Trailing Stop & Buy

Last updated November 3, 2024

Understanding 'Trailing Stop & Buy'

What are Trailing Stops & Trailing Buys?

A Trailing Order automatically adjusts to market movements. It follows your position when the market is moving in your favor and will take profits if the market moves against you and trigger your Trailing Order.

To give an example, let's assume you buy BTC at $45,450. You set your trailing stop at $250 below the current market level, so at $45,200.

The price moves in your favor by $1000 to $46,450. This move will have increased your Trailing Stop limit to $46,200 – maintaining a distance of $250 from your new position. Your stop distance will continue to move up every time BTC moves up.

However, your Trailing Stop limit will never go down. This ensures that your profit is always protected. To come back to the previous example, if BTC were to start dropping, the rule would sell at $46,200, making sure you secure a profit above the price of $45,450 at which you had bought in.

If you had set up a normal stop, say at $45,400, your position would have continued to drop, ultimately leading to a loss.

Please bear in mind that trailing stops are not guaranteed to execute and can be subject to slippage. This means that they may not be executed exactly at the level you’ve specified.

Trailing Buys

Another form of a Trailing Order is a Trailing Buy. This is used to set a Buy Order for a coin that is dropping in price. Say BTC is currently at $42,000 but on a downward trajectory. A Trailing Buy set at $100 would mean that if the price reaches $42,100 your rule would buy. However, if BTC's price continues to go down, the Trailing Buy would remain $100 above the current price. If BTC were to drop to $39,000 and then go up to $39,100, the rule would trigger. You would be able to buy in at a better price.

How Trailing Orders work on Coinrule

You can set up Trailing Orders inside any condition on the Rule Page.

Let's run through some examples:

