Hedge Mode in Futures Trading

Last updated December 12, 2024

Hedge mode is a trading strategy used by Futures traders to mitigate their risk exposure to the market. It involves opening two opposite positions, a long and a short, to profit from any market movement while minimizing potential losses.

Coinrule does not currently support Hedge Mode on Binance Futures or any other Futures exchange.

You can currently only trade Futures in one-Way Mode.

What is the difference between one-Way Mode and Hedge Mode?

1. One-Way Mode

In One-way Mode, you can only hold positions in one direction under one contract.

2. Hedge Mode

For example, if you open a short position and anticipate that the price will go down in the longer time frame, but you also want to open a long position for a shorter time frame. you won’t be able to open positions in both directions at the same time. Opening positions in both directions would cancel one another out or reduce their sizes.

In Hedge Mode, you can simultaneously hold positions in both long and short directions under the same contract.

For example, you can hold both long and short positions in the BTCUSDT contract at the same time.

How to switch to One-Way Mode?

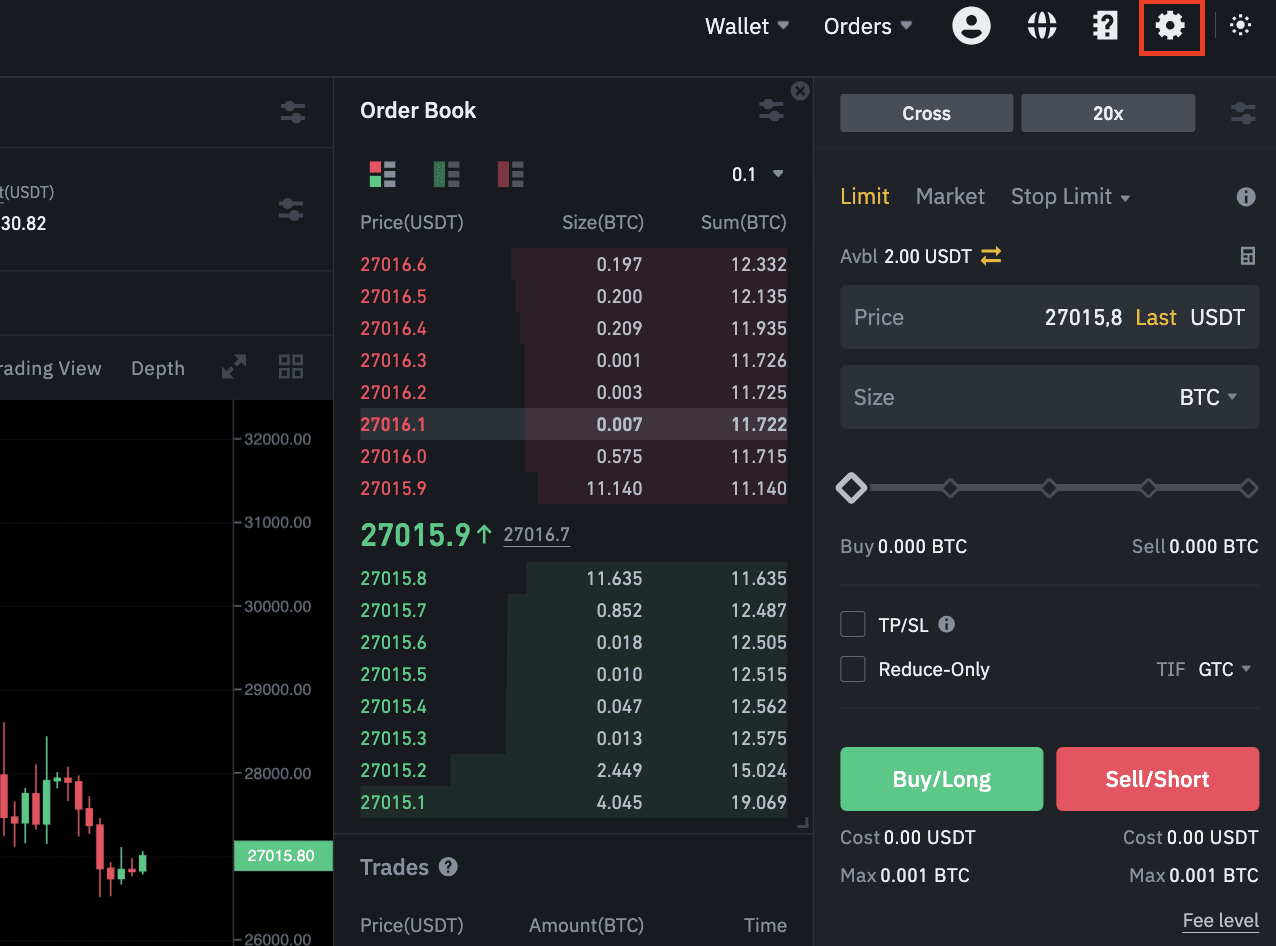

1. Open the trading interface and click [ USDⓈ-M ] on the top navigation bar.

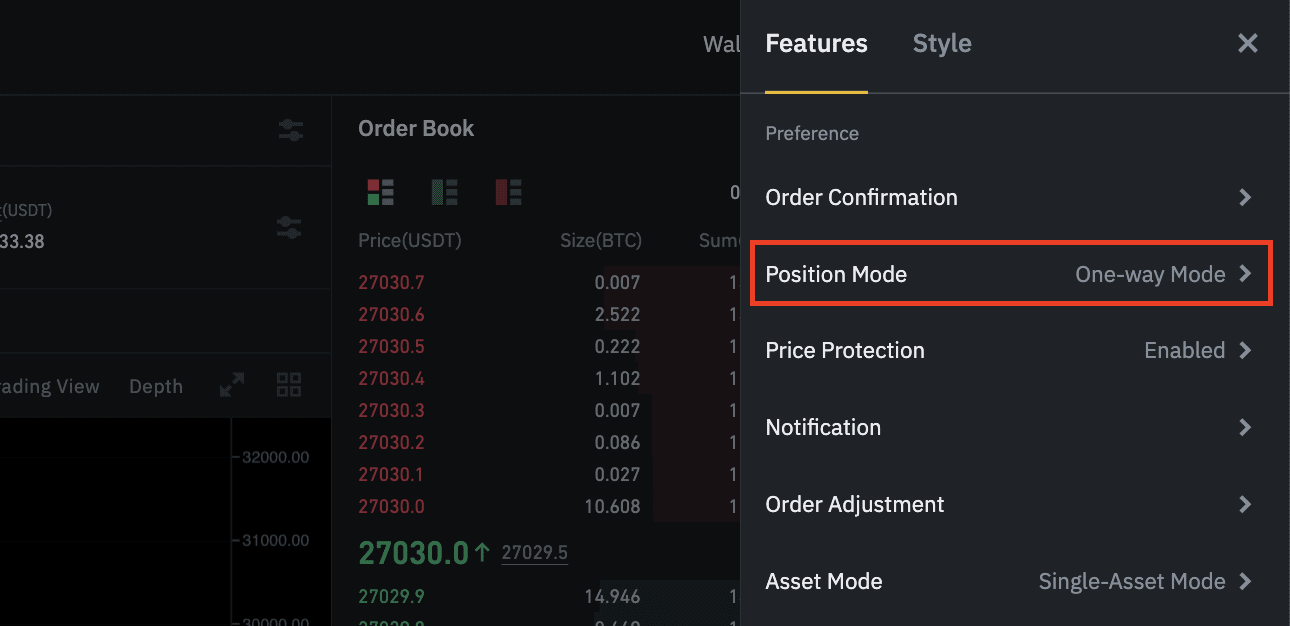

2. Click the settings icon at the top right and select [Preference] - [Position Mode].

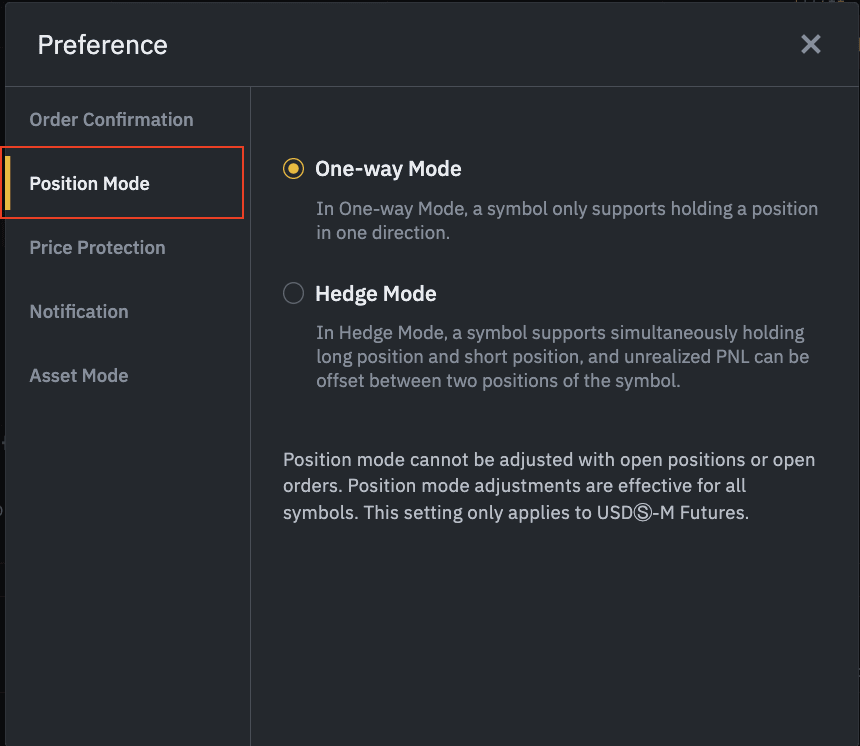

3. Select [One-Way Mode].

Please note that Position Mode cannot be adjusted while you have open positions or open orders.

4. A pop-up window will appear in the lower right corner of the screen once the Position Mode is successfully adjusted.