How To Use Moving Average (MA)

Last updated November 3, 2024

How To Use Moving Average (MA)

What Is a Moving Average (MA)?

A moving average (MA) is a technical indicator commonly used in technical analysis . The reason for calculating the moving average is to help smooth out the price data by creating a constantly updated average price .

By calculating the moving average, the impacts of random, short-term fluctuations on the price of a stock over a specified time frame are mitigated.

Moving averages are calculated to identify the trend direction of a coin or to determine its support and resistance levels. It is a trend-following or lagging , indicator because it is based on past prices. An upward trend in a moving average might signify an upswing in the price or momentum of a security, while a downward trend would be seen as a sign of decline.

Generally, technical analysts will use moving averages to detect whether a change in momentum is occurring for a security, such as if there is a sudden downward move in a security’s price. Other times, they will use moving averages to confirm their suspicions that a change might be underway.

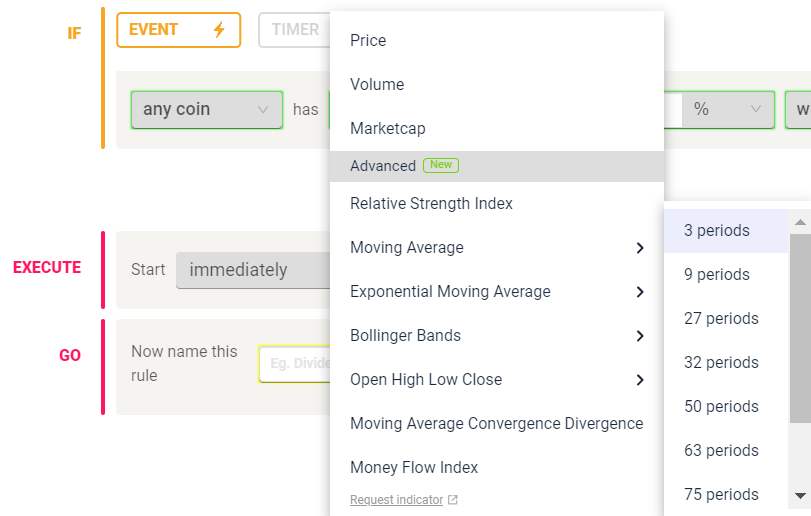

MA Periods available on Coinrule

We have now integrated support for 9 Moving Average (MA) periods. You can now build MA3, MA9, MA27, MA32, MA50, MA63, MA75, MA100 and MA200 into your strategies, giving you a greater degree of customizability for your rules.

