Catch The Price Swing

Last updated November 4, 2024

One of the questions investor plan traders more often ask is: what is the perfect trading indicator?

Every indicator is just a tool, so its efficiency is proportional to your ability to read its signals and translate them into an actionable trading strategy. The RSI is likely the most flexible and easy to use among the technical indicators.

This trading strategy tries to catch short-term swings on the coins of your choice with a simple yet profitable setup.

- Buy when the RSI is lower than 30 (you can adjust it to 35 in times of steep uptrend).

- Sell when the RSI is greater than 65 (the target may range between 60 and 75 depending on the volatility of the coin)

The best time to launch this strategy

A typical example of market conditions where this strategy works perfectly is as follows.

The first initial breakout indicates that a new leg up in the trend may start. Bitcoin starts to trade within a range which you can identify when it reaches point 3. That is the perfect time to start the rule because:

- trading within a channel anticipates possible swings up and down

- the trend is on the upside, providing low downside risk in buying the dips.

This strategy works well with selected coins of your choice, and it's a great fit on leverage exchanges like Binance Futures .

If you prefer to run it across all available coins on the market, instead, you may choose a tweaked version .

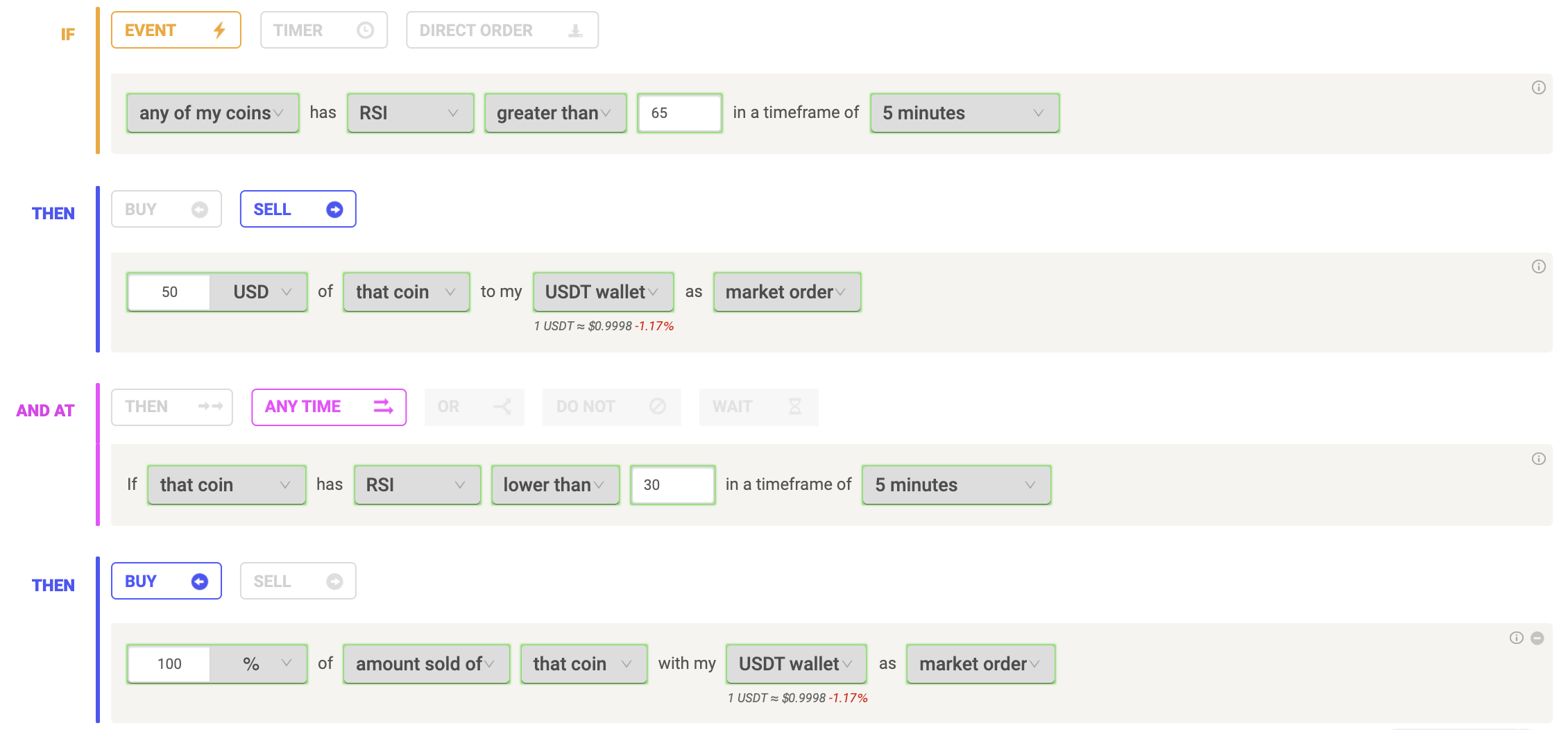

Build the strategy on Coinrule

The classic strategy with RSI is to buy the coin when RSI is low and sell it after the RSI rises.

RSI can be also be used if you want to capture moves on downtrends. You will find the template Portfolio Swing Strategy In Downtrend in the Template Library.

Here, you can set up the strategy on Coinrule so that you sell coins you already own when RSI is high to buy them back when the RSI is lower. This approach can add extra value to your wallet by selling coins that you already own, without increasing the overall exposure of the wallet by buying new coins.

Pro tip: For experienced traders, note that you can run this strategy to short-sell coins that you don't already own using Binance Futures.

Just select the contract you want to trade, sell them first, and then buy back the same amount later. For context about shorting on Binance Futures, you can read this article .

Pro tip: The 4H time frame has proven to return the best results on average. The strategy can work well also in the 5-min time frame.

This strategy made 67% net profit on BNB/USDT on the 4Hour timeframe from January 2022 - December 2022.

Backtest the strategy on Tradingview

You can backtest this strategy using this trading script published on Tradingview. You can test the results on historical data, selecting the coin of your choice, and adjusting the parameters to fit even better your needs.

This is a guide to learn how to backtest strategies on Tradingview.

Try out the Catch the Price Swing Strategy now on Coinrule to maximize your profits and returns!