Edit A Rule

Last updated November 3, 2024

How To Edit A Rule On Coinrule

Creating a successful automated strategy is a dynamic process. By monitoring the performance of the rule and adjusting some key parameters, you can improve the returns on the go.

Your next best strategy could be an edited version of one of the rules you are already running today!

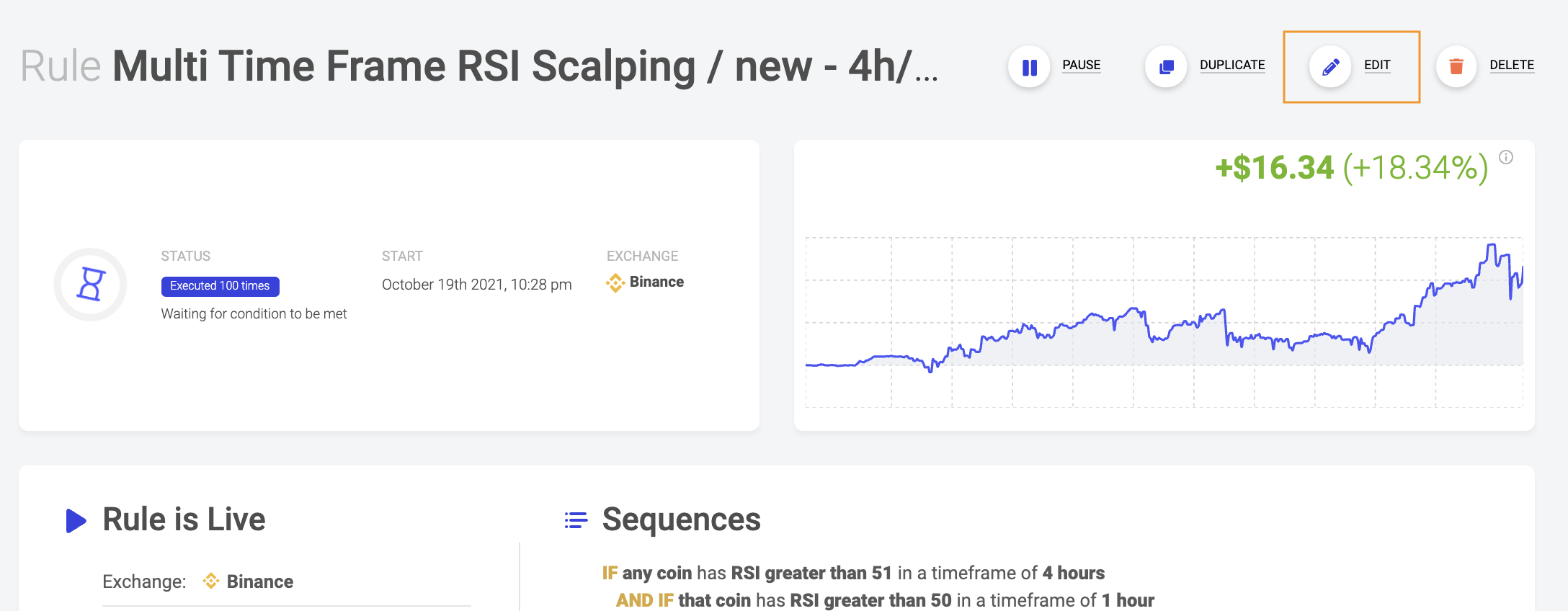

On the activity page of each rule, you can select the Edit option to change selected parameters of the rule to optimise it according to market conditions or your needs.

Some parameters are not editable, as they would change the overall structure of the rule significantly.

NOTE: If you need greater flexibility, you can use the Duplicate option, instead. That creates a new rule that will run in parallel to the original one.

