How To Use Supertrend

Last updated January 13, 2025

The Supertrend indicator is now live on Coinrule! Supertrend is a popular technical analysis tool used to identify the direction of the prevailing market trend. It is a trend-following indicator that dynamically adjusts based on price movement and volatility. Supertrend works exceptionally well in trending markets and can help traders make better-informed trading decisions.

What is Supertrend?

The Supertrend indicator is based on two key parameters:

- ATR (Average True Range): Used to measure market volatility.

- Multiplier: Determines the distance from the price at which the Supertrend line is plotted. Default value is 3.

The Supertrend plots a line above or below the price, depending on the market trend. If the price is above the Supertrend line, it indicates a bullish trend. Conversely, if the price is below the Supertrend line, it signifies a bearish trend.

How Supertrend Works

Supertrend uses the Average True Range (ATR) to factor in market volatility. The default multiplier on Coinrule is set to 3, which determines how sensitive the indicator is to price movements. The formula for Supertrend is as follows:

- Upper Band: (High + Low) / 2 + Multiplier × ATR

- Lower Band: (High + Low) / 2 - Multiplier × ATR

The Supertrend switches between the upper and lower bands based on the price closing above or below the bands, signaling a potential trend reversal.

We offer the following Supertrend periods: 5, 10, 15. These periods determine the number of candles used in calculating the ATR .

Using Supertrend on Coinrule

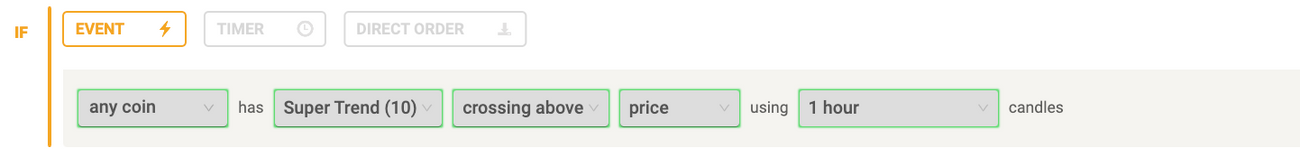

With Supertrend, you can create strategies that take advantage of trend signals such as:

Trend-Following Strategies:

- Trigger a buy rule when the price crosses above the Supertrend line, signaling the start of an uptrend.

- Example: If the price closes above the Supertrend (Period 10), initiate a buy order.

Trend Reversal Signals:

- Trigger a sell rule when the price crosses below the Supertrend line, signaling the start of a downtrend.

- Example: If the price closes below the Supertrend (Period 15), exit the position.

Dynamic Stop Loss:

- Use the Supertrend line as a trailing stop loss.

- Example: Set your stop loss dynamically at the Supertrend level to lock in profits while staying in the trade during an ongoing trend.