Futures

Last updated November 4, 2024

What is Leverage?

Leverage gives you the capability increase your position size by borrowing against your capital. This can result in profits and losses being amplified.

Leverage allows a trader to use their capital more efficiently as they can open more positions of the same size when compared to spot trading. When spot trading, It would require you to possess $10,000 total capital if you wanted to open 10 x $1,000 positions. When trading futures and using 10x leverage, you could open the same 10 x $1,000 Positions with only $1,000 total capital and $100 per position. Your margin of $100 for each trade becomes $1,000 with 10x leverage.

If you have a $1,000 position ($100 Margin and 10x leverage) and price increases by 10% from your entry price you will profit $100. However, if the trade goes the other way and price decreases by 10% from your entry price you will lose $100 and will be liquidated.

It is crucial that all traders who utilise leverage manage their risk correctly and always understand the sizing of their positions.

Benefits of Trading Futures

Capital Efficiency

Trading perpetual futures provides the ability to utilise leverage. This allows you to increase your position size enabling you to use your capital more efficiently. When spot trading, It would require you to possess $10,000 total capital if you wanted to open 10 x $1,000 positions. When trading futures and using 10x leverage, you could open the same 10 x $1,000 Positions with only $1,000 total capital and $100 per position.

Ability to Short

Another opportunity is the ability to short coins without having to buy the asset itself. Having the ability to short is crucial if you want to be a successful trader, and having this ability means you can effectively profit regardless of what direction the market is trending.

Hedging

Futures also enables you to hedge your portfolio through longing or shorting. The purpose of hedging is to offset any potential losses or gains. This allows your portfolio to be balanced to perform well in all market conditions and to take advantage of any upside / downside moves without needing spot exposure to the asset.

An example of where hedging can be beneficial, is if you had a position of 1 BTC in your spot holdings. During times of uncertainty where you are not sure what way the market may trend or you are expecting some potential downside, you could open a short of 1 BTC. This would offset any losses incurred from holding your spot position and provide extra capital to acquire BTC at a lower price.

As the example above illustrates, you would've profited over 40% by opening a short in the region of $56,000 and closing it at $33,000. This trade would've net you a profit of $22,400 and offset the vast majority of the loss incurred from holding your spot position.

This also means that you can maintain your spot exposure and is especially useful if you have your holdings in cold storage where they are not easily accessible.

Setting Margin Mode and Leverage

There are two different margin modes you can select, “cross” or “isolated”. “Cross” will result in all your trades sharing the same margin. This will result in your liquidation level being lower compared to “Isolated”, however, you run the risk of losing all your trading account capital if your liquidation level is reached.

“Isolated” results in each trade’s margin being isolated and only enables this amount to be lost if your liquidation level is reached. Your liquidation level will be higher than “cross”, but only the margin you have allocated for each trade is at risk. Read more here .

How to Setup a Rule on Binance Futures

This article describes how to connect your Coinrule account to Binance Futures.

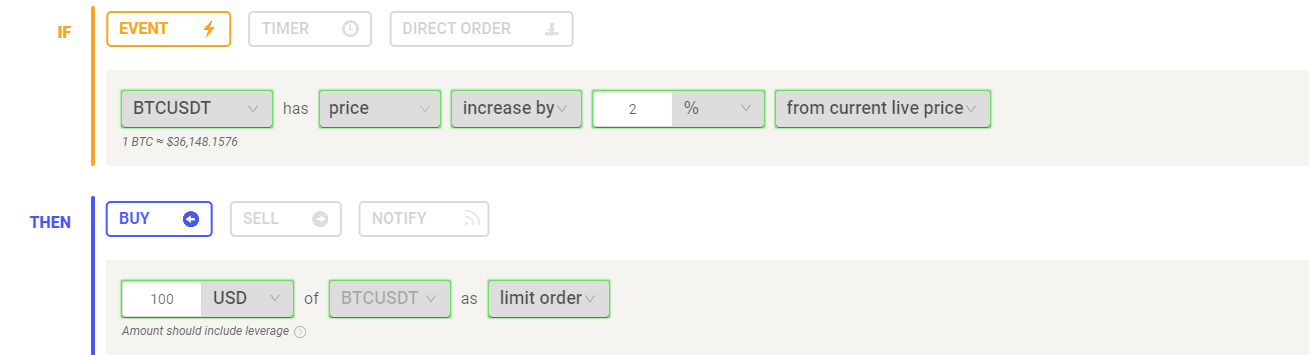

Limit Orders

When using Binance Futures, your rules will only place limit orders. Limit orders are orders that you place on the order book, with a specific limit price. When placing a limit order, the trade is executed when the market price reaches the limit price set or higher.

When using Coinrule, the limit price selected is the price at the moment conditions have been met, plus the safety margin that was chosen from the settings page as shown below.

Price margin selection for limit orders.

An example of this is if you have an order where the price condition for execution is at $100, if the safety range is 0.5%, the limit price is $100.5. If the safety range that is selected is 0, the limit price will be the same as the price triggered. Setting up a safety range helps ensure a maximum number of executions .

