Order Types For Your Rule

Last updated November 5, 2024

Understanding Order Types For Your Rule

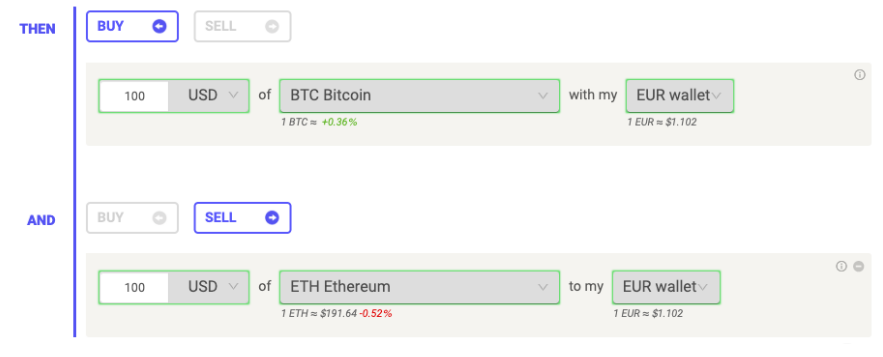

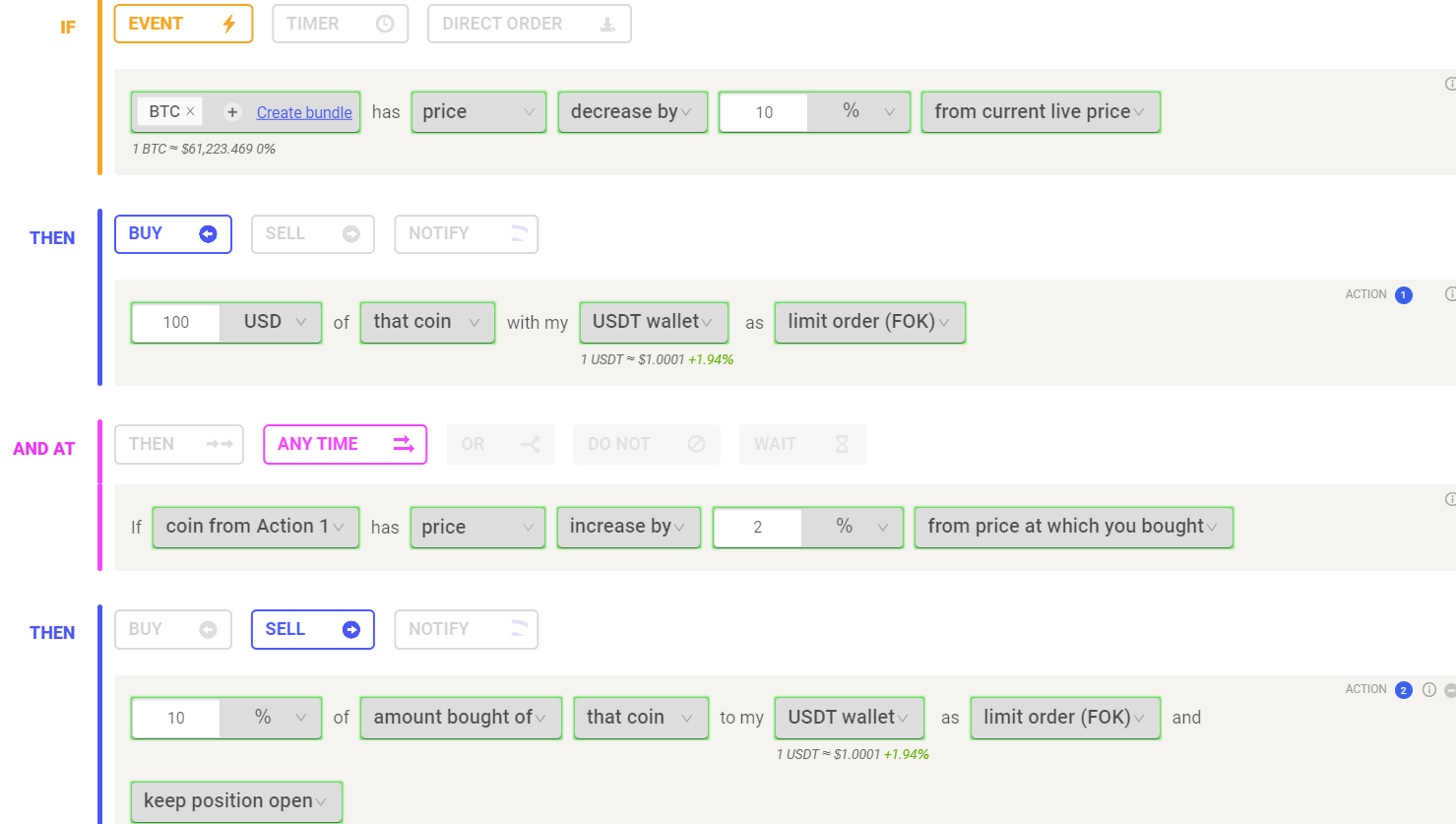

After having defined what will activate your trading bot , you have to fill in the parameters of your order (or of multiple orders). You can add up to two or more conditions for each action block depending on your subscription plan.

