How To Use Open High Low Close (OHLC)

Last updated November 3, 2024

Learn How To Use Open High Low Close (OHLC)

As part of Coinrule’s new product updates, we have now launched support for Open High Low Close , giving you even more customizability for your strategies!

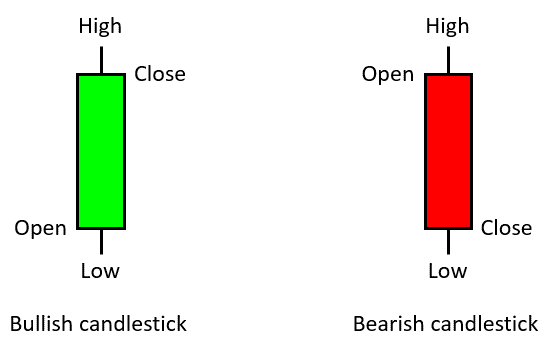

Candlestick charts are used by traders to determine possible price movement based on past patterns. Candlesticks are useful when trading as they show four price points (open, close, high, and low) throughout the period of time the trader specifies. Many algorithms are based on the same price information shown in candlestick charts.

Trading is often dictated by emotion, which can be read in candlestick charts.

The image below shows Open price, High price, Low price and Close price:

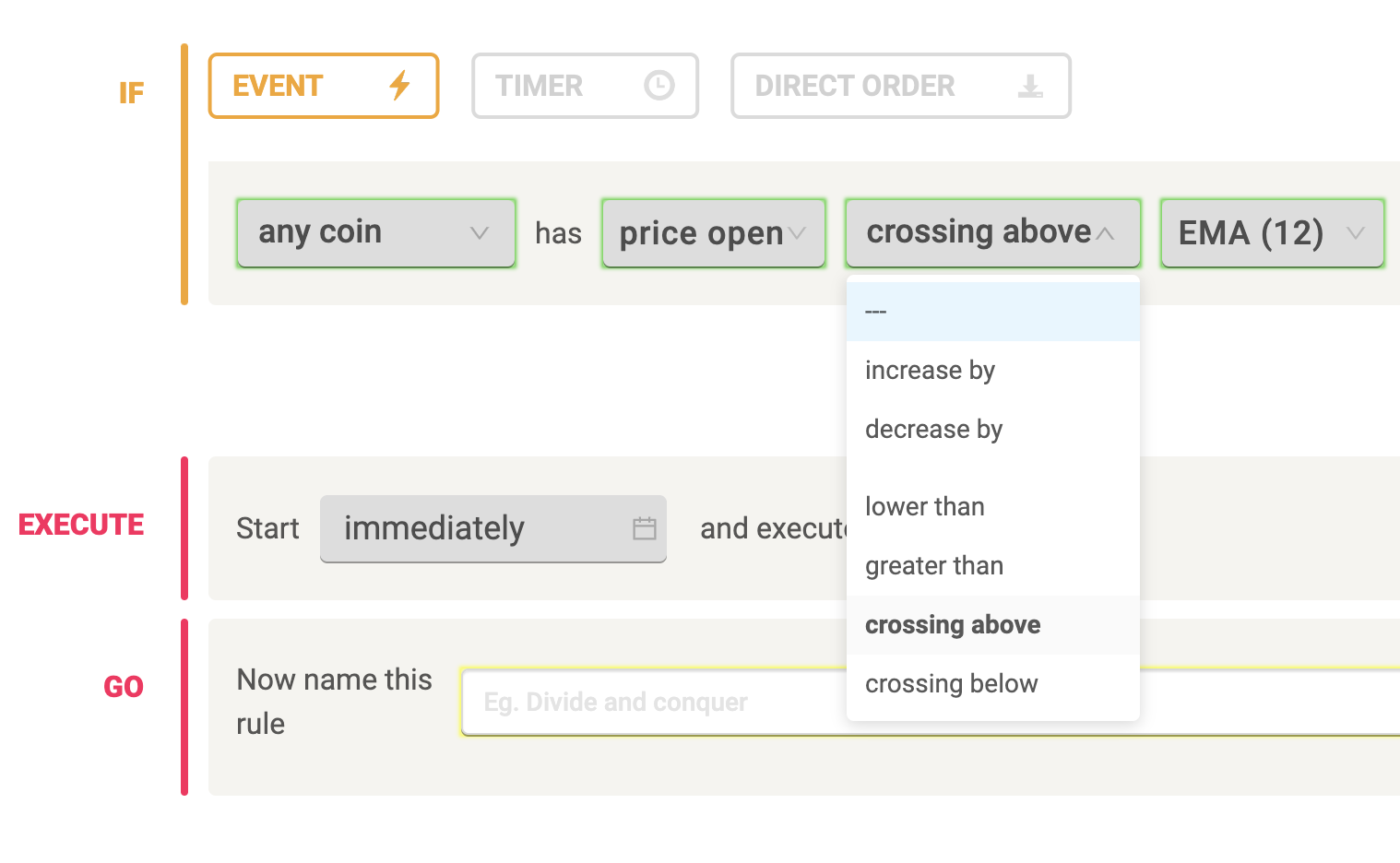

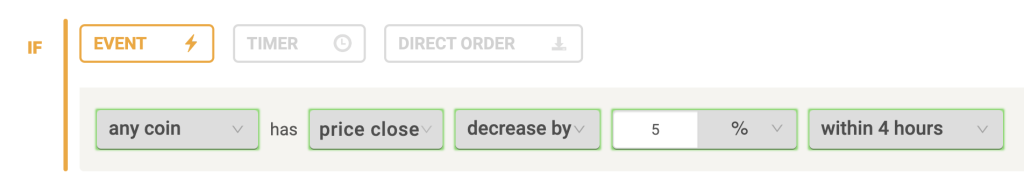

Open High Low Close allows you to customize your strategies in a variety of additional ways. You can set actions to trigger when either the open, high, or low price of the current candle crosses above or below, or is less than or greater than, the current price or a variety of technical indicators including MAs, EMAs, the MACD, and more.

Alternatively, you can use the closing price of the previous candle of the timeframe you specified. You can also set rules to trigger if the price increases or decreases by a pre-specified amount from either the open, high, or low price of the current candle, or when close is selected, the closing price of the previous candle: