RSI Decrease Scalper

Last updated November 4, 2024

Introducing The 'RSI Decrease Scalper' Template

The Relative Strength Index is one of the most commonly used technical indicators when trading. It can give an indication of whether a coin is over or undervalued in relation to the previous 14 candles in the selected timeframe.

Moving averages can provide a signal of the trend of a coin. They can also act as support and resistance with price breaking above a significant moving average suggesting the start of an uptrend. If price breaks below it can signal the start of a downtrend.

Build This Rule on Coinrule!

Entry

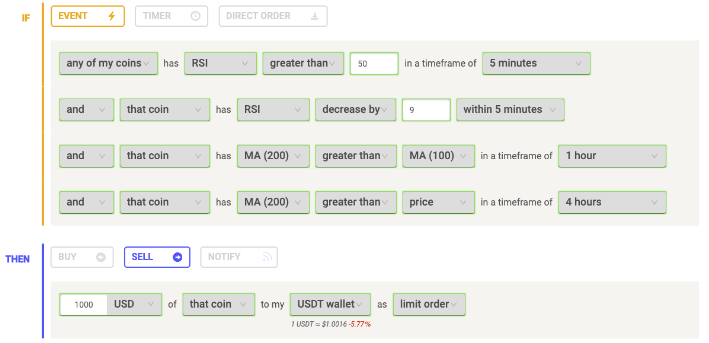

Condition 1

In this rule, the first condition identifies if the coin is above the 50 level, also known as the "fair value level", in a 5-minute timeframe. This aims to only sell coins that are not undervalued overvalued and potentially have some additional downside.

Condition 2

The second condition also uses the RSI and requires a decrease of 9 within a 5-minute candle. This signals that the coin's momentum is increasing to the downside and selling pressure has increased compared to buying pressure.

Condition 3

The third condition uses the moving average (MA) 100 and the MA 200, both in a 1-hour timeframe. The rule condition requires that the MA 200 is greater than the MA 100, signalling that the coin is in a downtrend and price has been decreasing.

Condition 4

The fourth condition acts as trend protection with the MA 200 in a 4-hour timeframe having to be greater than price. This prevents the rule from trying to sell any extended uptrends where price increases above the MA 200.

Learn more about trend protection and trading in a bear market in this article.

Exit

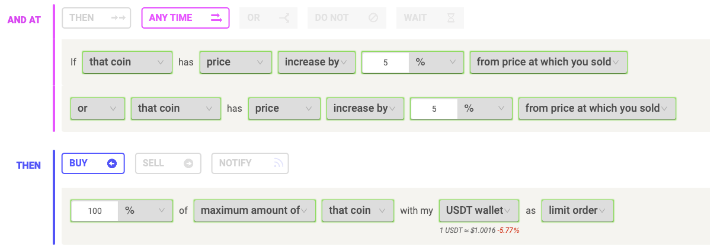

The exit for this rule uses a fixed stop loss and take profit.

Take Profit

The take-profit is set to trigger a buy when price decreases by 5% from the price at which the rule sold.

Stop Loss

The stop-loss is set to trigger a buy once price increases by 6% from price at which the rule sold.

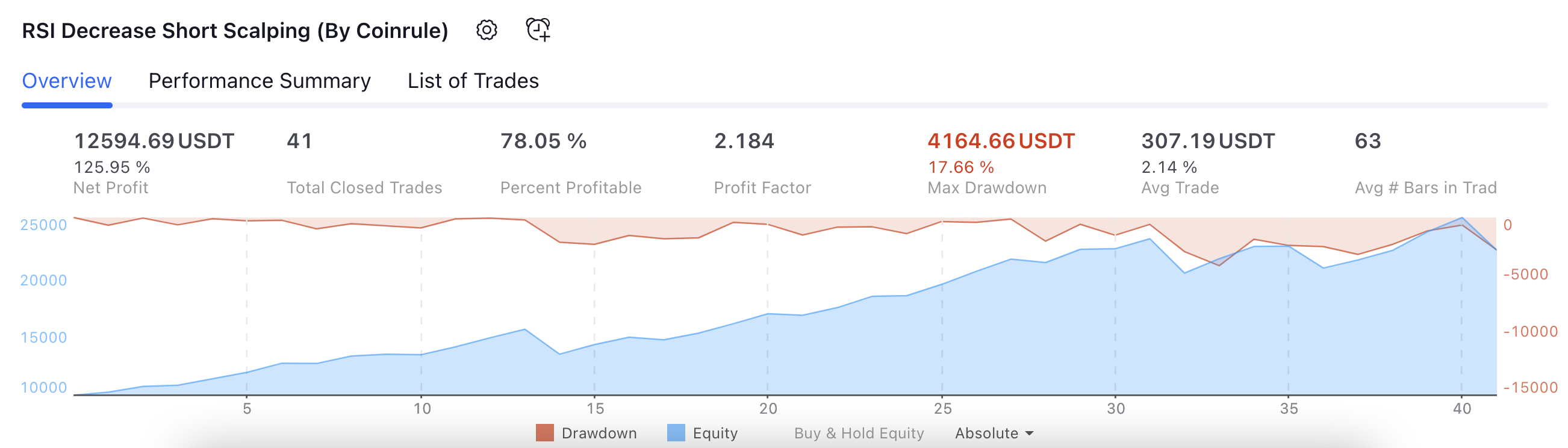

Backtesting Results

The risk:reward of this rule is 1. This means that for the rule to break even, for every trade that the rule hits the stop loss, the rule will have to have one trades execute at the take profit. This results in the rule requiring a win ratio of at least 50% for the rule to be profitable.

When backtested against Ethereum / USDT from May 1st 2022 to August 15th 2022, the rule achieved a net profit of 125% with a 78% win ratio.