How Does Grid Trading Work On Coinrule

Last updated November 5, 2024

How Does Grid Trading Work On Coinrule

Grid trading is a powerful strategy used by traders to maximize potential gains by systematically selling portions of a coin as its price increases. On Coinrule, grid trading is particularly flexible, allowing traders to customize their sell conditions and use the " Keep Position Open " feature.

It's tricky to trade when the market has no clear direction because of the high uncertainty of each price swing. During these times, the rate of growth of your profits on your assets can decrease. However, an automated trading strategy can add significant value to your wallet with these market conditions.

Understanding the 'Keep Position Open' Feature

The "Keep Position Open" feature on Coinrule is designed to allow traders to sell off a portion of a coin's position incrementally, based on predefined sell conditions, instead of closing the entire position at once. This method helps traders capitalize on rising prices while maintaining exposure to further increases. Here’s how it integrates with the different operators.

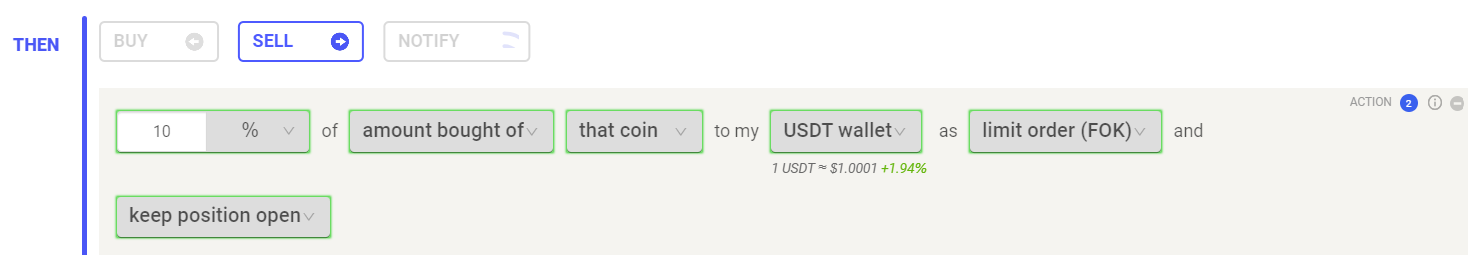

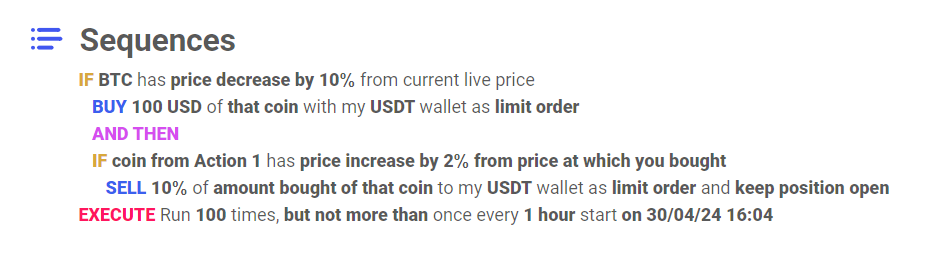

'Keep Position Open' & 'AND THEN' Operator

When using "Keep Position Open" with the 'AND THEN' operator, the rule is structured to execute a sale of a predefined percentage of the amount bought of a coin after a specific price increase has been achieved. For example, if a rule is set to sell 10% of a cryptocurrency when its price increases by 2%, it will execute this 10% SELL up to ten times as long as the price continues to rise by at least 2% before it starts buying again. This is in line with how the AND THEN operator is designed to work and ensures that the trading continues systematically during the price uptrend.