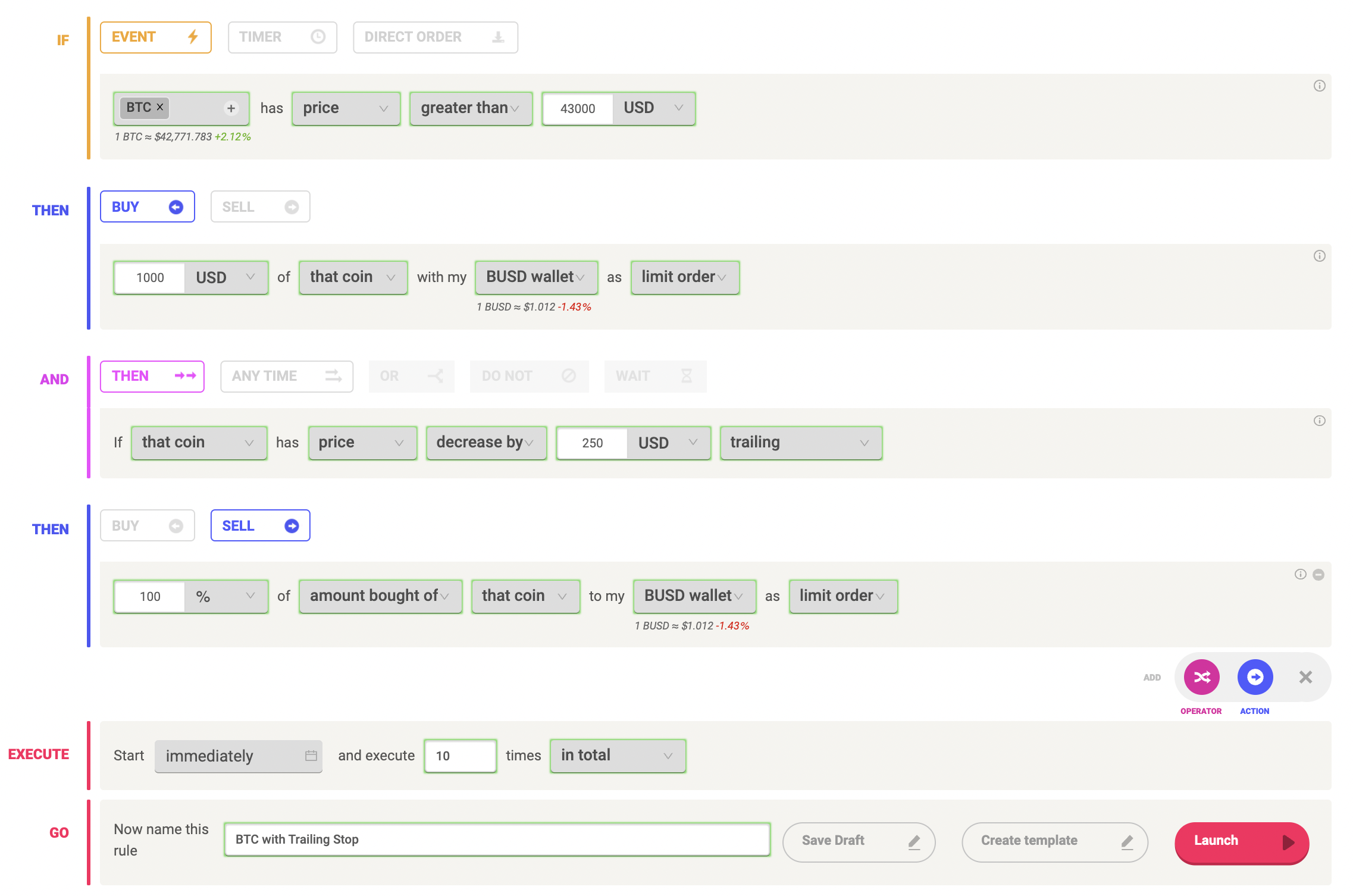

Trailing Stop

Here, the rule will buy $1,000 of BTC once BTC gets to $43,000. This will then trigger the Trailing Stop of $250 below the buy price of $43,000. If BTC immediately drops to $42,750, the rule will sell. However, if BTC continues to go up, the Trailing Stop will follow. Let's assume the price of BTC reaches $45,000, the sell price would be $44,750.

In this scenario, the Trailing Stop protects your profits.