The necessary parameters for each order

- Buy/Sell: Choose the nature of the trade, i.e. whether you want to BUY or SELL

- Specify Trade Size: The next step is to choose the amount for every order. That can either be expressed in terms of percentage of the amount bought or your total balance (i.e. sell 50% of amount bought), or in absolute terms indicated both in Fiat currency (i.e. sell 200 USD of my Bitcoin) or a specified amount of Coins (i.e. sell 0.5 coins of BTC).

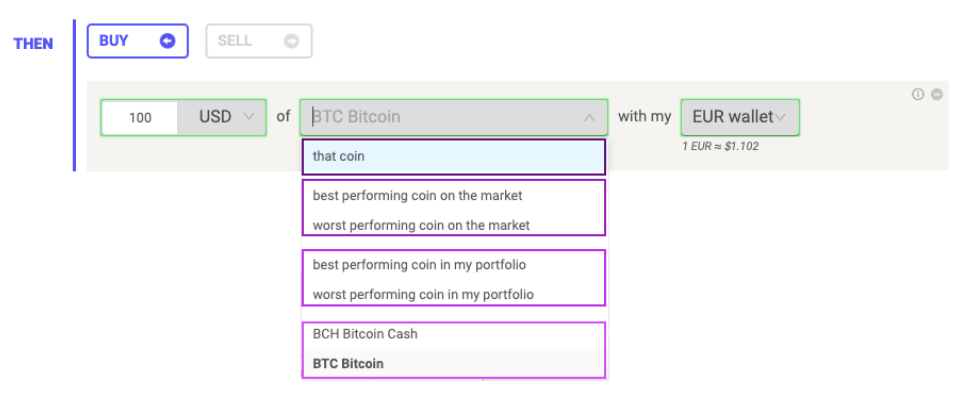

- In the following field you can choose which coins will be bought/sold. You can select one or more specific coins of your choice, or you can trade those meeting the set conditions (i.e. that coin, it refers to the previous condition). Alternatively, you can buy or sell a specific coin (among all available on the market or those already in your portfolio) depending on their price performance in the past 24 hours.

- Choose Wallet: Finally, you choose the wallet you want to use for the trade. That will define the trading pair of the order. Assuming the rule is going to buy Bitcoin (BTC) and you select the “USDT wallet”, a buy order of BTC/USDT will be sent to the exchange. Of course, make sure to have the proper available allocation in the selected wallet to execute the orders. Read more about the allocation of your rules here.

Using " Keep Position Open " users can create a rule where, each time the price of the specified coin rises by a set percentage (e.g., 2%), a defined percentage (e.g., 10%) of the amount originally purchased is sold. This process repeats every time the price increase threshold is met, continuing until 100% of the position has been sold. This strategy helps traders take advantage of rising prices while still maintaining exposure to potential further increases.

Learn more about how to use keep position open functionality on Coinrule.

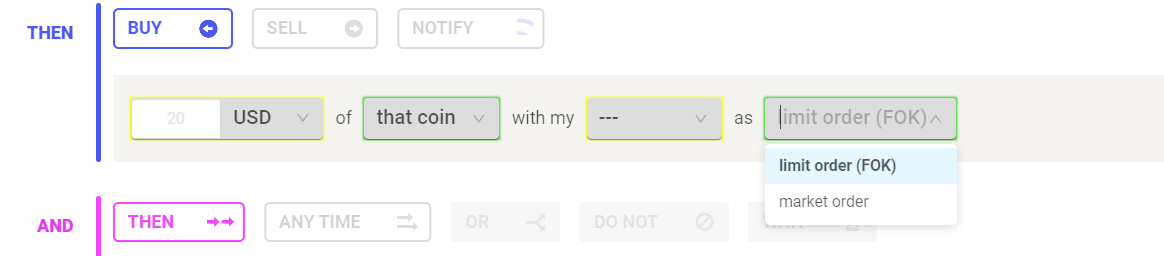

Market vs Limit orders

A market order is filled immediately at the best available market conditions at the moment of reaching the order book of the exchange.

So if you send a market order to buy 1 Ethereum, your order will be executed at the cheapest ask price quoted in that given moment. When using a market order, you might end up buying at a higher price than expected. That depends on the size of your order and the liquidity of the market in terms of available-to-trade coins.

Market orders allow you to trade the coin immediately but don’t guarantee to execute at a specific price.

- A market order is an instruction to buy or sell immediately (at the market’s current price).