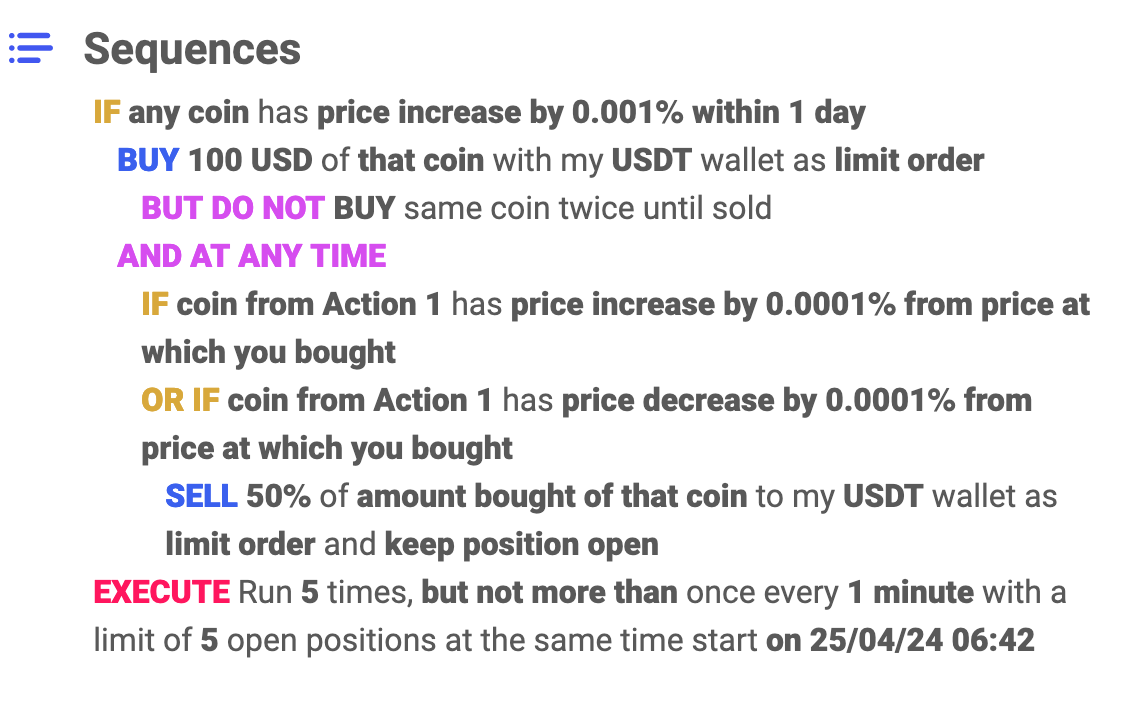

Keep Position Open & 'ANYTIME' Operator

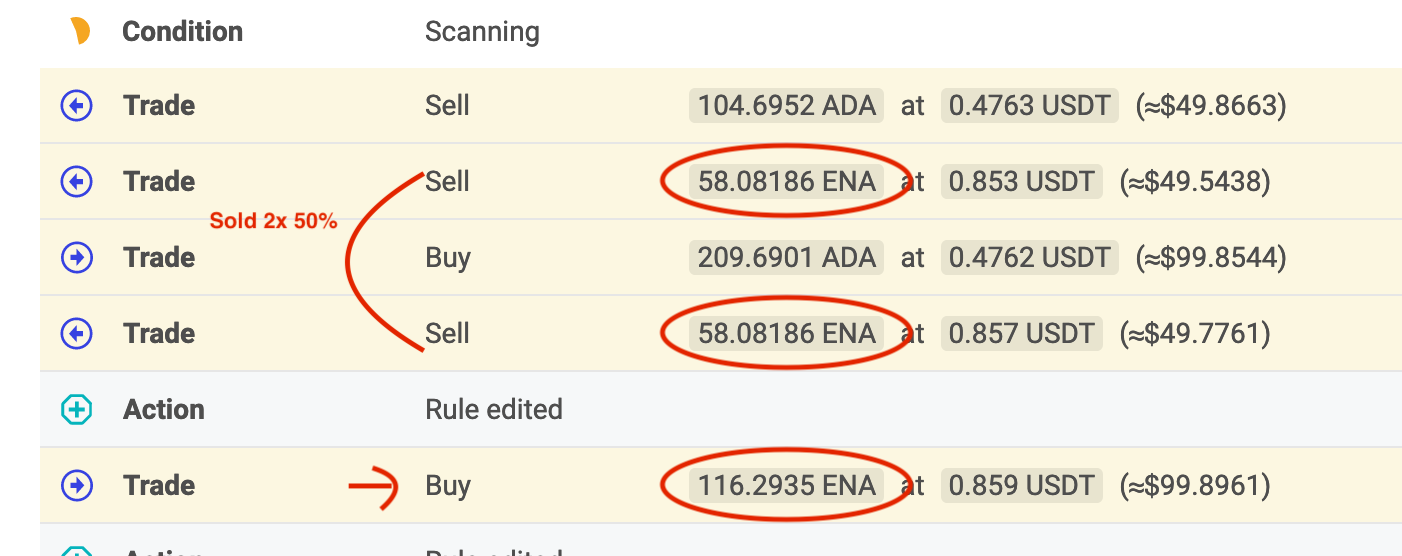

In contrast, when using the 'ANYTIME' operator, the rule will sell a set percentage of the coin anytime the price of the coin increases based on its sell conditions (e.g., 2%) without waiting for any specific sequence of events, in line with how the ANYTIME operator is designed to work. This operator allows for more flexibility, as it executes the SELL whenever the conditions are met.

Note: It's important to mention that if a rule is configured to sell a portion of its balance, such as 30%, it will only execute this three times (totaling 90%). Any remaining percentage that does not meet the exact selling condition (e.g., the last 10% in this example) will be ignored, similar to the "close position" scenario.

Key Points:

1. Single Sell per Candle: When using the "keep position open" option alongside candle-based conditions, such as within a specific time frame (e.g. within 30 min and so on), the rule will execute a single sell per candle. For example, if the rule is set to sell 50% of a coin and keep the position open within 30 minutes, it will execute the first 50% sell and then wait for the next 30 minute candle to evaluate the condition again.

2. Shortest Timeframe Consideration: If multiple conditions with different time periods are used in a rule, the rule will hold the position for the shortest timeframe amongst them. For instance, if the conditions are set as "IF within 15 minutes AND IF within 30 minutes," the rule will sell and wait for the next 15-minute candle to reevaluate.

