Grid Trading In Range

Last updated November 3, 2024

Introducing The 'Grid Trading In Range' Strategy

A Grid Trading strategy allows you to add value to your portfolio in times of low volatility when a coin trades sideways.

Traders have a common idea about cryptocurrencies: they are very volatile, with frequent steep uptrends and downtrends. The reality is that the market trades with no clear direction most of the time. If you just hold the coins in your wallet, you are not optimising the use of your capital.

Thanks to the Grid Trading In Range, you can catch all the ups and downs of the market at any time with no effort. To ensure that the strategy runs only when the right market conditions apply, you can set an upper and lower bound for the bot to execute trades.

The strategy is very capital-effective and has limited downside risk.

Parameters for your strategy

To run a strategy in the most effective way, make sure that you correctly set up the rule's parameters.

- Coin. You should have enough balance of the coin that the strategy will trade to make sure the rule executes the sell orders as planned.

- Wallet. The selection of the wallet defines the trading pair of your strategy. (eg. if you buy BTC with the USDT wallet, the rule will trade BTCUSDT).

Note: on derivatives exchanges like Binance Futures, the bot opens long and short positions regardless of whether you own any quantity of the trading coin.

- Range. You can set that directly in the condition blocks. That defines the price range within which the strategy will execute the trades. The Grid Strategy will remain inactive outside of the range, as the right market conditions likely don't apply anymore. Usually, you should identify the range where you think the price will trade for the next days or weeks.

- Percentage. That defines the magnitude of the swings you want to catch with the rule. A good rule of thumb is to use a slightly lower percentage than half of the price range. (eg. if the price range equals 3%, you can set the percentage to 1% to increase the chances to catch more swings.)

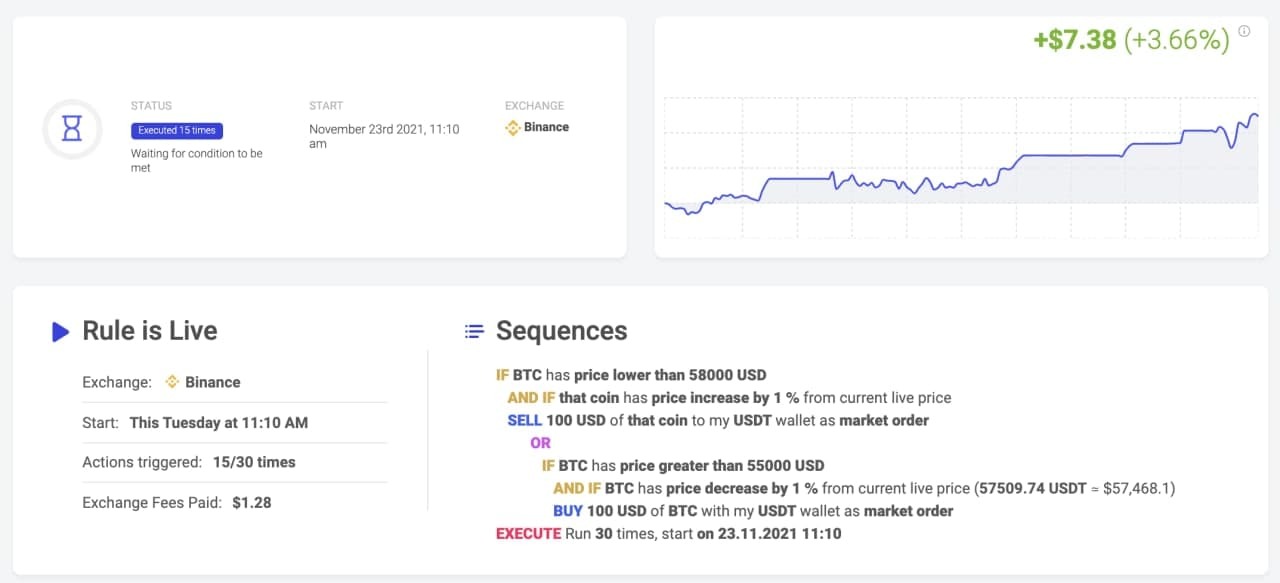

Grid Trading Bot Example

In the example below, you can see a price range for BTCUSDT. The presence of two significant wicks in opposite directions usually anticipates a short-term period of sideways moves that you can catch with the Grid Trading In Range strategy.

Once you identify the range, you can launch the strategy live on your exchange.

Are you looking for examples of trading pairs that could work well with this strategy?

Find here a list of trading pairs that are currently trading in a sideways market.