Comparing Candles

Last updated November 4, 2024

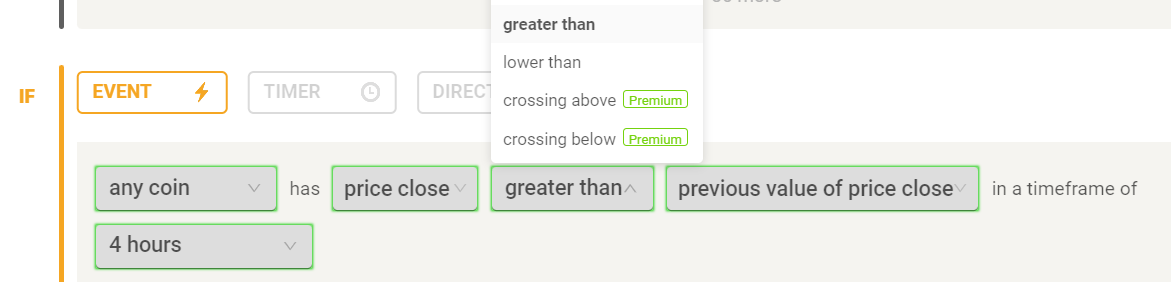

Creating rules based on the comparison of candlestick data is a powerful method to automate trading strategies on Coinrule. We have now launched support for comparing previous values of a candle when using Open High Low Close , giving you even more customizability for your strategies!

For instance, a user can create a rule with the above condition, comparing candle values. This condition leverages the momentum by identifying an uptrend and taking a position to benefit from the potential rise.

The rule engine compares the current closing price to the previous close value of a coin to determine whether the set condition is met. If the current close is higher than the previous, indicating an upward trend, the rule triggers a buy order.

Moreover, traders are not limited to comparing just closing prices. The platform allows for the comparison of other vital data points, such as:

- Price Open: The opening price of a new candle.

- Price High: The highest price reached during the candle's timeframe.

- Price Low: The lowest price within the candle's timeframe.

- Price Close: The closing price at the end of the candle's timeframe.

By setting up rules that compare these values to their previous instances, users can choose to look for a close value LOWER or GREATER than the current value.

This feature's flexibility ensures that users can develop complex strategies that can automatically react to market changes, potentially increasing their chances of making profitable trades.

Implementing Your Strategy

When implementing this strategy, users should consider the following steps:

1. Select "any coin", specific coin(s) or a preferred basket.

2. Define the Comparison Parameter: Decide which candlestick data point (open, high, low, or close) you want to compare.

3. Determine the Condition: Specify whether the rule should trigger when the price is greater than or less than the previous value.

4. Set the Timeframe: Establish the period for comparison, like 4 hours or any other preferred timeframe.

5. Action on Trigger: Decide on the action to be executed once the condition is met, such as buying or selling a percentage of the chosen coin.

Happy trading!