What Does 'Keep Position Open' Mean?

Last updated November 4, 2024

What Does Keep Position Open Mean?

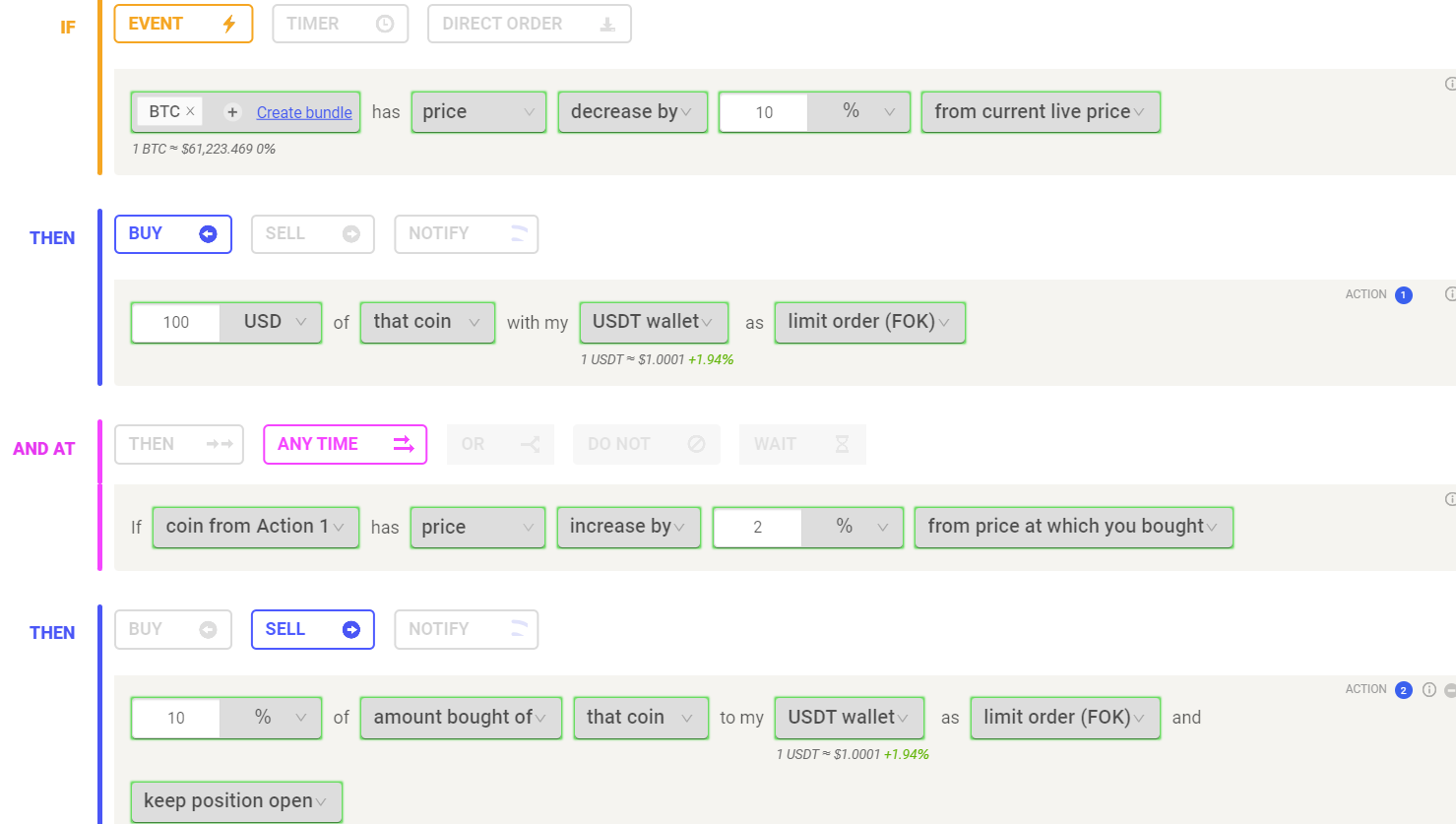

The "Keep Position Open" feature is designed to allow traders to maximize their potential gains by incrementally selling off a portion of a coin's position based on its sell conditions rather than selling it all at once.

Users can create a rule where, each time the price of the specified coin rises by a set percentage (e.g., 2%), a defined percentage (e.g., 10%) of the amount originally purchased is sold. This process repeats every time the price increase threshold is met, continuing until 100% of the position has been sold. This strategy helps traders take advantage of rising prices while still maintaining exposure to potential further increases.

Key Points:

- Incremental selling: Sell a set percentage of your holding as the price increases.

- Customizable thresholds: Define your own percentage triggers for price increases and sale amounts.

- Ongoing engagement: The rule continues to operate until the entire position is sold, allowing for systematic profit taking during an uptrend.

Points To Note:

1. Single Sell per Candle: When using the "keep position open" option alongside candle-based conditions, such as within a specific time frame (e.g. within 30 min and so on), the rule will execute a single sell per candle. For example, if the rule is set to sell 50% of a coin and keep the position open within 30 minutes, it will execute the first 50% sell and then wait for the next 30 minute candle to evaluate the condition again.

2. Shortest Timeframe Consideration: If multiple conditions with different time periods are used in a rule, the rule will hold the position for the shortest timeframe amongst them. For instance, if the conditions are set as "IF within 15 minutes AND IF within 30 minutes," the rule will sell and wait for the next 15-minute candle to reevaluate.

3. Price Reference Update: The "from price at which you bought" option remains extremely relevant with the "keep position open" feature. When the initial 50% is sold, the price reference is updated to the current execution price. Subsequently, the rule starts evaluating like "from price as which you previously sold". This ensures that subsequent evaluations consider previous execution price, which prevents unexpected behavior.

4. Trailing Considerations: Trailing functionality operates similarly when using 'keep position open', adjusting the reference point as trades are executed while keeping the position open.

5. Incompatibility Warning: It's important to note that the "from current live price" option is not compatible with the "keep position open" functionality and may lead to unexpected results. Coinrule provides a warning when users attempt to combine these options to prevent unintended outcomes.