How To Use Volume-Weighted Average Price (VWAP)

Last updated February 4, 2025

Learn How To Use Volume-Weighted Average Price (VWAP)

VWAP stands for Volume-Weighted Average Price and is calculated by dividing the total value traded (price multiplied by volume) by the total volume traded during a specified period. It's similar to a moving average in that when price is above VWAP, prices are rising and when price is below VWAP, prices are falling.

The formula for VWAP is:

VWAP = (Sum of ( Price × Volume within Anchor Period ) ) / (Sum of Volume within Anchor Period)

VWAP is a widely used trading benchmark that calculates the average price of an asset weighted by its trading volume. VWAP acts as a line plotted on a price chart, serving as a dynamic support or resistance level.

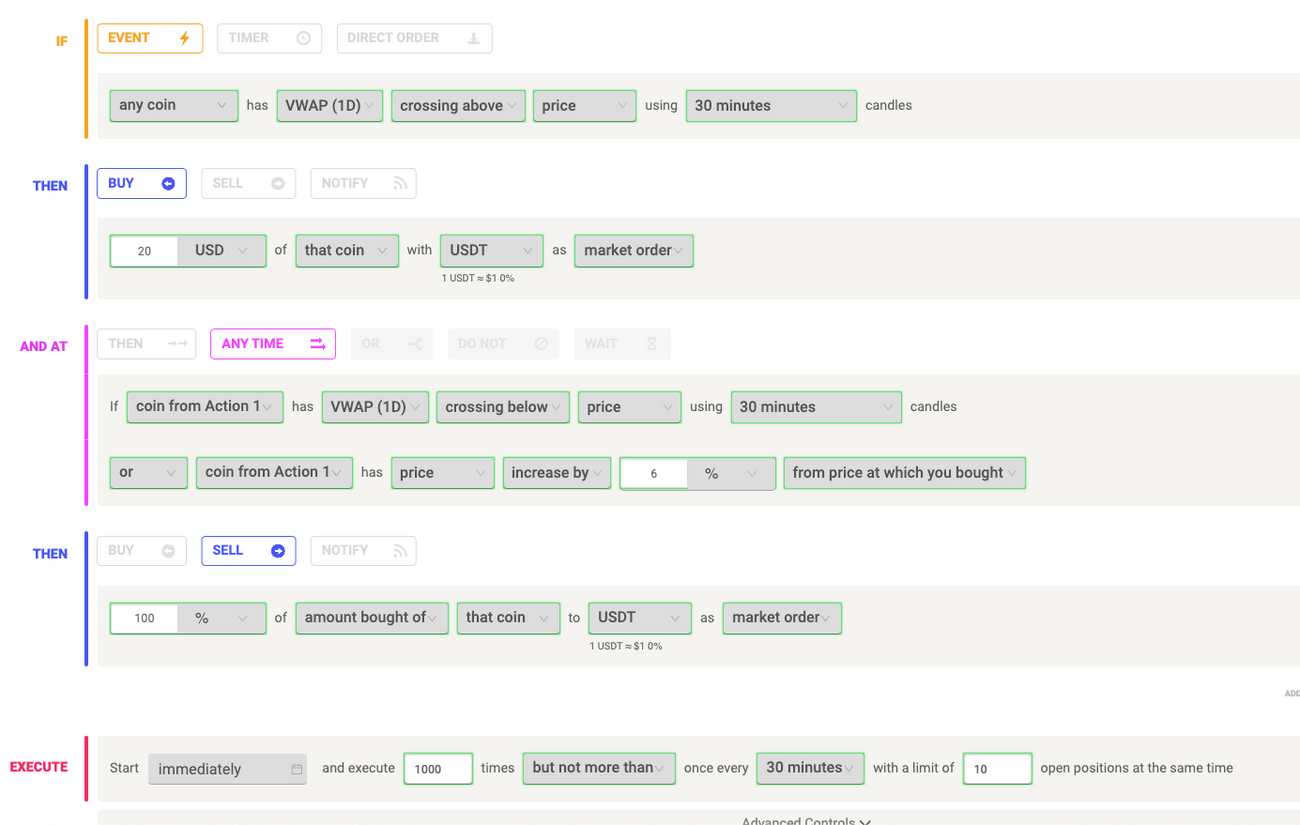

Using VWAP on Coinrule

On Coinrule, you can configure VWAP to match your strategy. The periods available range from 5 minutes to 1 day.

The Anchor Period setting specifies the Anchor, i.e. how frequently the VWAP calculation will be reset.

VWAP in Action

Trading View Indicator:

We created a modified VWAP indicator to be fully compatible with Coinrule, offering the same anchor periods available on the platform.

Unlike TradingView’s default VWAP, this version allows you to select 1 hour, 4 hours, 12 hours, 1 day, 2 days, 3 days, weekly, monthly, and yearly anchor periods and the price source is fixed to HLC3 to ensure full compatibility with Coinrule.

If you're comparing VWAP values with TradingView, use this indicator to unlock all the options supported by Coinrule and avoid discrepancies.

Potential Uses

- Trend Confirmation:

- Use VWAP to confirm the direction of the market.

- Example: Buy an asset when its price consistently stays above the VWAP, indicating bullish momentum.

- Dynamic Support and Resistance:

- Trade reversals when the price interacts with the VWAP line.

- Example: Sell when the price approaches VWAP from above and shows rejection.

- Intraday Trading:

- Use VWAP as a benchmark for intraday trades.

- Example: Avoid buying when the price is significantly above VWAP to reduce the risk of overpaying.

Consider this example:

An coin starts trading at $100 and moves up to $105 with heavy volume.The VWAP line calculates the average price weighted by the traded volume and might settle at $103. A trader sees the price pulling back to $103 (VWAP) and uses this level as a support to enter a position (buy), benefiting from a subsequent price bounce.

Key Takeaways

- Prices above the VWAP indicate a bullish trend, while prices below the VWAP indicate a bearish trend.

- Dynamic Indicator: VWAP resets based on the anchor period.

- Use VWAP for trend identification, trade benchmarking, and dynamic support/resistance levels.

- If you're comparing with TradingView, use this updated VWAP indicator.

Experiment with VWAP to discover its full potential for your trading approach.

Important Note: this article does not constitute trading advice.