Uptrend Breakout Scalper

Last updated November 4, 2024

Introducing The 'Uptrend Breakout Scalper' Template

A trend can be identified and exploited when a variety of indicators showcase confirmation that a strong trend is occurring.

This template makes use of some of the most popular ways of determining a breakout using moving averages (MA), the relative strength index (RSI), price and volume. The goal of using these indicators in tandem is to increase the probability of buying when a true breakout is occurring.

Build This Strategy on Coinrule

Entry

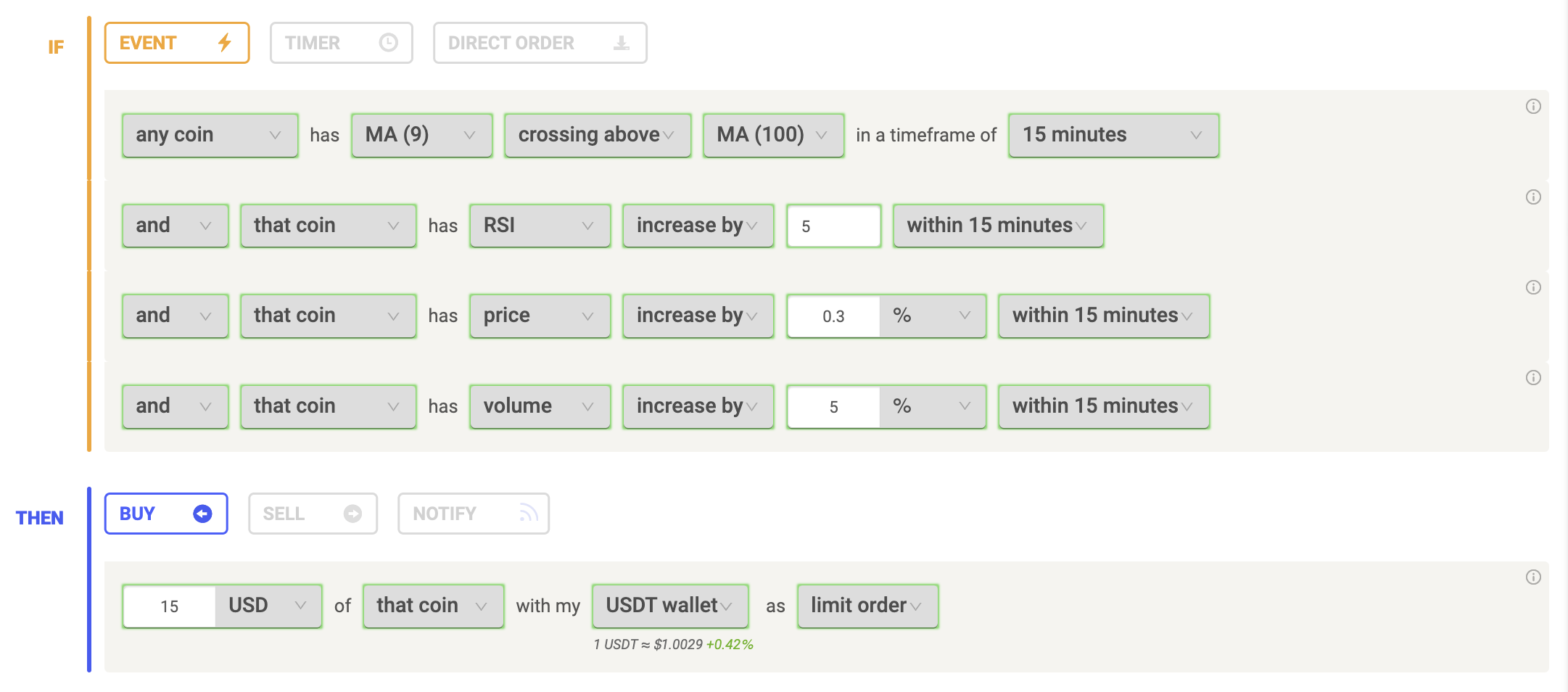

Moving Averages

To ensure the rule buys when the asset is in a position where a breakout may occur, the MA 9 has to have crossed the MA 100 in a timeframe of 15-minutes to showcase that price is in a short-term uptrend.

Relative Strength Index

The RSI is also used to confirm that the asset’s momentum is to the upside with the condition being met once the RSI value has increased by 5 within 15-minutes. The rule will then buy once these four conditions have been met.

Price and Volume

It could be argued that one of the most important and fundamental indications of a breakout is price and volume. The saying: “price follows volume”, details there is a clear indication of a strong uptrend when both volume and price increase simultaneously. This showcases there is a true demand for the asset and a large amount of buying. This is opposed to just a normal amount of buying and a low amount of selling which occurs when volume does not increase substantially but the price does. To act as this confirmation, the conditions will be met once the volume has increased by 5% and the price has increased by 0.3%, both within 15-minutes.

