How To Calculate Profit On Coinrule

Last updated November 3, 2024

Learn How To Calculate Profit On Coinrule

Making a profit is at the center of trading, so it is important to understand how profit and loss are calculated in Coinrule fully.

Traders need to identify and measure the profitability of their strategies.

Coinrule shows the actual performance of your rules and what it adds to your holdings; hence, the net profit on the dashboard is the total profit of all the rules run on the account.

However, once a rule is deleted or completed, it seizes to be considered in the net profit. It is important to keep in mind that profit calculation is not considered in demo rules. The net profit on the dashboard counts active rule, plus paused rules and rules you have been running in the past.

Possible Differences between Profit and Loss on Coinrule and Exchanges

Coinrule doesn't consider the manually sold coins when calculating profit and loss when Trades are performed manually on the exchange.

That implies that the P&L is calculated on Coinrule as though the manual trade never happened.

For example,

If 1 ETH is sold at $500, and the current price is $450. If the trader repurchases the coin manually at $450, the trader has profited by $50. However, that will not reflect the Coinrule net profit should the price change because the sale was made manually.

As a rule of thumb, any trade that happens outside of a rule is not considered. Every rule considers its actions to give a good overview of what value a rule can specifically add to the wallet.

Also, the profit doesn't consider the trading fees shown separately on the activity page, thereby giving you the accurate value of your holdings.

Overall, the profit calculation in Coinrule is designed to portray the real value Coinrule adds to one's wallet while trading. The total profit on the dashboard gives a trader an overall idea of his performance while trading. Having a proper profit calculation allows traders to reassess their strategies' success or failure and adjust accordingly.

Virtual Allocation (VA)

Virtual Allocation (VA) can be defined as how much money a user needs to pay from their pocket in order for the rule to running.

Virtual Allocation When Trade Size Is A Fixed Dollar Amount

For example:

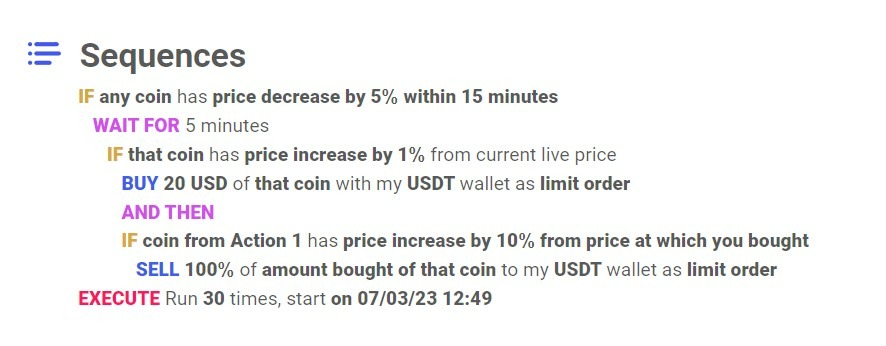

When using AND THEN operator in a rule, eg. "BUY 20 USD of any coin, AND THEN sell and repeat", VA equals to 20 USD, the rule would be reusing the same amount of 20 USD for each open/closed position.

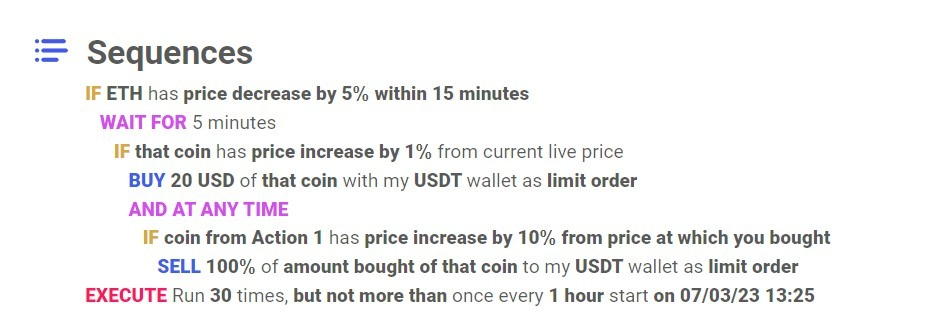

Instead with ANY TIME, the rule requires much more money.

