Limit Open Positions

Last updated November 4, 2024

How To Use 'Limit Open Positions' On Coinrule

When using the ANY TIME operator, a strategy can simultaneously open a large number of trades.

To avoid over-trading or having too many open positions at once, you can limit the maximum number of Open Trades in the 'Execute' part of the Rule page.

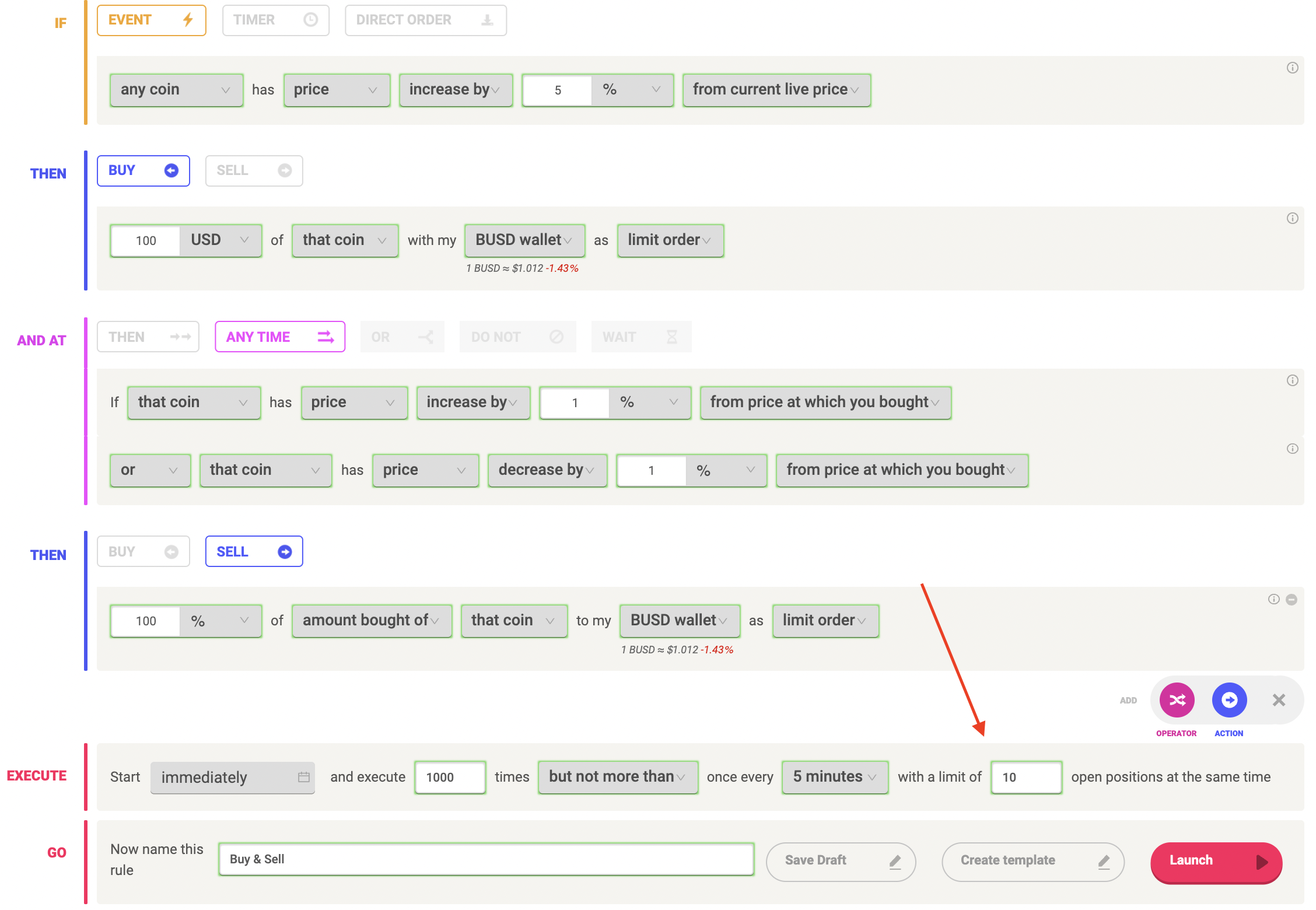

Let's run through an example using the above rule. This rule will buy $100 of any coin on the selected exchange that has a price increase of 5% from its current price.

