Buy The Dips In Bull Market

Last updated November 4, 2024

Introducing the 'Buy The Dips In Bull Market' Template

During a Bull market, trading strategies that buy the dips on coins represent one of the best ways to surf the trend and optimize the returns.

When the price drops, it's challenging to anticipate precisely when the price will rebound. Even in strong trending markets, the price occasionally reverses strongly, offering great buy-opportunities. The RSI is an excellent tool to catch price drops as it adjusts the entry to the asset's current volatility. You can read more about how the RSI works in this article .

This strategy tries to catch very short-term opportunities to prevent remaining stuck in positions for long periods.

How it works

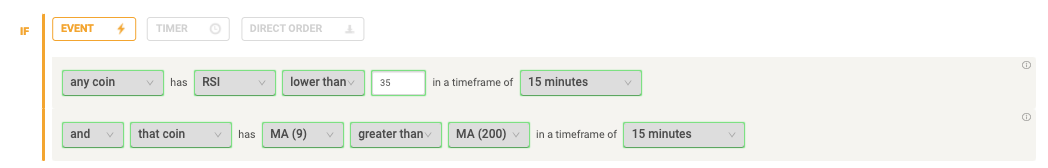

The rule buys when the RSI value is lower than 35 in a time frame of 15 minutes. That isn't an indicator that the primary trend is turning on the downside and can be a good buying opportunity.

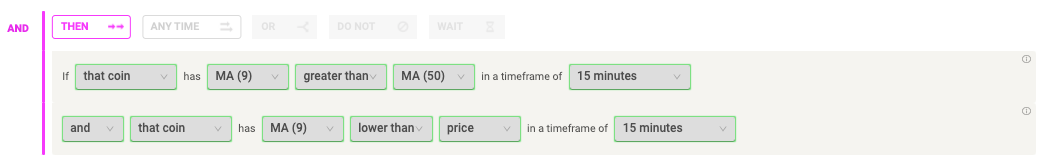

The strategy then sells when the price is back on-trend. To spot this, the condition for selling is

You can read more about how to use Moving Averages in this article .

Pro-tip: this is a long-term strategy that performs on all coins. By default, the rule opens one trade at a time , but you can increase the trade frequency using the Any Time Operator .

The best dips to buy in a Bull market

The bot buys the coin when the price experiences a drop, but the MA9 is still above the MA200. That indicates that the trend is strong, and there are good chances for a rebound.

- RSI is lower than 35 in a 15-minutes time frame

- the MA9 is above the MA200 in a 15-minutes time frame

Seize the gain

Closing the trade quickly reduces the risk of missing the profit and allows the bot to start looking for the next opportunity on the market.

When the coin rebounds, the strategy sells and moves on to the next coin. A Bull market offers many opportunities every day.

- MA9 to be above the MA50

- The price to be above the MA9

This strategy made 72.90% net profit on BNB/USDT on the 1Day timeframe from January 2022 - November 2022.

Backtest the strategy on Tradingview

You can backtest this strategy using this trading script published on Tradingview. You can test the results on historical data, selecting the coin of your choice, and adjusting the parameters to fit even better your needs.

This is a guide to learn how to backtest strategies on Tradingview.