Smart Accumulation and De-risk

Last updated March 3, 2025

Introducing The 'Smart Accumulation and De-risk' Template

This strategy utilises the common technique of dollar cost averaging (DCA) to buy the same fiat amount of an asset over consistent time intervals. The goal of DCA’ing is to diversify your purchases over the extended volatility of an asset’s price movements. This opposes the idea of buying in one lump sum on one occasion and instead splits the buys over a period of time. This aims to mitigate the risk of “buying the top” and deploying all your capital when the price may have further fall.

Utilising DCA and allocating the same fiat amount in every purchase, results in you buying more of an asset when the price is lower and less of it when the price is higher - leading to your average purchase price lowering as the price declines. This can be significantly less stressful than simply buying in one go, as you won’t have to be constantly watching the charts - especially if you use Coinrule.

The process of DCA’ing also encourages you to formulate a plan for how you will accumulate the asset and removes the emotional element out of each purchase with every buy being a small amount relative to your total allocation. Utilising this template will allow you to simply sit back and let the bot do the work without any intervention required for potentially up to several years.

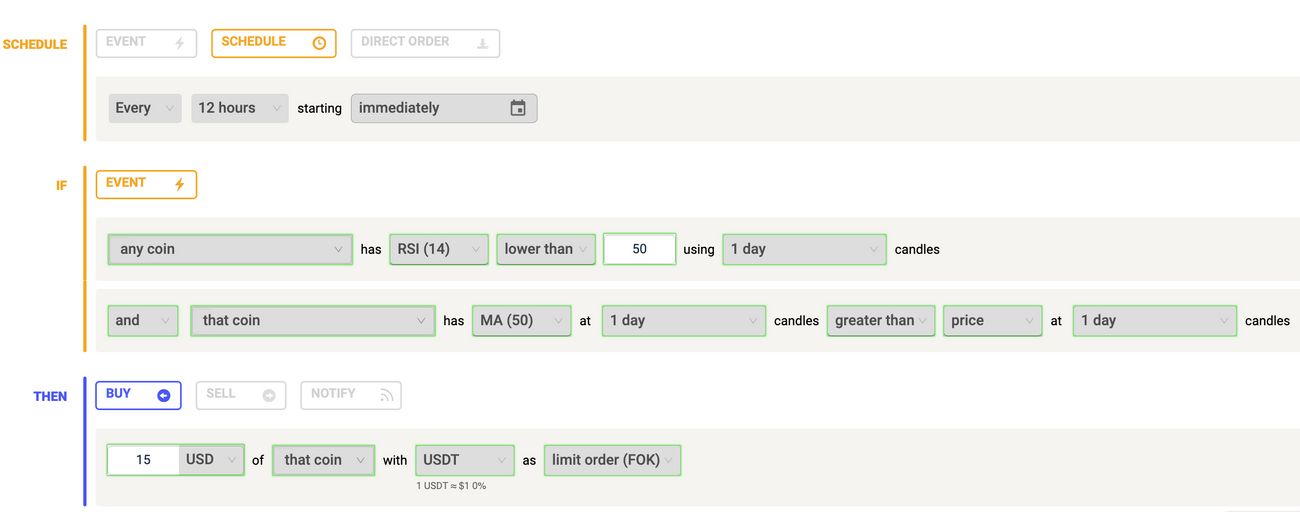

ENTRY

The template is initially structured by using the Schedule trigger. This is set to 12 hours and will result in there being a 12-hour delay after every purchase is made. This template then features the relative strength index (RSI) indicator. The RSI is a momentum-based indicator that provides a reading on the momentum of the coin’s price movements over the past 14 periods.

The RSI provides a gauge of how oversold or overbought a coin is in relation to how many past periods it has followed an upward or downward trajectory. Buying when a coin is approaching oversold can be a signal that there has been consistent selling pressure and the price may be on a dip - providing a good buying opportunity.