Exit

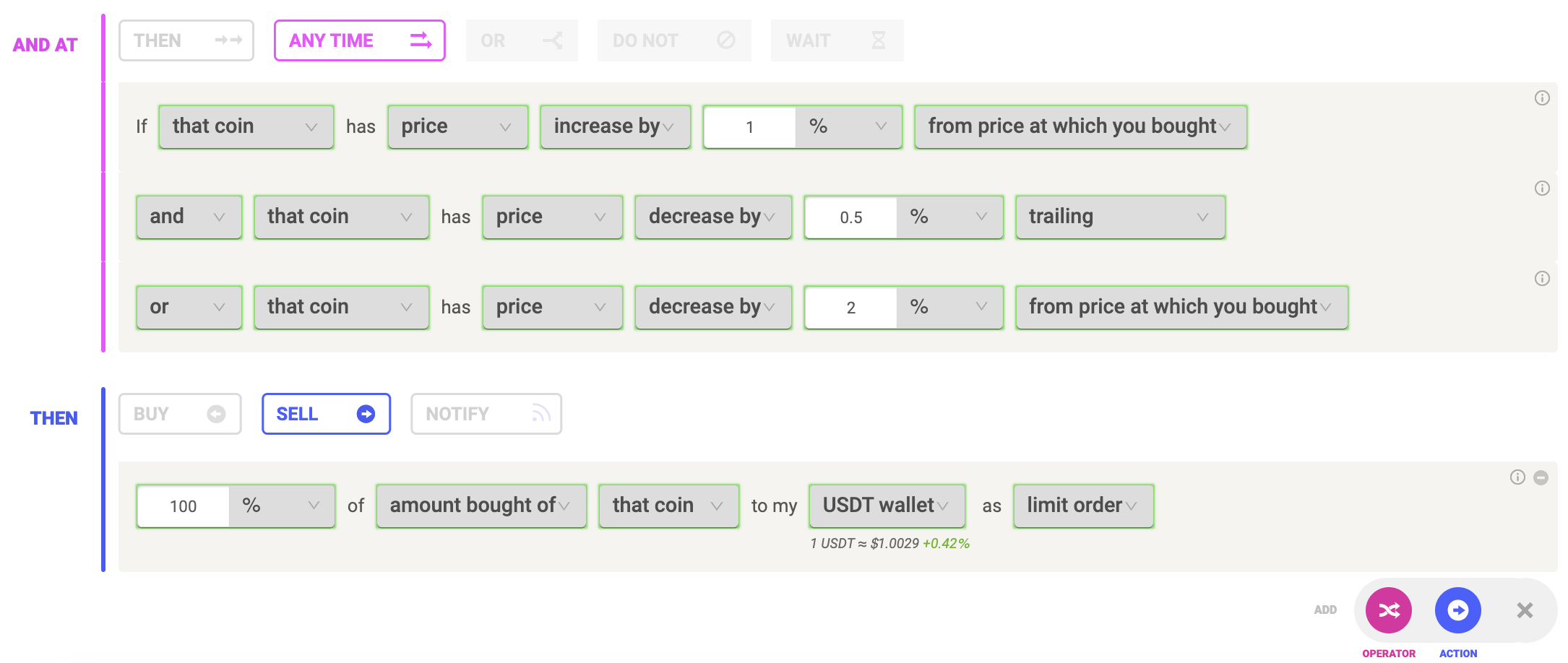

This strategy uses the "Any Time" operator, allowing multiple trades to be open at the same time. You can manage your total exposure to the rule at any one time by limiting the max number of positions open. This can be found and edited in the "Execute" section at the end of a rule.

This strategy’s exit includes a trailing take-profit and a fixed stop-loss. Trailing take-profits provide additional flexibility compared to their fixed variants as they do not limit the upside of the trade.

Take Profit

The take-profit is set up to ensure that a minimum profit of 1% is taken when the price has retraced by 0.5% from its highest during the trade. This allows large moves to the upside to be experienced surpassing the 1% take profit level, with the trade closing once the price has decreased by 0.5% - locking in profits of greater than 1%.

Stop-Loss

To prevent being stuck in a losing trade and experiencing extended downside, a 2% stop-loss has been used. With the minimum profit per trade being 1% and the maximum loss being 2%, this template has a minimum risk reward ratio of 0.5. This results in the strategy having to win more than 66.6% of trades to be profitable.

Due to the flexibility of the trailing take-profit, the average profit of the rule will most likely be greater, enabling additional security in the strategy not having to be profitable for the majority of trades.