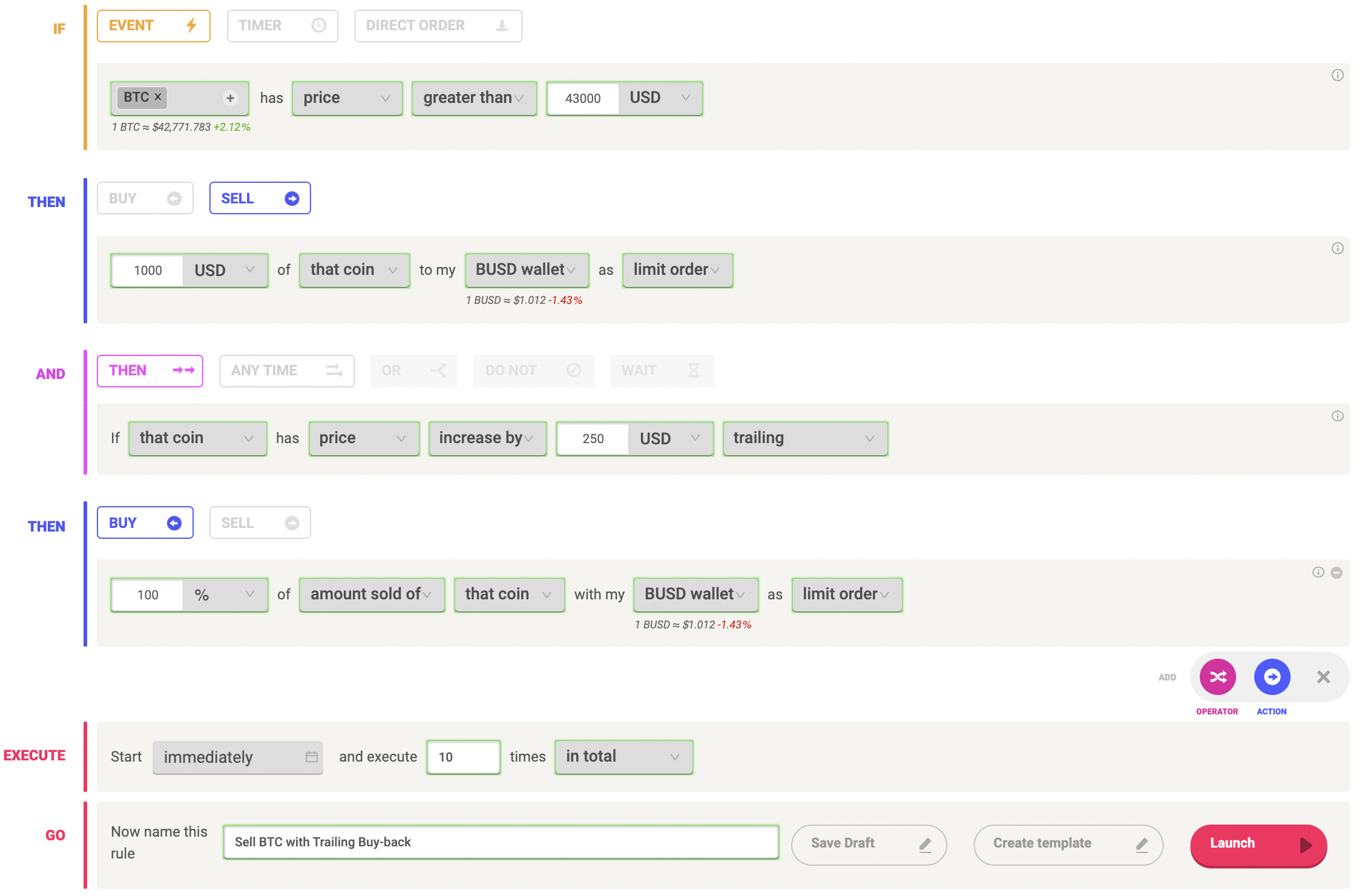

Trailing Buy

Here, the rule will sell $1,000 of BTC once BTC gets to $43,000. This will then trigger the Trailing Buy of $250 above the BTC price of $43,000. This makes sure you buy back into the rally should the price continue to go up. But let's assume you expect BTC to go down once it reaches $43,000

With the Trailing Buy, the rule will continue to adjust the Buy price to $250 above the current price. If BTC drops to say $42,000, the new buy price will be $42,250. Should the down trend now reverse and BTC go up by $250 to $42,250, the rule will buy back 100% of the amount you sold.

In this scenario, the Trailing Buy ensures that you buy back at a better price than with a simple Buy set a fixed price.

Risky Scenarios

Certain rule structures with Trailing functionality are possible but should not be used unless you have a very specific strategy in mind.