3. Price Reference Update: The "from price at which you bought" option remains extremely relevant with the "keep position open" feature. When the initial 50% is sold, the price reference is updated to the current execution price. Subsequently, the rule starts evaluating like "from price as which you previously sold". This ensures that subsequent evaluations consider previous execution price, which prevents unexpected behavior.

4. Trailing Considerations: Trailing functionality operates similarly when using 'keep position open', adjusting the reference point as trades are executed while keeping the position open.

5. Incompatibility Warning: It's important to note that the "from current live price" option is not compatible with the "keep position open" functionality and may lead to unexpected results. Coinrule provides a warning when users attempt to combine these options to prevent unintended outcomes.

Benefits of Grid Trading on Coinrule:

- Incremental Selling: This strategy allows for selling a set percentage of the amount bought of a coin as the price increases, which can help lock in profits incrementally.

- Customizable Thresholds: Traders can define their own triggers for price increases and the corresponding sale percentages, allowing for tailored strategies that match their risk tolerance and market expectations.

- Ongoing Engagement: By using the 'Keep Position Open' feature, rule remains active until the entire position is sold off. This provides systematic profit taking during a price uptrend and keeps the trader engaged in the market dynamics.

Grid trading on Coinrule is an effective strategy for traders who wish to maximize their trading opportunities in volatile markets. By setting up rules that automatically adapt to market conditions, traders can ensure they are always positioned to take advantage of price movements while effectively managing their exposure.

You can view an example of a Grid Trading strategy on Coinrule here .