Once the first coin has been bought, the rule will continue checking the first condition (5% price increase of any coin) and execute more Buys for coins that meet the condition. At the same time, thanks to the ANY TIME operator, the rule will start checking the two conditions (price increase or decrease by 1% from price at which you bought) and trigger a Sell once either one of these conditions is met.

The limit of 10 open positions will mean that Action 1 of the rule, the Buy, will trigger a maximum of 10 times without any subsequent sells.

Let's assume the first condition is met quickly, the rule will buy a coin once every 5 minutes (see 'Execute' section). After buying the first coin, it can still open a further 9 trades before the limit has been reached. After another buy, we are down to 8 additional Buys and so on.

Should the second Action 'Sell' be triggered at any point, a trade is 'closed' and the rule would be able to open an additional new Buy action. The limit on open trades makes sure that you have full control over how many trades are open for your rules.

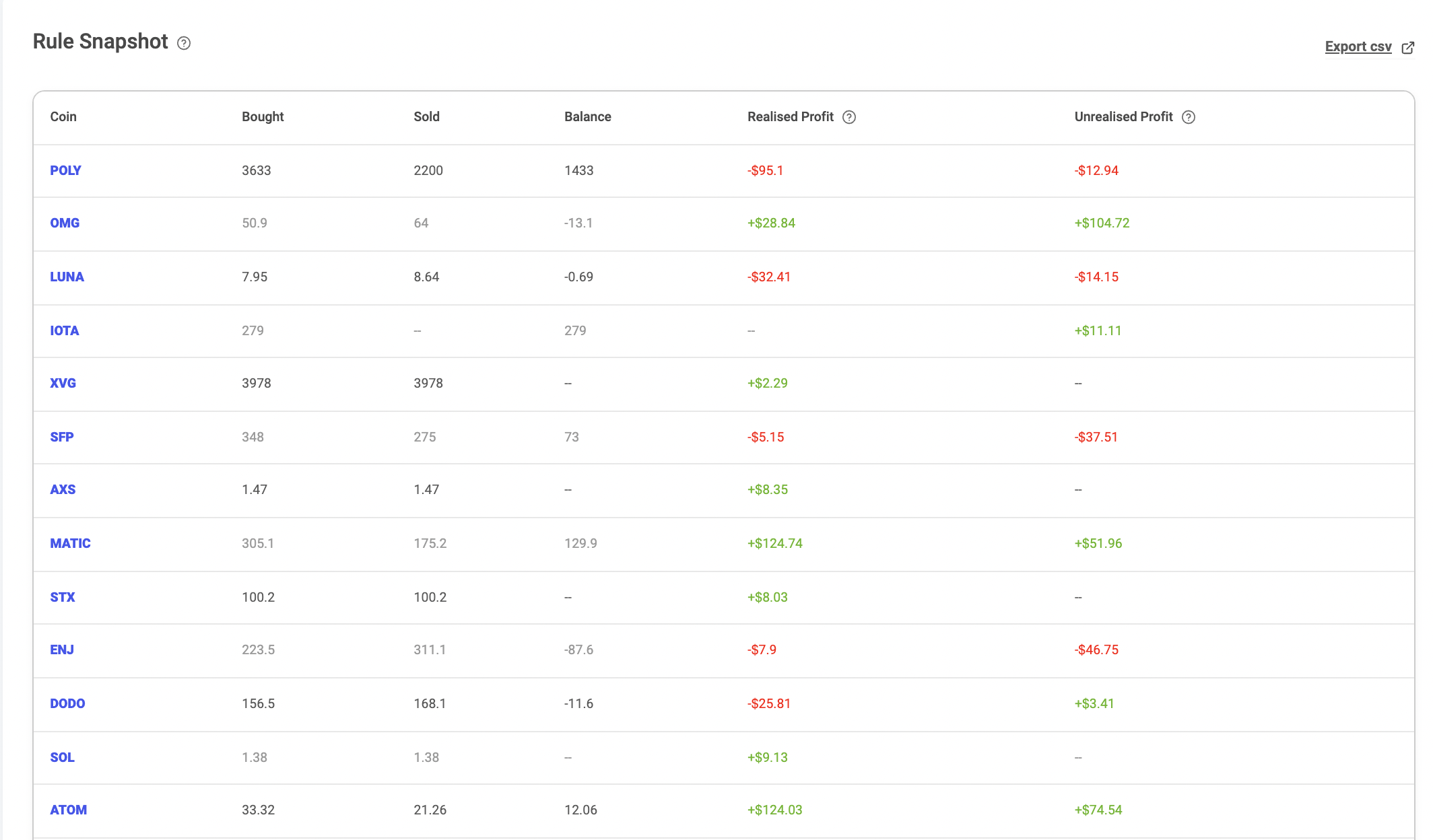

In the Rule Detail page you can also check all your open and closed trades for each Rule:

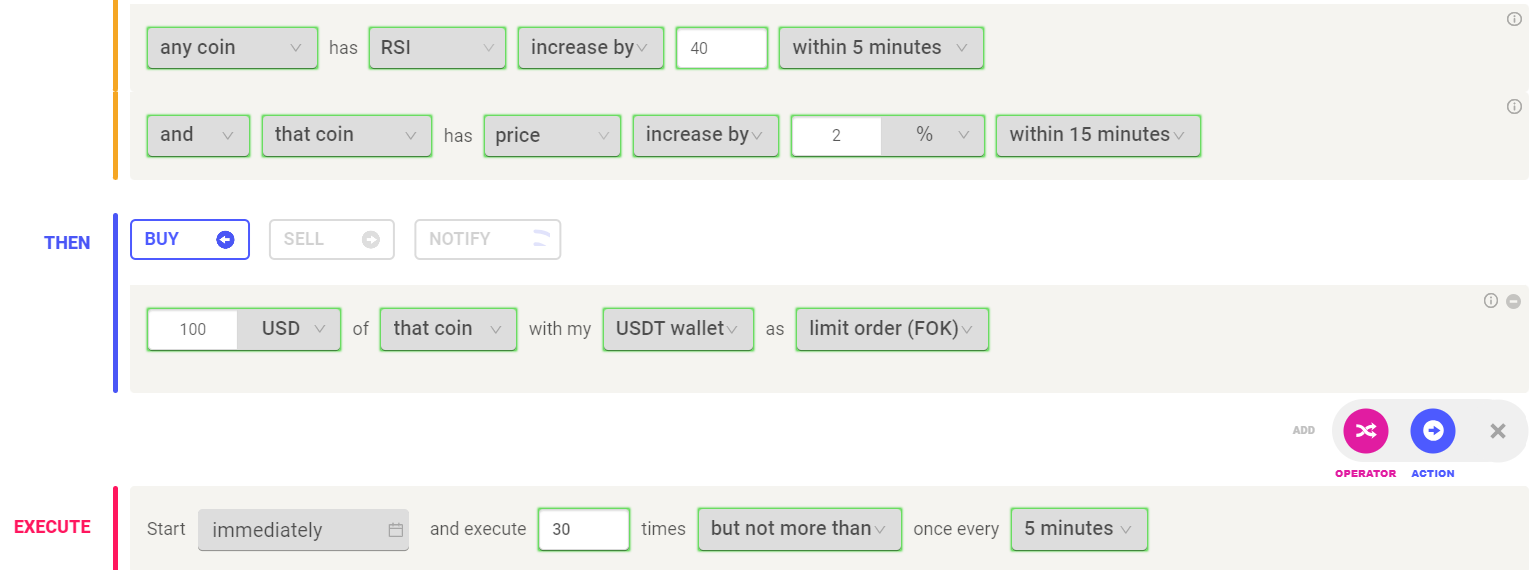

It is important to note that if there are multiple timeframes selected in rule, for example, using the timeframes below, i.e. 5 minutes and 15 minutes, when setting 'not more than once per x' users should use the smaller timeframe i.e. 'not more than once per 5 minutes', which is the smallest timeframe selected in those conditions. This setup protects users and allows the rule to buy at every shortest candle used in any related condition.