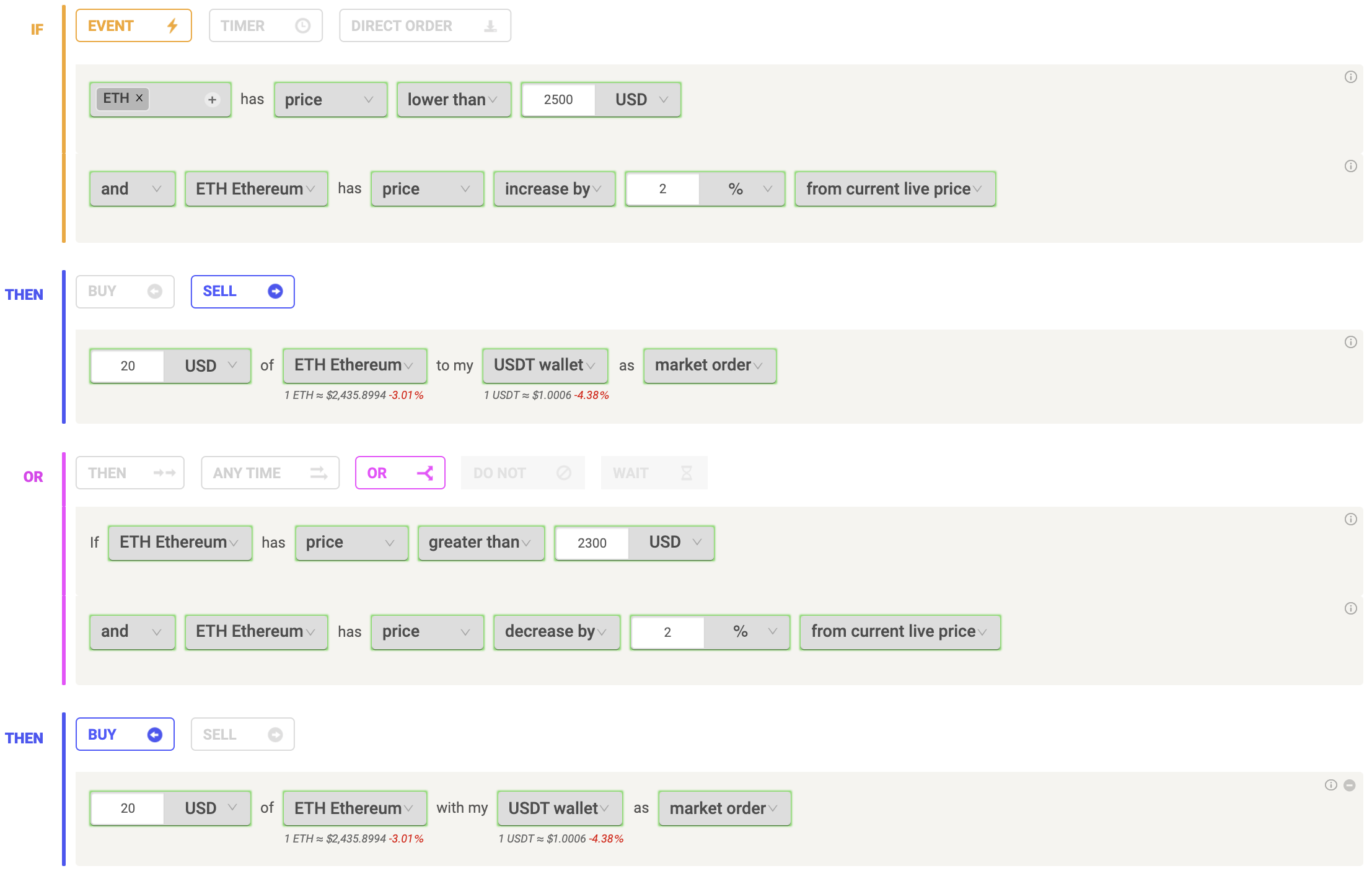

Pro tip: The best way to maximize profits from this strategy is to select a

precise price range within which we want the rule to be executed. In this way, we are sure that the actions will be triggered only under sideways market

conditions. The price range can be established by analyzing the chart of the

selected trading pair.

In this example, the bot will only trade the grid strategy if the price of Ethereum is within the set range. That will optimize the executions.

Try out the Grid Trading Strategy now on Coinrule to maximize your profits and returns!