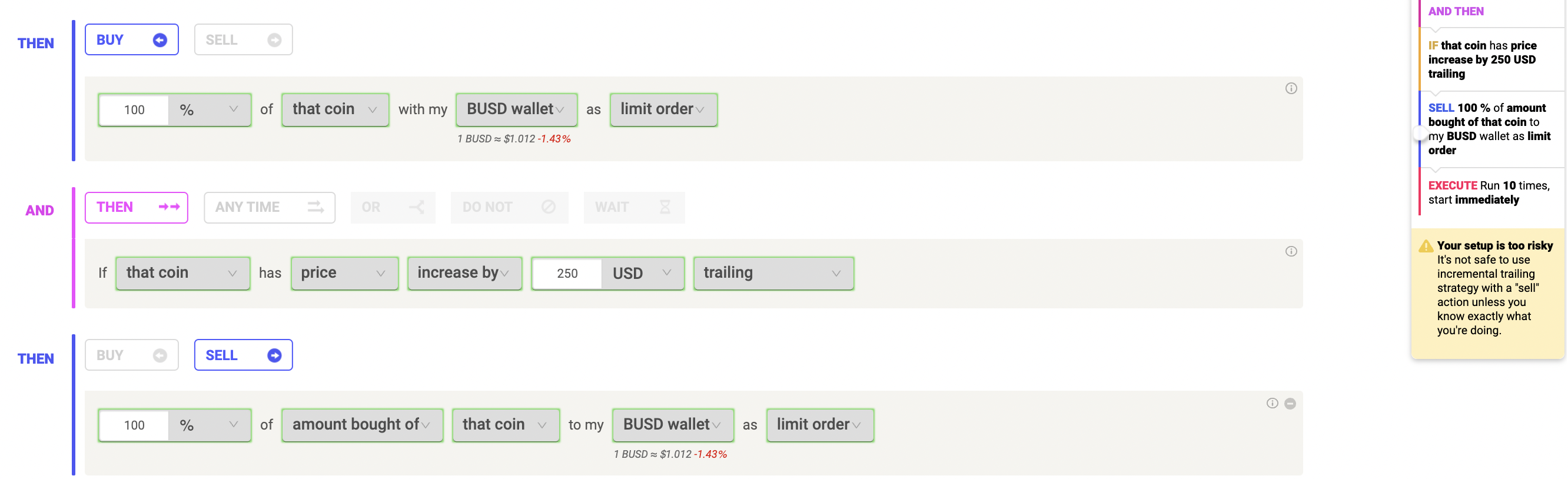

Example 1:

In this case the rule would buy BTC but as exit condition it would sell with a Trailing $250 above the current price.

This means that if you buy BTC at $43,000 and the price drops to $40,000, you would not have a Stop Loss / Exit condition defined on the way down. The rule would only sell once the price bounces back by $250, i.e. in this case if after dropping to $40,000 the price goes up to $40,250, the rule would sell.

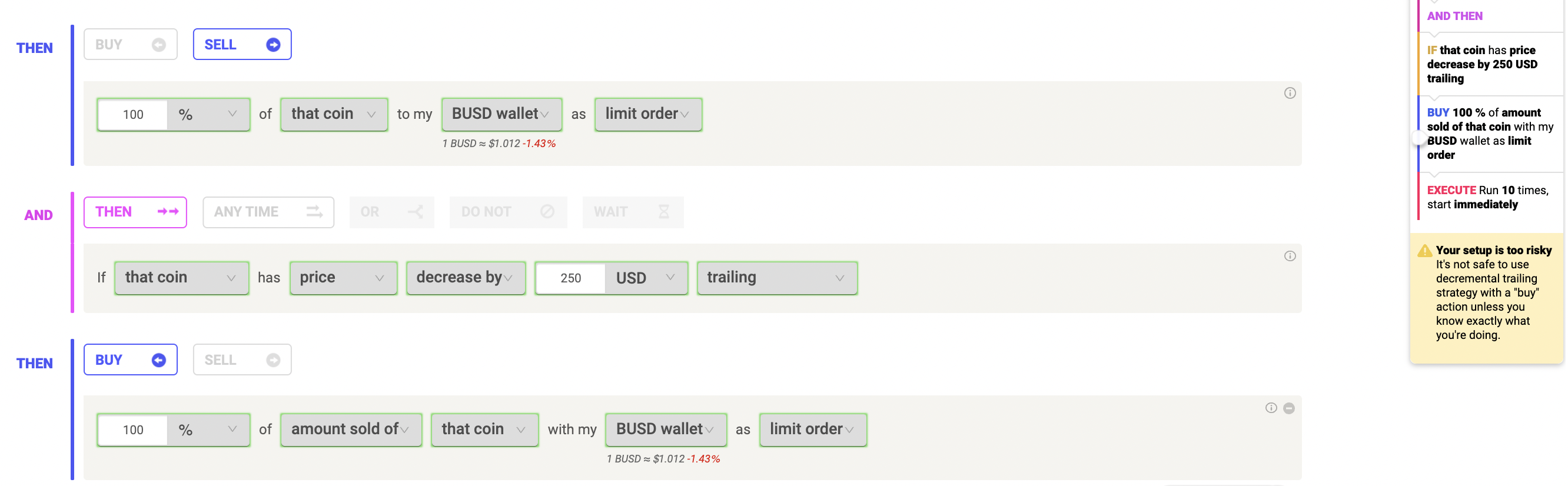

Example 2:

In this case the rule would sell BTC and try to buy back with a Trailing $250 below the current price.