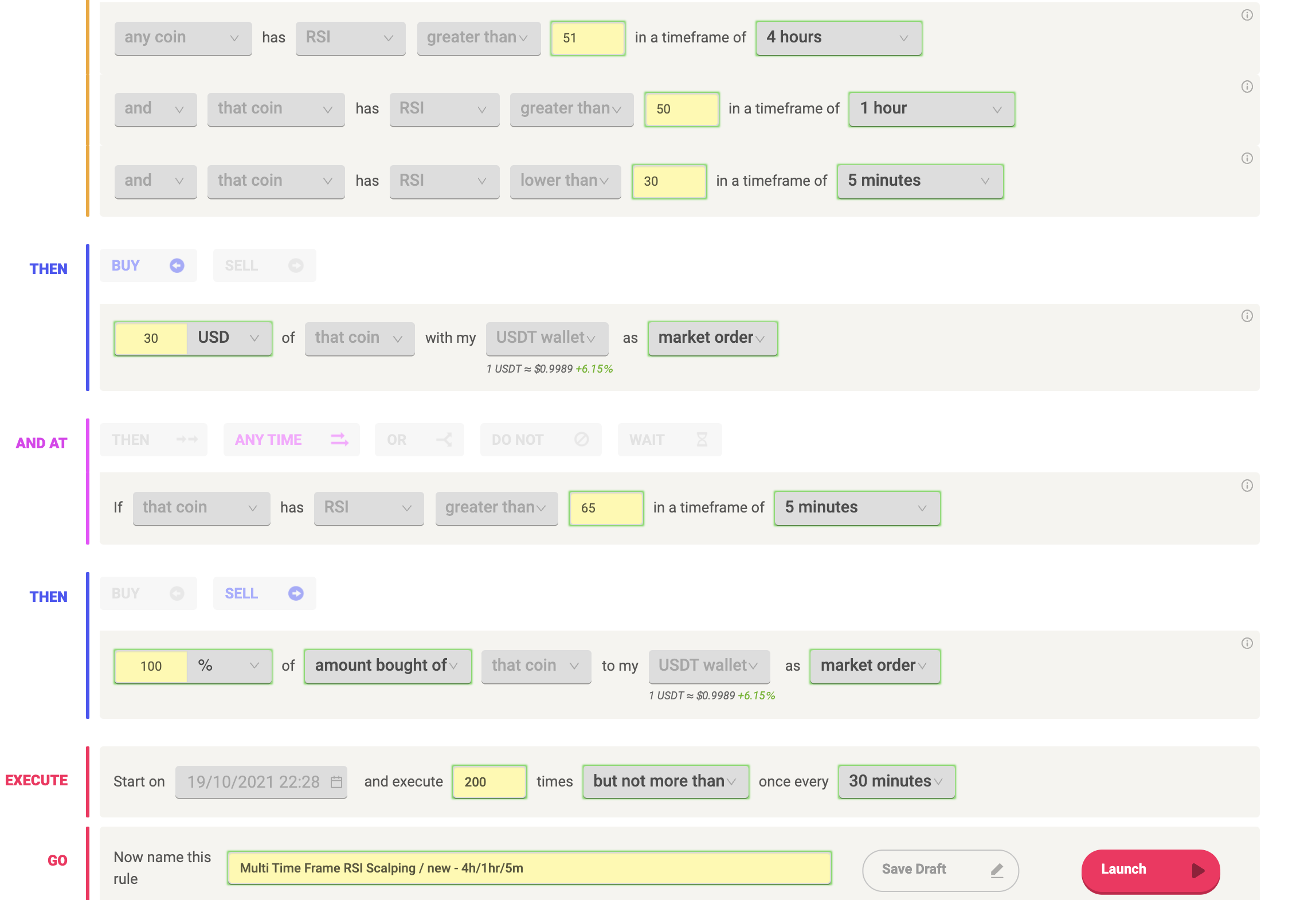

In Edit mode, you can change the following parameters:

- Price percentages

- RSI target values

- Order type (market or limit)

- Order amounts and sizes

- Rule Name

- Max number of executions

- Max frequency of executions ("no more than")

Typical use cases

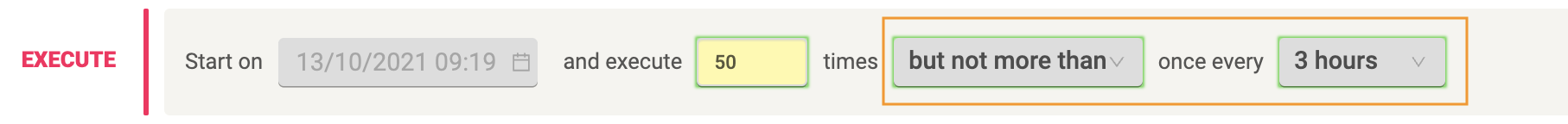

- Increase the number of executions of rules which are performing well to boost your profits.

- Stop new executions by changing the number of times the rule should execute and setting it equal to the number of times the rule is already executed. For example, by setting the number to 50 for a rule that opened 50 positions, the rule is not going to open new trades. Trades previously open are not affected, they will close gradually according to the original setup.

- Increase or decrease the frequency the rule will open new positions. Depending on your needs, you can run rules more or less aggressively.

- Adjust stop loss and take profit on trades. Depending on evolving market conditions, you can adjust on-the-go your risk management approach for the strategy.

- Adjust order sizes. This way, you can allocate more funds for rules that are overperforming, and scale down on rules that not performing as expected.

- Change the rule name. Rule names are important for record-keeping, and to add notes about the performances of the strategy.

NOTE: When editing a rule including a TradingView signal, you don't need to edit the alert on TradingView. The webhook address and the requited message remain the same.