When using ANY TIME VA is dynamic and it depends on trades the rule has executed and how many open positions there are. In theory, the required amount may be up to 20 USD multiplied by the number of executions specified in the rule. In this example, the rule is set to execute 30 times.

If the rule is set to execute up to 30 times, i.e. the maximum VA could be up to 600 USD as that's the amount that a user would need to spend if the rule would only be buying first and the sell part would always come later.

For example:

Buy 20 USD of ETH -> 1 position open -> VA = 20 USD

Sell 20 USD -> no position open -> VA is still 20 USD

Buy 20 USD of ETH -> 1 position open again -> VA is still 20 USD

Buy 20 USD of ETH -> 2 positions open -> VA = 40 USD

Sell 20 USD -> 1 position -> VA remains 40 USD

etc...

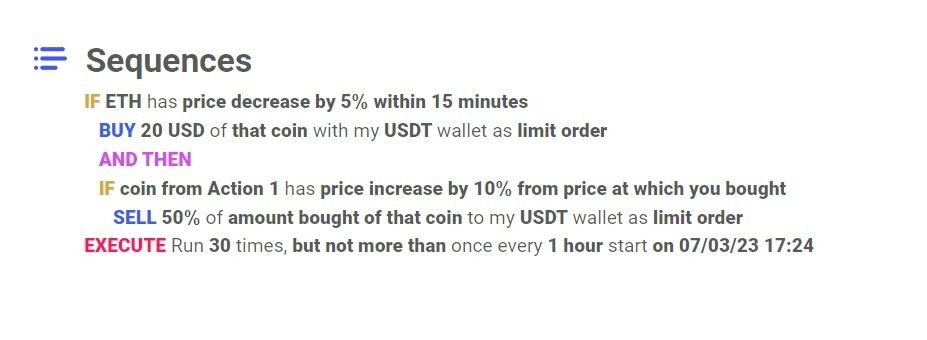

Virtual Allocation When Trade Size is a Percentage (%) Of A Specified Wallet

Example 1:

Imagine VA as a wallet. With the first rule run, you need to deposit 20 USD from the wallet to buy something. VA is 20 USD. Once you sell 50% of the coin, you get back 10 USD so for the next buy, you only need to deposit 10 more USD (10 you got from the sell action + 10 additional USD). Then VA becomes 30 USD.

Additionally, when using ANY TIME, what can happen is that the rule buys 20 USD of ETH about 10 times in a row before the rule even sells something. This means you need to deposit 200 USD (VA), otherwise the rule would not be able to buy more ETH until a position is closed. Once all positions are closed, you get 100 USD back (i.e. 50% of amount bought) which means a rule can buy another 5 coins without any need to deposit additional funds.

Realised and Unrealised Profit

The profit of each rule takes into account the performance of all trades the rule executes, both open and closed.

Rules can open multiple trades at the same time. Therefore, to calculate the P&L of a rule, the system considers both closed and open trades. To do that, Coinrule uses the concept of realised and unrealised profit when calculating the P&L of a rule.

An unrealised profit or loss refers to trades that are still open, for example, coins bought and not sold or vice versa. It uses the current market price of that coin relative to the entry price as a reference. As the price of an asset fluctuates, the unrealised profit can change over time until the trade is closed. Therefore, your profits will not be secured (realised) until you close the trade and sell the coins you have purchased.

Example:

The strategy buys 1 ETH at $500.

After one day, the current market price is $600, so the P&L will show a profit of $100.

The following day the current market price drops to $550, so the P&L will decrease by $50, resulting in the unrealised P&L of the trade being $50.

Instead, a realised profit or loss refers to complete trades where the coins have been sold. Here the calculation compares the exit with the entry price. Thus, the realised P&L does not fluctuate as it illustrates the performance of each closed trade.