In this example, the timeframe is set to 1-day and the condition is set to buy when RSI is lower than 50. This will result in the coin being in the lower half of the RSI overbought to the oversold range and enables some leeway to ensure there is enough opportunity to make the purchases.

The 50-day moving average is also used for additional confirmation, with the condition met when the price is lower than this moving average. This ensures that the price of the asset is not overheated and will stop the rule from executing when the coin starts appreciating in price and entering less desirable buying zones.

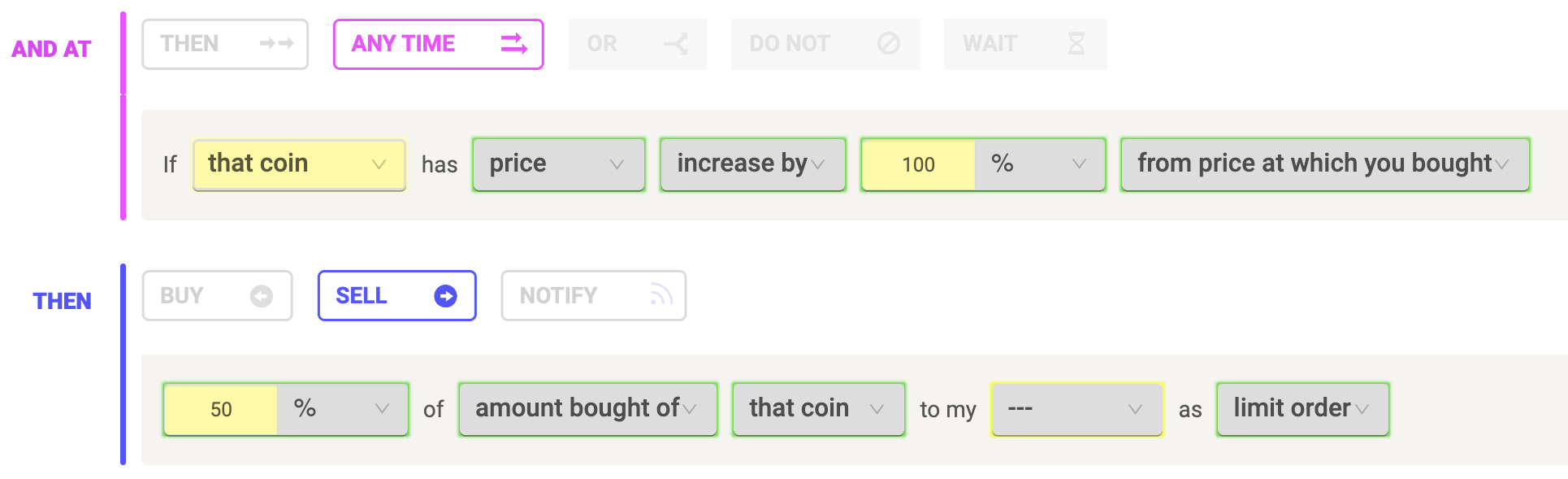

EXIT

In some accumulation strategies, there would be no set exit with the goal to hold for the long term. However, we want to protect our principal at all costs so we have added a sell condition that is met once any buy increases by 100% - selling 50% of the amount we purchased. This ensures we have secured our initial investment and eliminates the possibility of holding out for too long due to greed and losing our principal investment. This also gives us the flexibility to use this capital to reinvest in other opportunities that may be more attractive as the price of this asset has doubled. The funds can also be used to reinvest in this strategy once the price is no longer overheated and an attractive buying opportunity presents itself.

Another benefit of this technique is that you still have 50% of the amount you bought remaining invested in the asset - hedging you against any further upside. For example, If the price increases another 400% from when you sold the initial 50%, you will still have profited 500% whilst having removed your risk and have the ability to reinvest elsewhere where the asset may be price correlates with value.

This template can be especially effective on altcoins where their risk is greater compared to bitcoin, with the process of de-risking mitigating you losing any of your principal investment. Depending on your risk tolerance, you can also edit the rule to increase the price increase you sell at or the amount you sell.