This means that if you sell BTC at $43,000 but the price continues to increase say to $45,000, you are missing on the upside. At the same time, the rule would then buy back once BTC would drop by $250. In our example, if BTC dropped from $45,000 to $44,750, the rule would buy the drop. The risk however would be that BTC could continue dropping.

Both examples above could make sense if you connect them to other indicators and triggers but if in doubt, avoid building complex strategies that may not trigger as you expect.

Trailing Order in first Condition

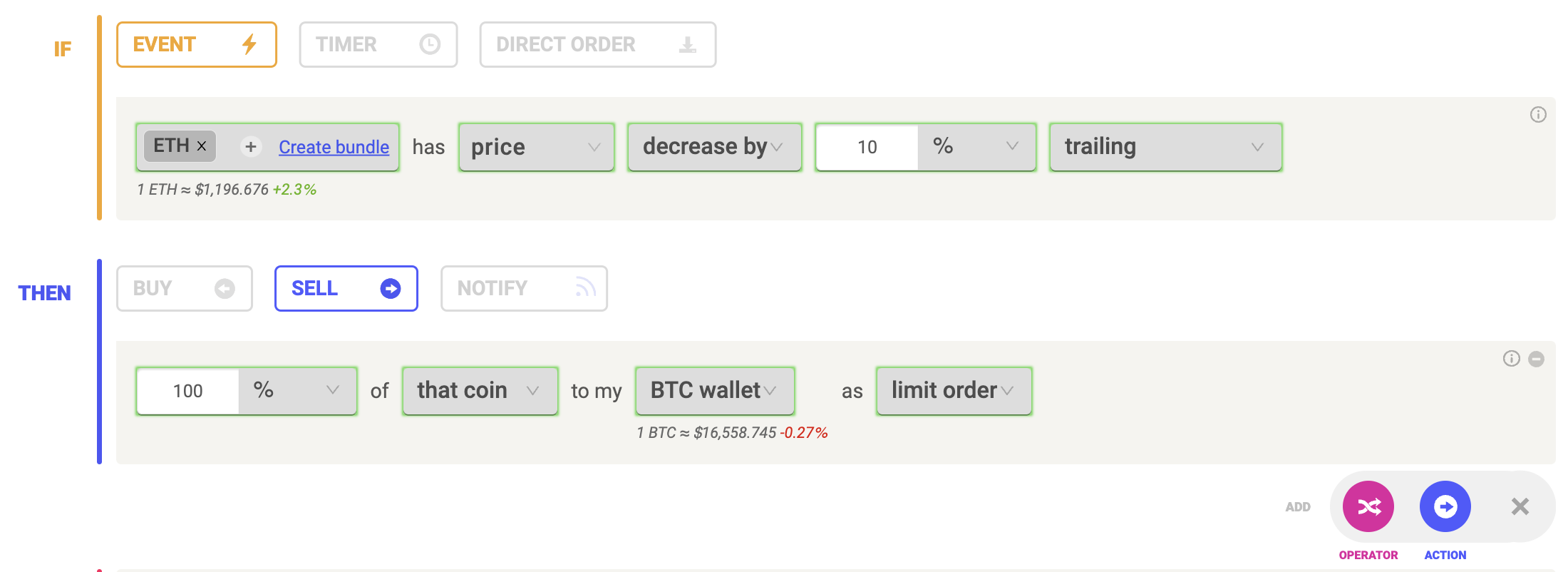

Example 1

Price at rule launch: 1 ETH at $1,197

Trailing Order Price: 1 ETH at $1,197

Possible cases:

1) Price decreases until it has decreased by 10% from $1,197 (trailing order price) --> the rule triggers

2) Price increases from $1,197, then at some point decreases by 10%

Example: assuming the price increases to $1,400 - this now becomes the new trailing order price. The rule triggers if the price decreases by 10% from $1,400.

