How To Use Average True Range (ATR)

Last updated January 13, 2025

Learn How To Use Average True Range (ATR)

The Average True Range (ATR) is now available on Coinrule!

ATR is a widely used technical analysis indicator that measures market volatility. Unlike other indicators that indicate trend direction, the ATR is used purely to measure volatility, especially volatility caused by price gaps or limit moves.

What is Average True Range (ATR)?

The ATR is a volatility indicator that calculates the average of true ranges over a defined number of periods. The true range is determined by considering the following:

- The difference between the current high and low.

- The difference between the previous close and the current high.

- The difference between the previous close and the current low.

The true range is the greatest of these three values, and the ATR is the Wilder smoothing average of these true ranges over a specified period. It helps traders identify the level of market activity and volatility.

Note: "current" refers to the most recent closed candle.

Unlike oscillators such as RSI or MFI , the ATR doesn’t provide overbought or oversold signals. Instead, it highlights the level of volatility, which can help traders in:

- Setting Stop Losses: Higher ATR values indicate greater volatility, suggesting a wider stop loss might be appropriate. Conversely, low ATR values suggest tighter stops.

- Determining Market Activity: A rising ATR indicates increasing volatility, often preceding significant price movements. A falling ATR suggests reduced volatility, potentially signaling a consolidation phase.

- Assessing Risk: High ATR values indicate more significant price fluctuations, which traders should account for when managing risk.

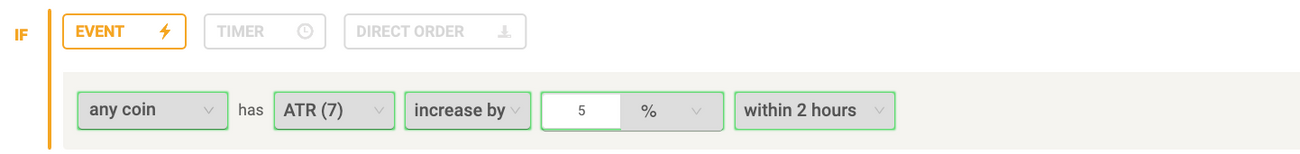

ATR Offerings on Coinrule

We have integrated ATR for the following periods: 2, 3, 5, 6, 7, 8, 12, 14, and 24. These periods allow for varying levels of sensitivity to market changes:

- Shorter Periods (e.g., ATR (2), ATR (3) ): Capture immediate volatility, providing faster signals but potentially more noise.

- Longer Periods (e.g., ATR (14), ATR (24) ): Smooth out short-term fluctuations, giving a broader view of market trends.

- ATR Measures Volatility: It doesn’t indicate price direction, but it helps assess the magnitude of price movements.

- Versatile Applications: Use ATR for setting stop losses, gauging market activity, and filtering trades based on volatility.

- Customizable Periods: Coinrule offers ATR with periods ranging from 2 to 24, allowing for tailored strategies.

Key Takeaways

By integrating ATR into your trading strategies, you can better navigate volatile markets and optimize your rule performance. Experiment with different ATR periods to find the best fit for your trading style.

Happy Trading!