How To Use Time-Weighted Average Price (TWAP)

Last updated January 31, 2025

TWAP is a trading benchmark used to determine the average price of an asset over a specific period. It is particularly useful for traders aiming to execute large orders while minimizing market impact.

What is TWAP?

TWAP, or Time-Weighted Average Price , calculates the average price of an asset over a set period by dividing the total value traded by the total volume traded during that period.

TWAP = (Sum of (Price × Time Interval within Anchor Period) ) / (Sum of Time Intervals within Anchor Period)

TWAP is commonly used by algorithmic traders and institutions to split large trades into smaller chunks to ensure execution at or near the average market price, reducing slippage and impact on the market.

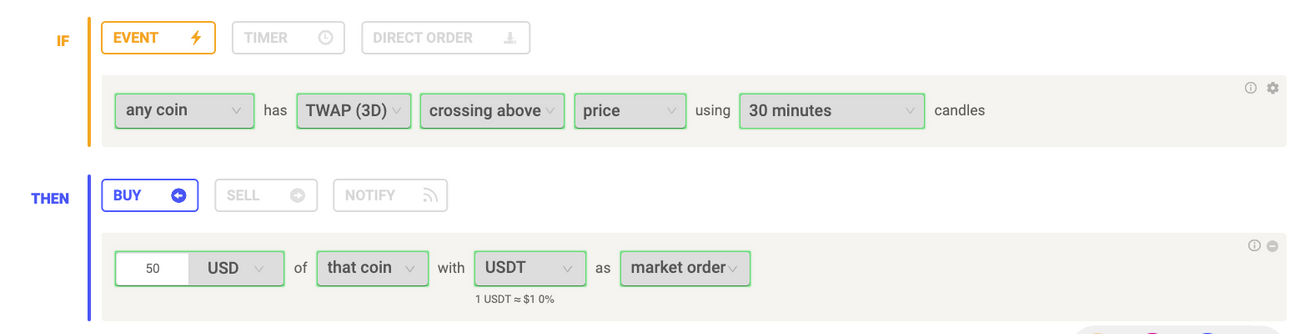

Using TWAP on Coinrule

On Coinrule, you can configure TWAP to match your strategy. The periods available range from 5 minutes to 1 day.

The Anchor Period setting specifies the Anchor, i.e. how frequently the TWAP calculation will be reset.

Here are some ways to integrate TWAP into your strategies:

- Market Execution Strategy:

- Place orders based on the TWAP value to ensure execution near the average price.

- Example: Buy an asset when the market price is below the TWAP for the selected period, signaling a potential discount.

- Price Benchmarks:

- Compare the current price to the TWAP to gauge market conditions.

- Example: If the current price is significantly above TWAP, it might indicate an overbought condition.

- Exit Strategies:

- Use TWAP as a reference for selling an asset when prices exceed a defined threshold relative to the TWAP.

- Example: Trigger a sell when the market price is 5% above the TWAP.

Example Use:

Example: TWAP in Action

Let’s consider a TWAP with a 1-hour period:

- An asset has fluctuated in price over the last hour, with the TWAP calculated at $100.

- If the current price falls to $95, traders might see this as a buying opportunity, expecting a reversion to the mean.

- Conversely, if the price rises to $105, it could signal an overbought condition, prompting a sell.

Important Note: this article does not constitute trading advice.