Movements in price do not affect the realised P&L as you have sold the coins and closed the trade. That secures your profits and enables you to re-invest the capital in other trades. In addition, if you realise your profits into stablecoins, such as USDT, DAI, or USDC, you will not be exposed to volatility and any price movements. That is due to the price of these assets not fluctuating and changing.

Example:

You buy 1 ETH at $500.

After one day, the current market price is $600, and you sell at that price and realise this gain. The realised P&L will show a profit of $100.

The following day the current market price for 1 ETH decreases to $550, but you sold all the coins, so the P&L is still $100.

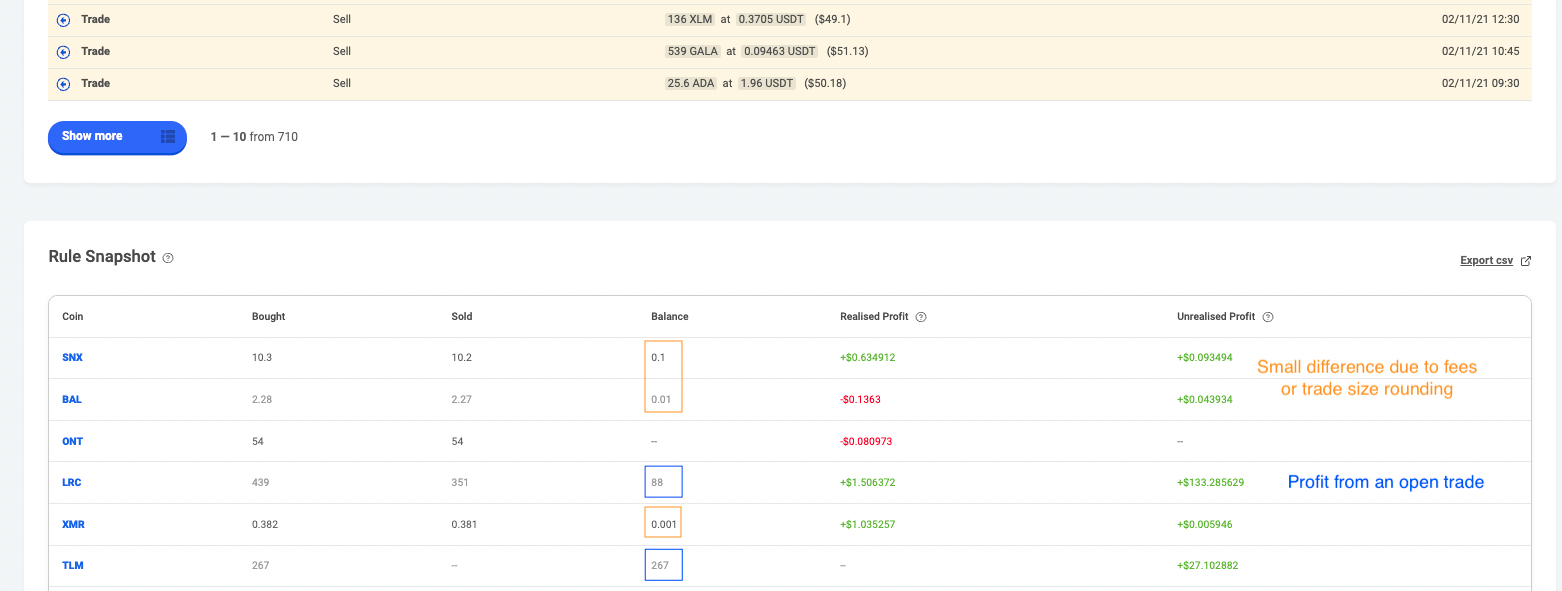

Rule Snapshot

Each rule's activity log page provides all the helpful info about realised and unrealised across all the traded coins you may need.

You will have a breakdown of the P&L per single coin, so you have a better overview of the performance of the rule.