- A limit order is an instruction to wait until the price hits a limit or better price before being executed

With a limit order you can set up a maximum (or minimum) price you are willing to get executed when buying (or selling). This gives the warranty of not trading at inconvenient prices. Read more about Limit Orders .

Nevertheless, the price protection comes at “a cost”. You may need to wait for the order to be executed. Of course, the closest your limit price will be to the current market conditions, the higher the chances of trading the coins.

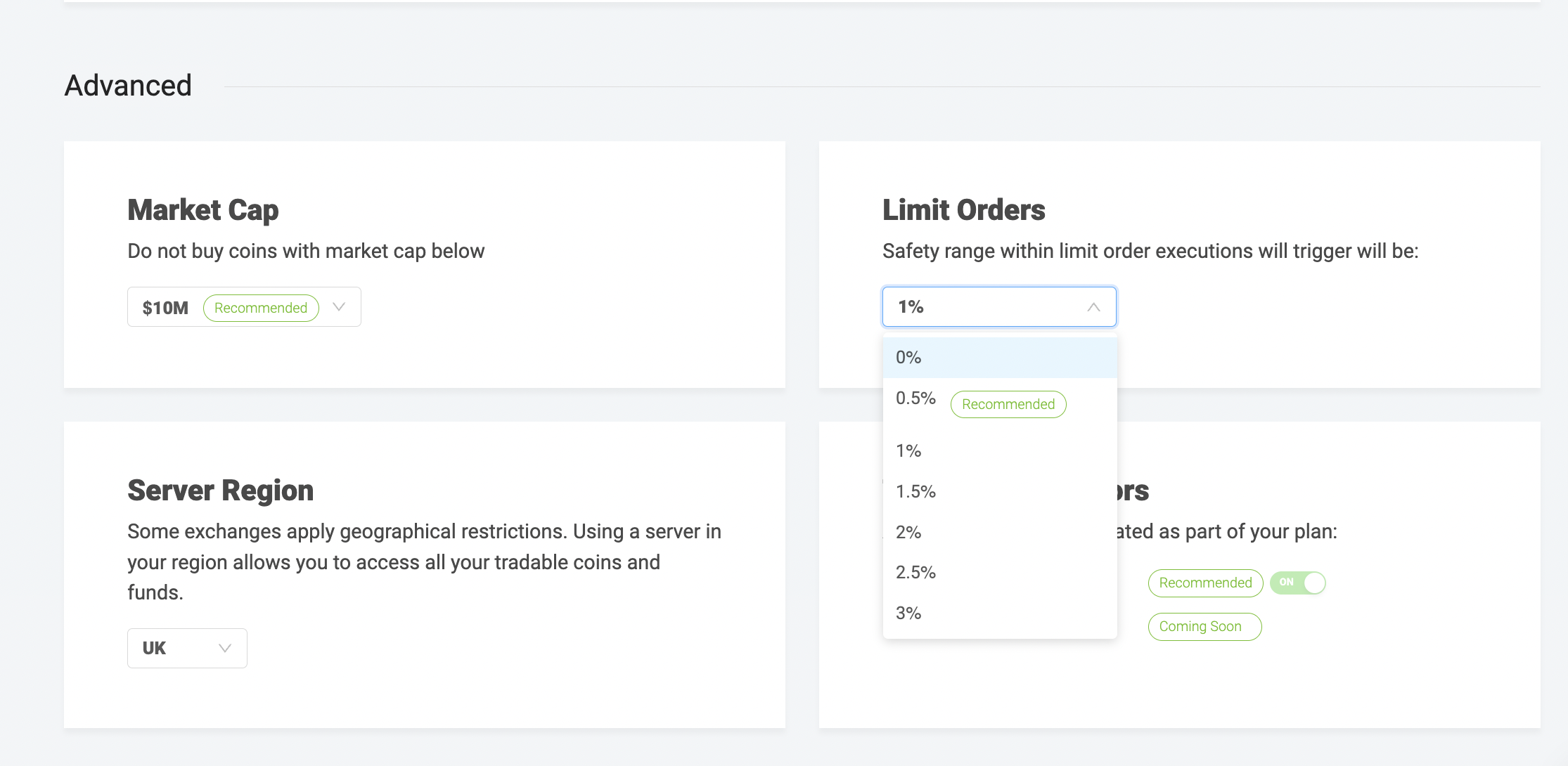

In the setting page, you can set up the price-margin to apply to your limit order to increase/reduce the possibility of execution. Here is how it works.

- the rule is going to buy ETHUSD

- The price that triggers the order is 240 USD

- The margin for the limit order is set to 0.5%

- Therefore, the bot will send an order with a limit price of 241.20 USD

Use Limit orders when you want to protect from the risk of executing your orders at inconvenient prices. Limit orders may not be filled.

Keep Position Open

You can read more about the 'keep position open' functionality and how it enables you to take profit incrementally and build powerful Grid Trading strategies here .