How The Demo Exchange Works

Last updated November 5, 2024

Learn How The Demo Exchange Works On Coinrule

If you are looking to try out trading strategies without putting your assets at risk, Coinrule has you covered!

With our demo exchange, you can simulate real trading conditions to test your strategies.

The Demo exchange provides a virtual starting allocation to help you test out your strategies. Your rules will run in paper trading on Binance , properly mirroring actual trades.

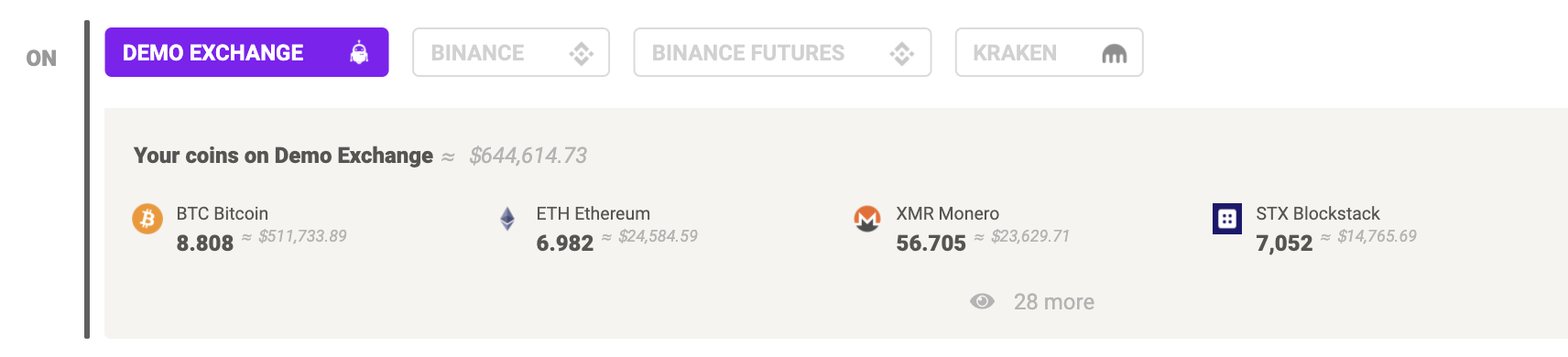

In the demo exchange, you have access to a virtual allocation of 10 BTC and 10000 USDT that can be used to execute trades in real market conditions. Even if you decide to trade with coins that are not available in this allocation, you are free to adjust your allocations by placing direct orders for new coins. You can also read more about allocations here .

Paper Trading on Binance with real-time Prices

When you create a rule on the rule page, select Demo Exchange to check the allocation of your Demo Wallet.

The demo exchange provides what is obtainable when using paper trading on Binance.

This means that you can trade with the provided allocation, in the same conditions as live trades, giving a realistic overview of your likely results when you use live trades.

The Demo exchange is connected to Binance , which means that you can test your strategies with all the available coins on the exchange.

You can check this page to confirm that you can trade your preferred pair.

The Advantages of Using Demo Rules

With the demo exchange, you can create countless rules and strategies. Trading with paper balances allows you to test out your strategies and tweak existing ones to increase returns.

Usually, the major difference between the demo and live trades is the emotions associated. With Demo rules, you have the luxury of making right or wrong trading decisions and learning from them without hurting your asset.

What is the Difference Between Demo and Live Rule

You can use both Limit and Market Orders on the Demo Exchange.

For Market Orders, the price used will be the Top 1 ask price in the Binance Order Book when buying or the Top 1 bid price when selling.

Limit Orders work similarly to market orders and use the top 1 ask or bid price. However, the price used is the better price out of either Binance Order Book or current Market price.

The main difference between Live and Demo Rules will be on low-volume coins that have less liquidity. In those cases were the 'Top 1' execution price might not be available, prices could be less accurate. Including an additional condition for volume or market cap could help reduce the differences between paper trading and real trading.

Exchange Fees

Demo orders include a simulated 0.1% Binance fee. When buying, the fee is taken from the Quote currency and when selling from the Base currency. As an example, if you are trading the BTC/USDT pair, the fee is paid in USDT when buying or in BTC when selling.

A difference between Demo and Live trading is that on Binance, exchange fees can be paid in BNB with a discount. This is not taken into account on our Demo Exchange.

Trading with the Demo Exchange is the perfect way to start automated trading.

Start trading with some level of confidence in your results today!

Please note that this article contains affiliate links.