How To Use Exponential Moving Average (EMA)

Last updated November 3, 2024

Learn How To Use Exponential Moving Average (EMA)

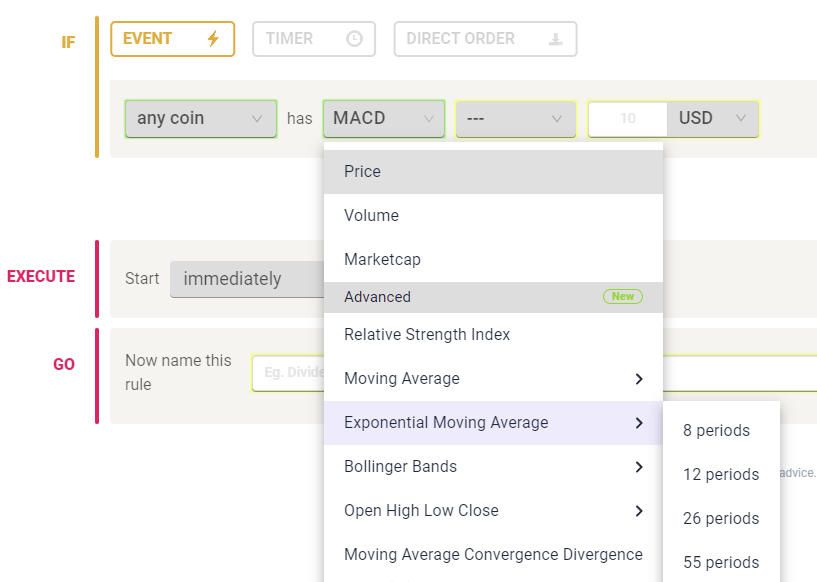

As part of our new technical indicator offerings, we have now integrated support for 4 Exponential Moving Average (EMA) periods. You can now build EMA8, EMA12, EMA26 and EMA55 into your strategies, giving you a greater degree of customizability for your rules.

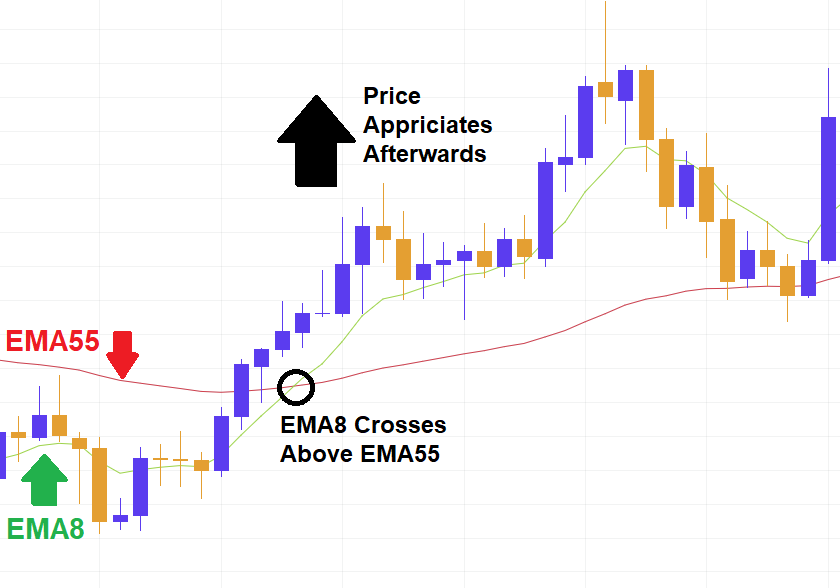

EMAs are a type of moving average that places a greater weight and significance on the most recent data points. The exponential moving average is also referred to as the exponentially weighted moving average . They react more significantly to recent price changes than a simple moving average , which applies an equal weight to all observations in the period. Similar to Moving Average crossings, EMA crossings can provide important signals for traders. For example, if a fast period Exponential Moving Average (e.g. EMA8) crosses above a slower period Average (e.g. MA55) it can act as a buy signal for a trader:

Intuitively, when the fast period EMA crosses below the slower period EMA, it can act as a signal to close a position or open a short position.