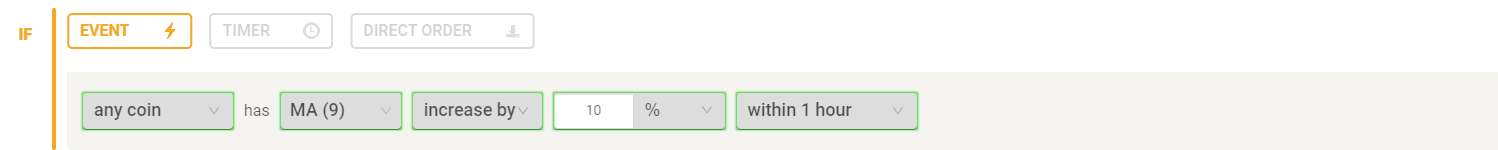

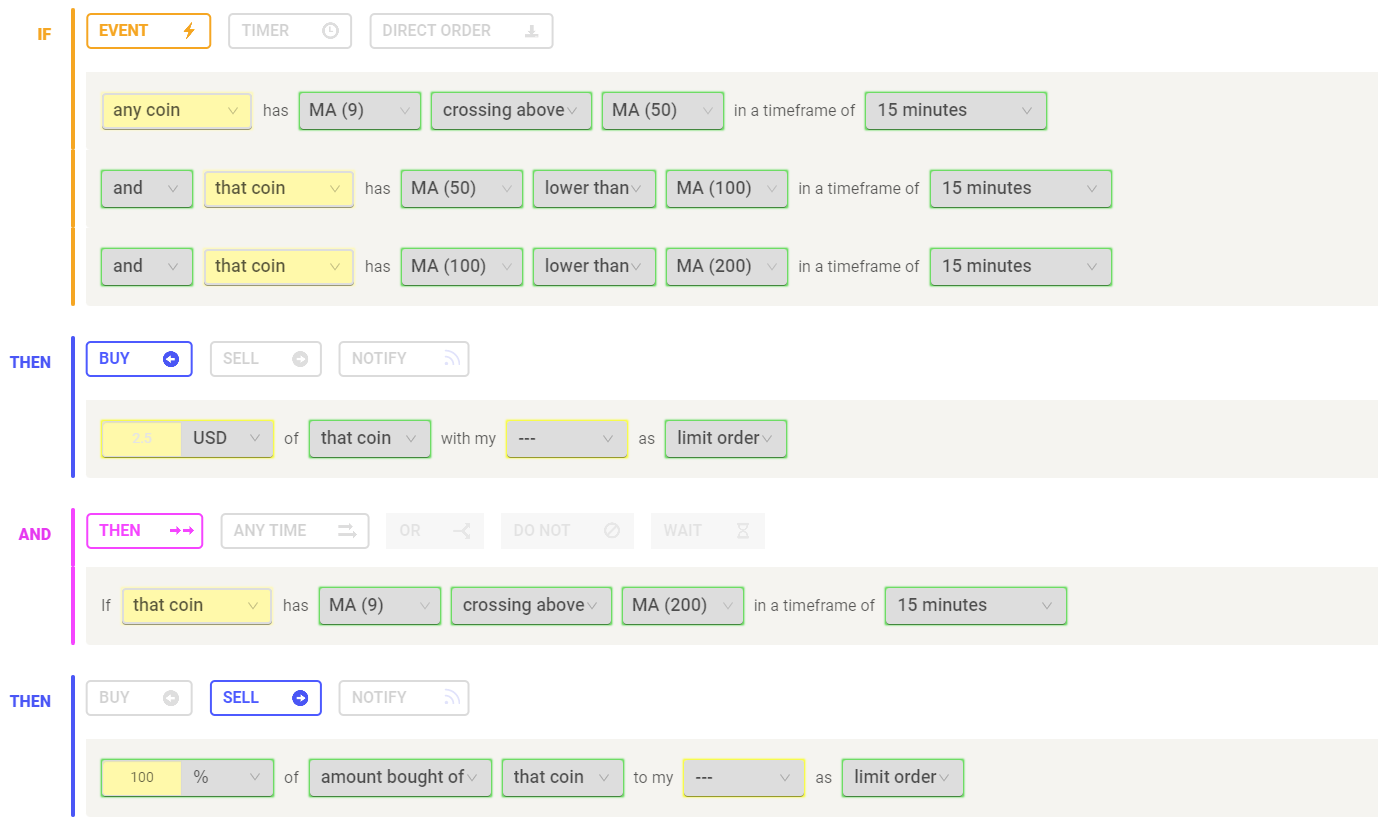

Below is an example strategy using MA while trading on Coinrule:

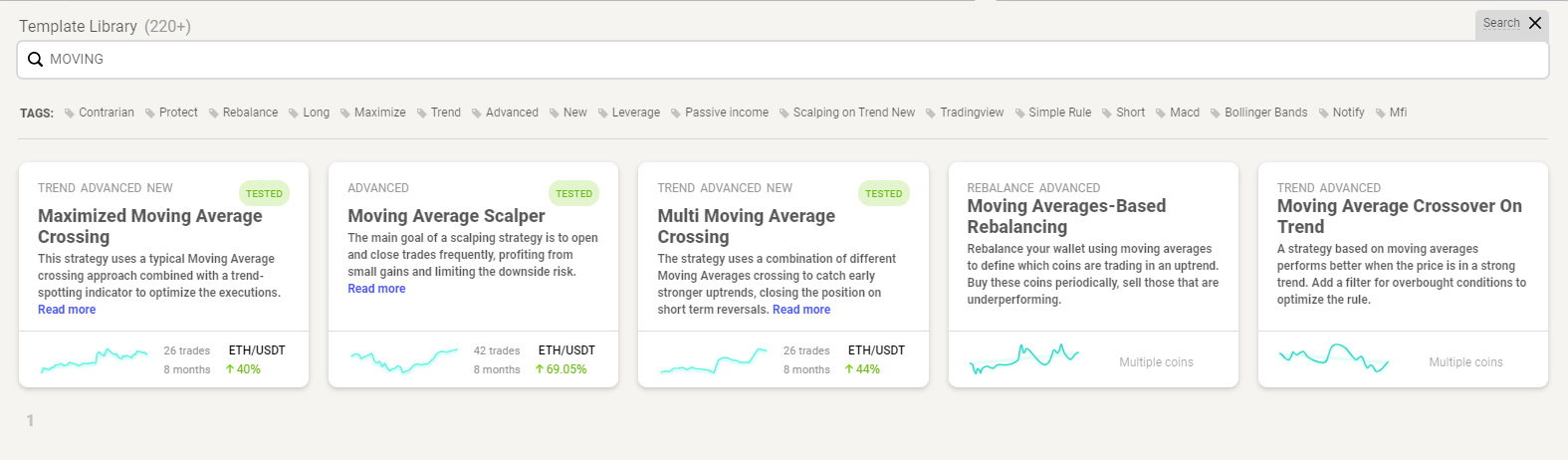

Check out some of our MA templates to get started with building this indicator into your strategies: