Low Volatility Buy And Sell

Last updated November 4, 2024

Introducing the 'Low Volatility Buy And Sell' Template

When a coin's volatility decreases, buyers and sellers are generally balancing each other forces on the market. Once this equilibrium ends, the price can experience strong moves. If the price increases from there, that could be a very interesting buying opportunity.

You can use Moving Averages to capture that event.

How it works

A way to find times with low volatility and the potential for the price to jump is to use a specific setup of Moving Averages to be close to one another.

You can run the rule across multiple coins, or alternatively, you can select a single coin you want to trade in the long-term. In this case, the rule will trade less often, but you will have greater control.

Pro-tip: this rule can work well mostly in all market conditions, excluding times when the market is trending down for long periods.

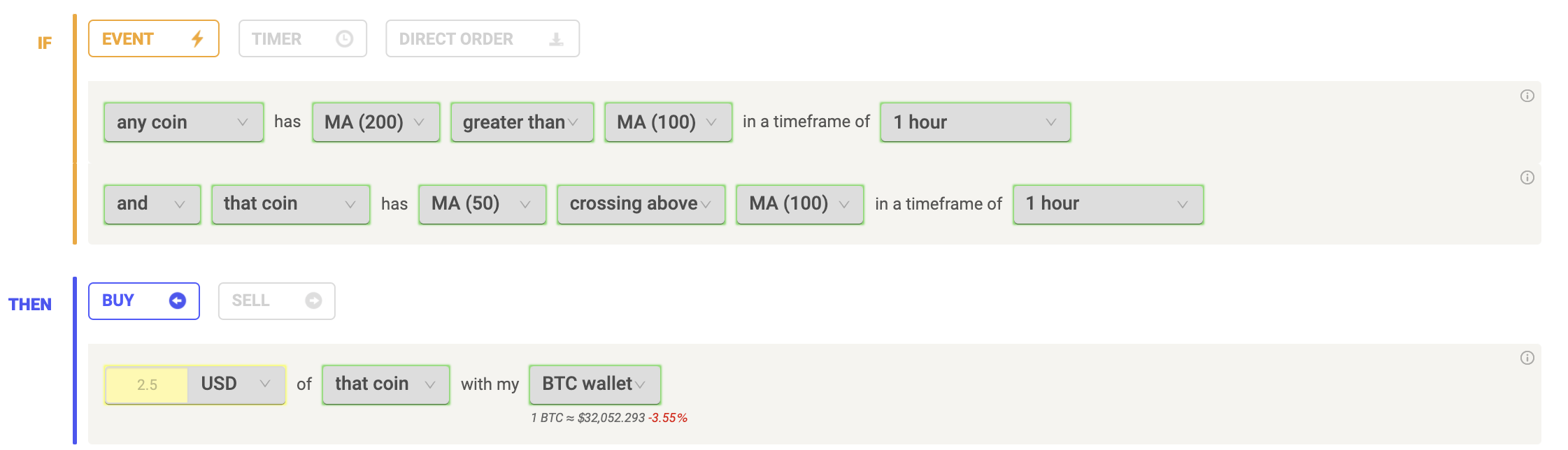

The setup to spot times of low volatility

The strategy buys when three moving averages (the MA50, MA100, and MA200) have the following setup:

- The MA200 is greater than the MA100, meaning that the coin is moving sideways or in a downtrend

- The MA50 crosses above MA100, meaning that there are early signs of an uptrend.

The best time frame for this setup is the 1-hour, but it can also work well on the 4-hour.

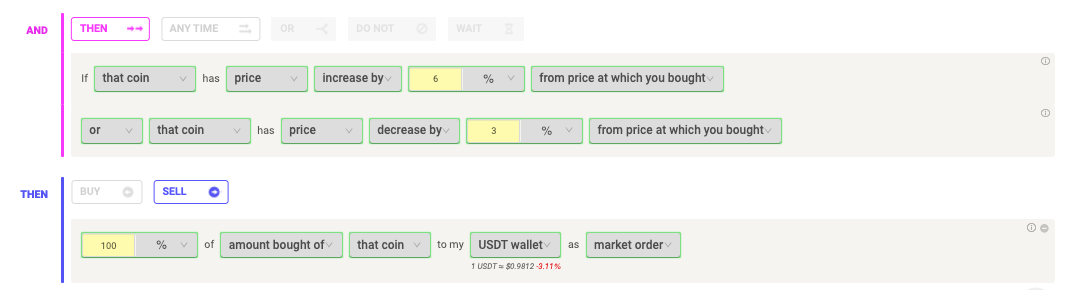

Protect your trades

The bot protects all your trades to reduce the risk of losses and capitalize the profit if the price increases.

The system sells the coin when one of the two following scenarios happen

- the price decreases 3% from the entry price, as a stop loss

- the price increases 6% from the entry buy price, as a take profit.

The absolute profit on each trade completed successfully more than compensates the trades in loss for a better risk-management of the funds.

Pro tip: The 1-Hour time frame has proven to return the best results on average.

This strategy made 46.67% net profit on LINK/USDT on the 1-Hour timeframe from January 2022 - December 2022.

Backtest the strategy on Tradingview

You can backtest this strategy using this trading script published on Tradingview. You can test the results on historical data, selecting the coin of your choice, and adjusting the parameters to fit even better your needs.

This is a guide to learn how to backtest strategies on Tradingview.