Formula used to calculate EMA on Coinrule

EMA = (price - emaData[idx]) *k + emaData[idx]

Smoothing = 2

k = smoothing divided by (length of the candle + 1)

EMA[idx] is the candles data feed we get from the exchange

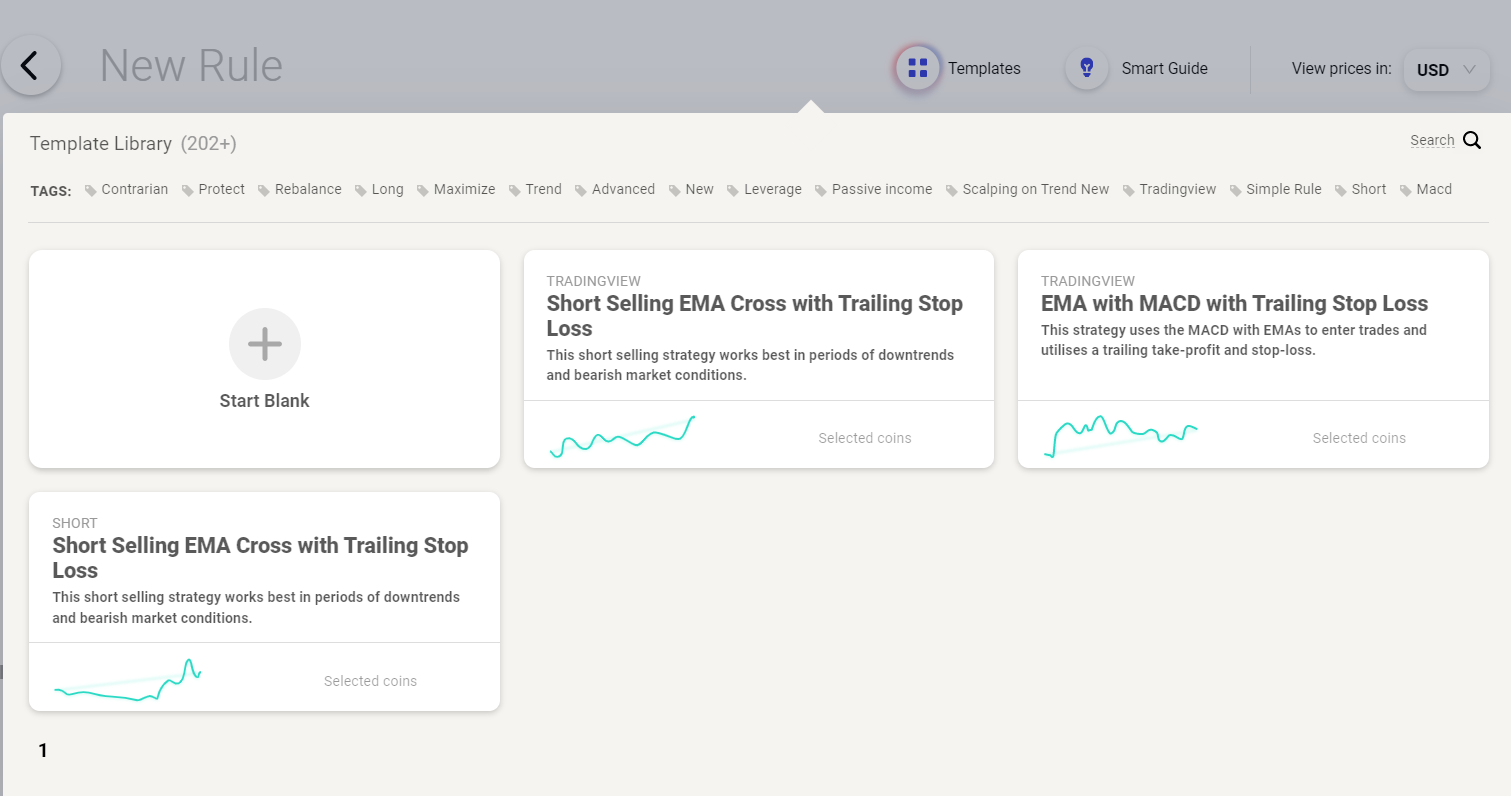

Pre-built Templates using EMA can be found in our Template Library by seraching 'EMA' here:

The template library features a 'Short Selling EMA Cross with Trailing Stop Loss' strategy. This short selling strategy works best in periods of downtrends and bearish market conditions. This strategy comes with a trailing stop loss which allows the strategy to capitalise on strong gains and helps protect your profits.

We hope you enjoy the new indicator. Happy trading!