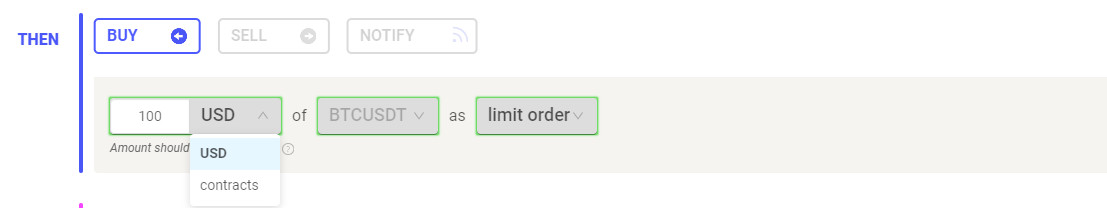

USD Amount For Trading Futures

Coinrule has now integrated support for USD amount when trading futures. This gives users the ability to choose between specifying their trades in terms of a USD amount or number of contracts rather than relying solely on the traditional method of using the number of contracts. This aims to provide traders with more flexibility and convenience in executing their trading strategies.

How to trade with "USD Amount":

1. Log in to your Coinrule account.

2. Navigate to the Rule page and select your connected futures exchange

3. When creating or editing a rule, you will now see an option to select either "USD amount" or "Number of contracts" as the quantity type for your trades.

4. Select the "USD amount" option.

5. Enter the desired dollar amount you wish to allocate to the trade.

6. Coinrule will automatically calculate the corresponding number of contracts based on the current market price and contract specifications.

7. Customize your rule's conditions, actions, and any additional parameters as needed.

8. Save your rule and launch it to start trading based on the specified USD amount.

Important Tip: When closing a position, users have the option to choose from percentage (%), USD amount or contracts.

Margin, Position Size and Contracts

When trading futures, a contract is 1 unit of the asset you are choosing to trade. It can also be thought as the current price of the asset. For example, 1 contract of Ethereum is a single coin and is worth $2,000 (at current market price).

The value of number of contracts you trade is also know as your position size. Your position size consists of your margin multiplied by the leverage you are using.

Position Size = Margin * Leverage

Alternatively, you can calculate your position size by multiplying the price of the contract when you opened the position by the number of contracts you are trading.

Position Size = Price * Number of Contracts

Your exchange uses your capital (margin) as collateral and lends you funds against this initial amount. The amount you borrow is determined by the amount of leverage you are using.

You can calculate the amount of margin required by using this formula :

Margin = Position Size ($ Value of Contracts you are Trading) / Amount of Leverage

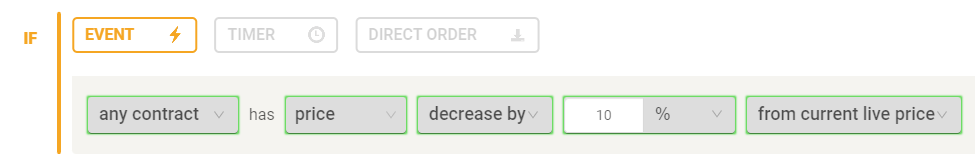

Any Contract Market Scanner For Futures Trading

The “Any Contract” market scanner to empower traders, regardless of their level of experience, to track the entire market simultaneously. By allowing traders to track the entire market simultaneously, it paves the way for more trading opportunities, while also reducing the stress and time associated with manual market monitoring. Now, traders can focus on refining their strategies and making informed decisions, knowing that the Any Contract market scanner is ceaselessly working to identify potential trades across the entire crypto market when trading futures. Read more in this article .

Do Not Buy Contracts With Open Position

The 'Do not buy contracts with open position' operator ensures that a rule won't purchase contracts that already have an open position.

This applies whether the position was initiated by the same rule, a different rule, or even if it was opened manually or externally.

The do not buy any contract with open position exception has been added to "Trading exceptions" in settings and enabled by default.

Do Not Buy Same Contract Twice Until Position Closed

The “DO NOT buy same contract twice until position closed” operator will prevent the rule from buying a contract again until the position has been closed. Once the open trade has been closed through a sell, the rule will then buy the same contract again should it meet the conditions you have set up.

'Do not buy same contract twice until position closed' operator only applies to contracts bought by the same rule while 'do not buy contracts with open position' applies to any contract with an open position regardless of whether the position was initiated by the same rule, a different rule, or even if it was opened manually or externally.

MarketCap Protection For Futures

The MarketCap Protection, previously available for only spot trading, has now been extended to futures contracts. This ensures that your futures trading will consider the market capitalization of the position coin. This upgrade aims to provide you with more comprehensive tools to manage your portfolio risks.

Always trade responsibly and stay updated with the latest settings to optimize your trading experience.

If you have any further questions or need assistance, please reach out to our support team ( [email protected] ), who will be happy to help.

Happy trading with Coinrule!