This view also allows you to quickly check the already closed trades and those still open on the market.

Note: in some cases, the amount bought and sold may not match. That usually happens because the exchange charge the fee with the traded coin, so you have less to sell after. On top of that, there is a round lot to comply with. When the system rounds the trade amount to allow the trade to go through, you are left with a small residual amount in the wallet.

If you need customised calculations for your analysis, you can also export the list of trades using the top right option.

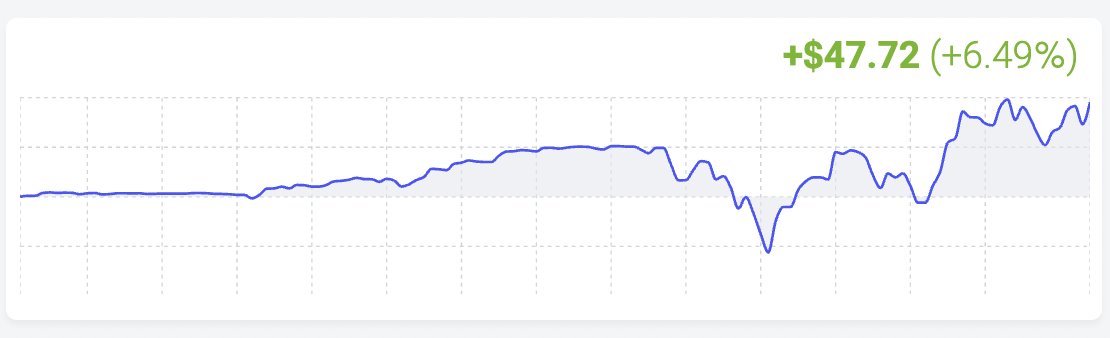

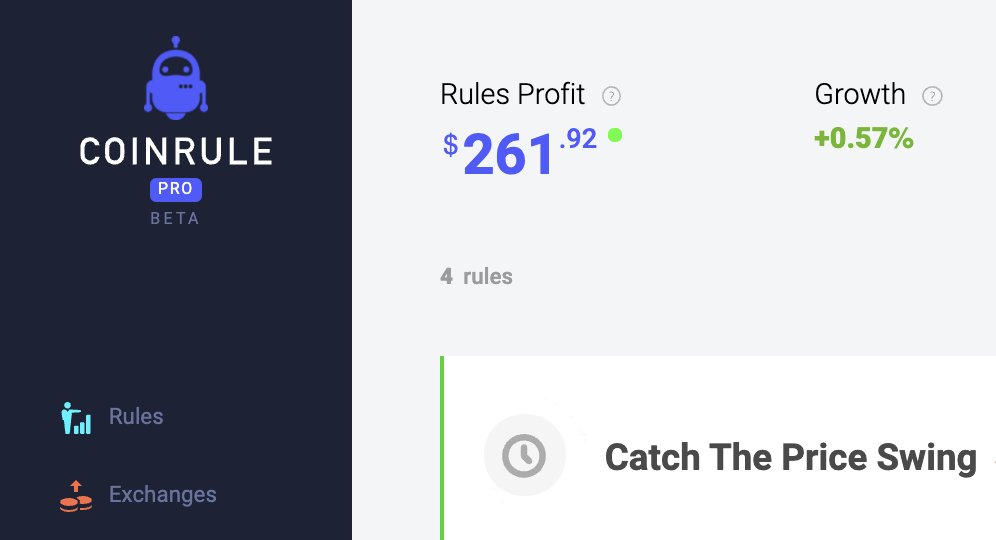

Profit and Loss on the Dashboard

This is an example of what your Live account may look like on the Rules Dashboard.

Rules Profit is the net sum of the P&L across all active rules at that moment.

Total Growth equals the Rules Profit divided by the value of all the wallets you have connected to Coinrule via API.

In the example below, the Total Growth equals 15% because the total balance of the exchanges connected to Coinrule is around $81,00.