Assuming the price now drops 10% from $1,400, reaching $1,260, the rule will sell.

The difference between using the 'Current Live Price' option in the dropdown [referred to here as 'price at rule launch'] and the 'trailing' price is that the rule would have continued to evaluate the price increase against the 'price at rule launch' of $1,197 if 'trailing' was not used. The rule would have triggered at a lower price of $1,077. The trader would have done worse compared to selling at $1,260.

Coinrule's engine will always take the highest reached trailing order price from which to calculate the trailing decrease.

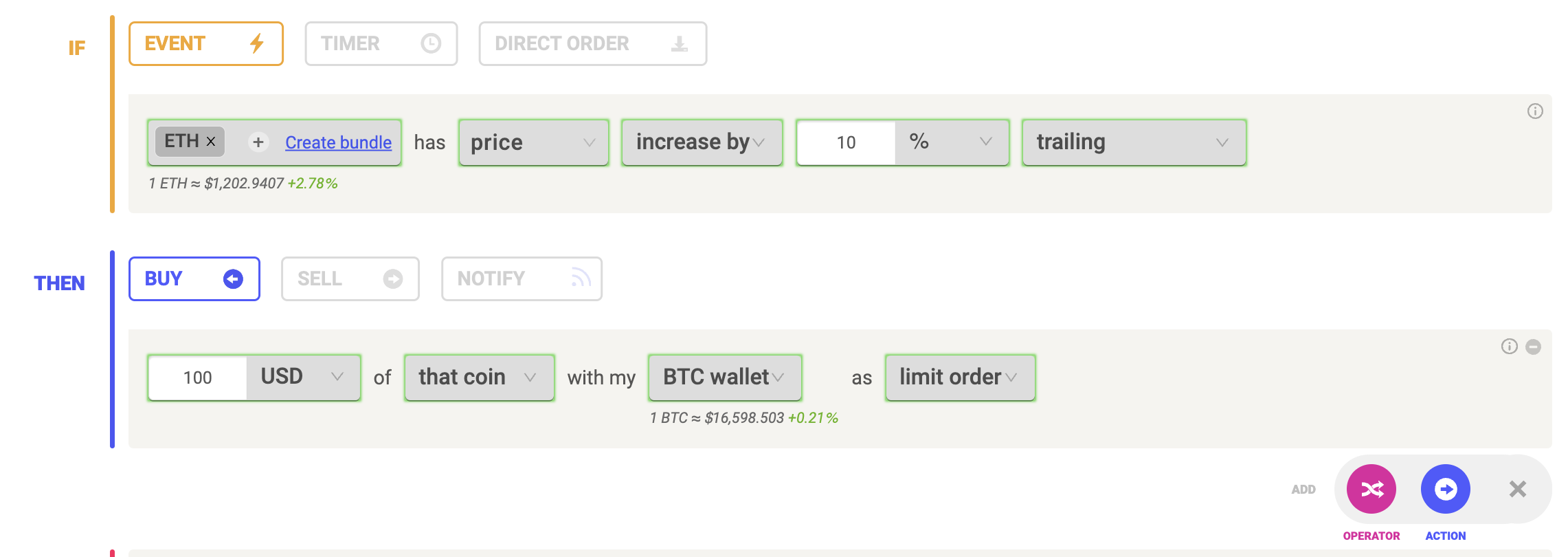

Example 2

Price at rule launch: 1 ETH at $1,203

Trailing Order Price: 1 ETH at $1,203

Possible cases:

1) Price increases until it has increased by 10% from $1,203 (trailing order price) --> the rule triggers

2) Price decreases from $1,197, then at some point increases by 10%

Let's assume the price of 1 ETH now decreases to $1,150. The Trailing Order Price gets updated to $1,150. The system now evaluates the condition against the new Trailing Order Price of $1,150.

For the rule to trigger, the price would now need to increase by 10% from the new Trailing Order Price of $1,150 and reach a price of $1,265 before the order triggers.

