How To Use Leveraged Tokens on Coinrule

Last updated November 5, 2024

How To Use Leveraged Tokens on Coinrule

Coinrule has integrated support for Leveraged Tokens on Binance and Kucoin. Leveraged tokens have become increasingly popular among traders in recent years. This article will explore what leveraged tokens are, how they work, and how to integrate use of these tokens with your rules on Coinrule.

What are Leveraged Tokens?

Leveraged tokens are a type of derivative product that allows traders to gain leveraged exposure to cryptocurrency markets without the need to hold collateral or use margin. These tokens are designed to track the performance of an underlying asset, such as Bitcoin or Ethereum, with a leveraged multiplier applied to amplify the gains or losses of the asset.

For example, if a trader purchases a 3x long Bitcoin leveraged token, and Bitcoin's price goes up by 5%, the leveraged token will increase in value by 15%. Conversely, if Bitcoin's price drops by 5%, the leveraged token will decrease in value by 15%.

Leveraged tokens are available in various leveraged ratios, ranging from 1.5x to 5x, and they can be either long or short. Long leveraged tokens provide leveraged exposure to an asset's price going up, while short leveraged tokens provide leveraged exposure to an asset's price going down.

Important: Leverage is built in to the leveraged tokens. It is basically designed in such a way that if BTC moves 10%, BTC3x moves 30% and so on. This is opposed to 'leverage exchanges/markets' where you actually decide yourself with how much leverage you want to trade an asset'.

How do Leveraged Tokens Work?

Leveraged tokens are designed to provide traders with a convenient way to gain leveraged exposure to cryptocurrency markets. Although leveraged tokens are featured with leverage, they are still the spot trading type and are traded on the spot market. Therefore, no matter how the price of the corresponding coin/token changes, there will never be liquidation. Unlike margin trading, leveraged tokens allow you to gain exposure to leveraged positions without having to borrow funds, put up any collateral, maintain a maintenance margin level, or worry about the risk of liquidation.

Leveraged tokens work by automatically rebalancing their positions on a regular basis to maintain their desired leverage ratio. For example, if a trader purchases a 3x long Bitcoin leveraged token, and Bitcoin's price goes up by 5%, the token's leverage ratio will decrease to 2x. The token will then rebalance its position to bring the leverage ratio back to 3x.

The rebalancing process can result in leveraged tokens experiencing "slippage," which means the token's price may deviate from its underlying asset's price due to the rebalancing process. This can result in leveraged tokens experiencing price decay over time, particularly in volatile market conditions.

What Exchanges are Leveraged Tokens Available On?

Leveraged Tokens are enabled and can be traded on Coinrule, with Binance and Kucoin. You can do so by connecting your Binance or Kucoin Account to Coinrule. Once your account is connected, the Leveraged Tokens list will be available to trade. You can view a list of Leveraged Tokens available on Binance and Kucoin’s list of Leveraged Tokens .

Trading With “Any Leveraged Token” on Coinrule

There are many reasons why you may want your Rule to buy or sell any Leveraged Token. This gives you a wide range of options, as opposed to trading one specific Leveraged Token per rule.

The “Any Leveraged Token” function will allow the rule to scan for any Leveraged Token (available on the coin list) when checking for potential trades. The rule will take a reading of all Leveraged Tokens available on the exchange and will continuously buy any Leveraged Token which meets pre-set conditions of the rule.

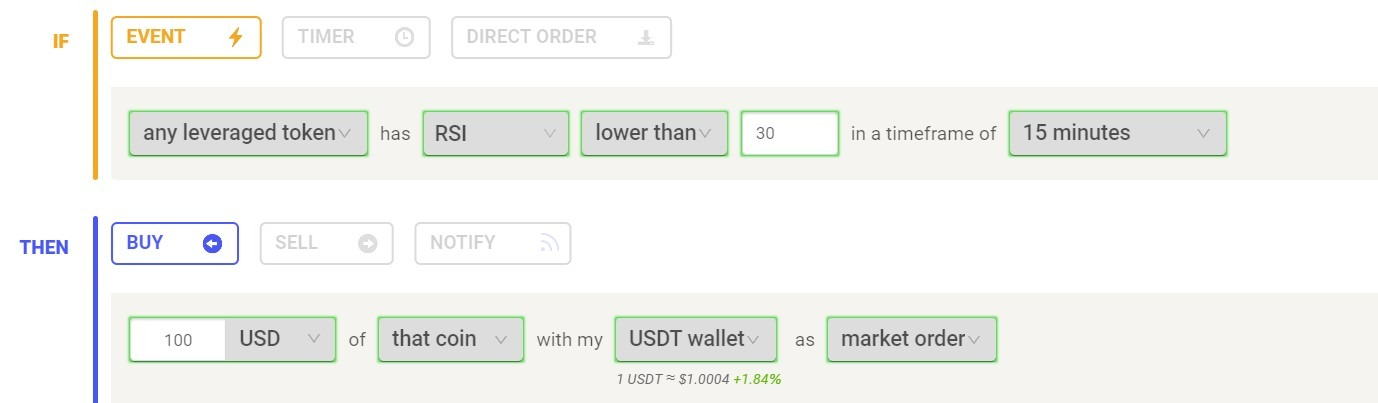

The image below is an example of the “Any Leveraged Token” function in use featuring our RSI Classic Strategy :

Conclusion

Leveraged tokens are a popular derivative product available in various leveraged ratios and can be either long or short.

However, it is important to note that leveraged tokens also come with significant risks, including the potential for amplified losses and price decay over time. The leveraged multiplier applied to these tokens can amplify both gains and losses, which means traders can lose their investment if the underlying asset's price moves against their position.

Traders should carefully consider these risks when trading leveraged tokens and ensure they have the necessary market knowledge and experience to trade effectively.

We hope you enjoy the new feature. Happy trading!