Without using the trailing functionality here, the rule would have triggered at a higher price of $1,323.

In connection with a 'trailing price increase' and a 'Buy' you can catch trend reversals with a better entry price compared to the regular 'current live price' value.

Create your rule with the trailing stop or buy on Coinrule today!

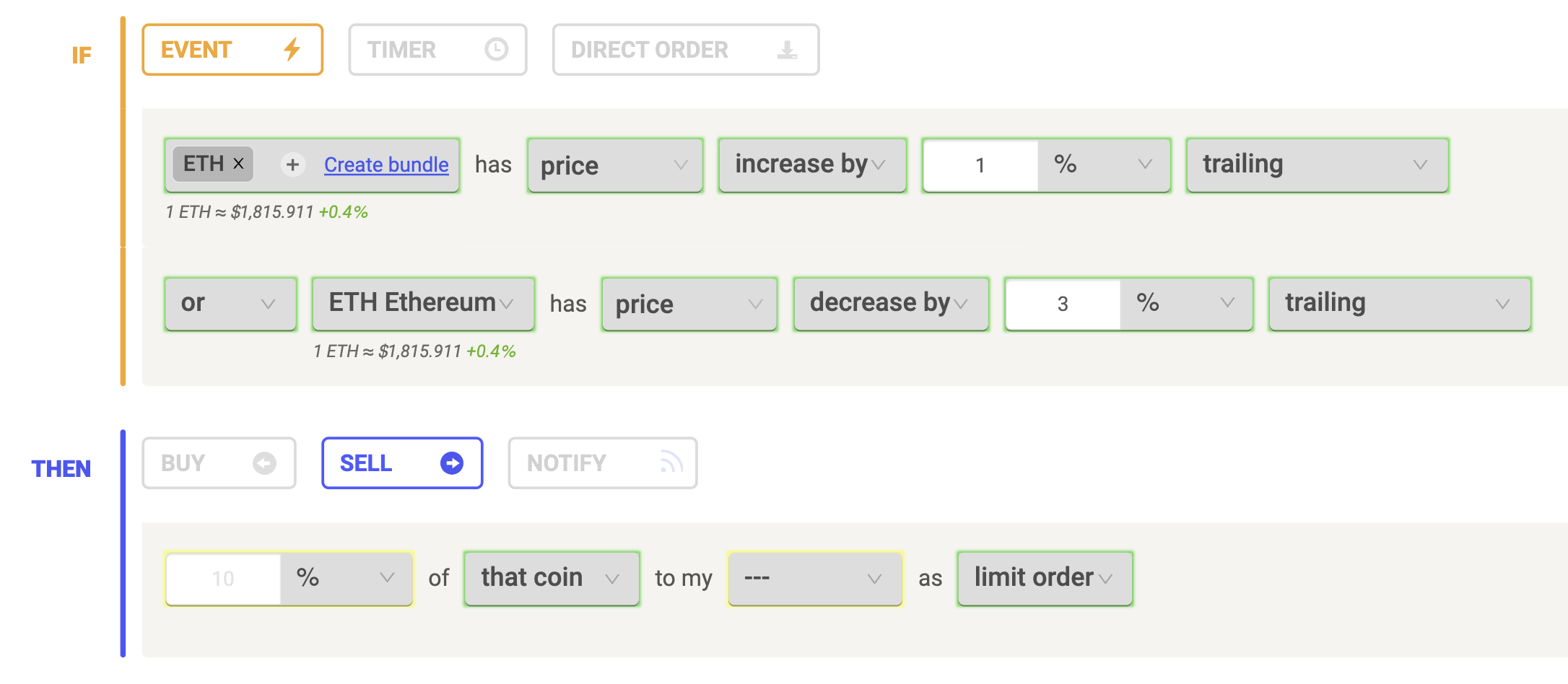

Known Issues: Multiple trailing conditions

Using 'trailing' more than once inside a condition block will create a logical bug in the rule execution.

This is a known-issue and will be resolved by the team soon.

Do not use 'trailing' more than once per condition block.